Tempus Reports Second Quarter 2025 Results

2025/8/11 17:50:29 Views£º537

Original from: Tempus

Tempus AI, Inc. (NASDAQ: TEM), a technology company leading the adoption of AI to advance precision medicine and patient care, today reported financial results for the quarter ended June 30, 2025.

¡¤ Revenue increased 89.6% year-over-year to $314.6 million in the second quarter

¡¤ Genomics revenue increased 115.3% year-over-year to $241.8 million on accelerating year-over-year volume growth in Oncology (26%) and Hereditary (32%) testing

¡¤ Data and services revenue increased 35.7% year-over-year to $72.8 million, led by Insights (data licensing), which grew 40.7% year-over-year

¡¤ Quarterly gross profit was $195.0 million, a 158.3% year-over-year increase

¡¤ Issued $750 million of 0.75% convertible senior notes that will drive significant interest expense and cash savings

¡¤ Increasing full year 2025 revenue guidance to $1.26 billion, along with positive adjusted EBITDA of $5 million, a $110 millionimprovement over 2024

¡°The business is performing well with revenues and margins growing faster than expected, contributing to our continued improvement in adjusted EBITDA on a year-over-year basis,¡± said Eric Lefkofsky, Founder and CEO of Tempus. ¡°We saw significant re-acceleration of our clinical volumes which grew 30% in the quarter, as we delivered more than 212,000 NGS tests. Combined with our continued leadership in AI and progress toward building the largest foundation model in oncology, ¡®we¡¯re hitting our stride¡¯ as we approach our 10th anniversary.¡±

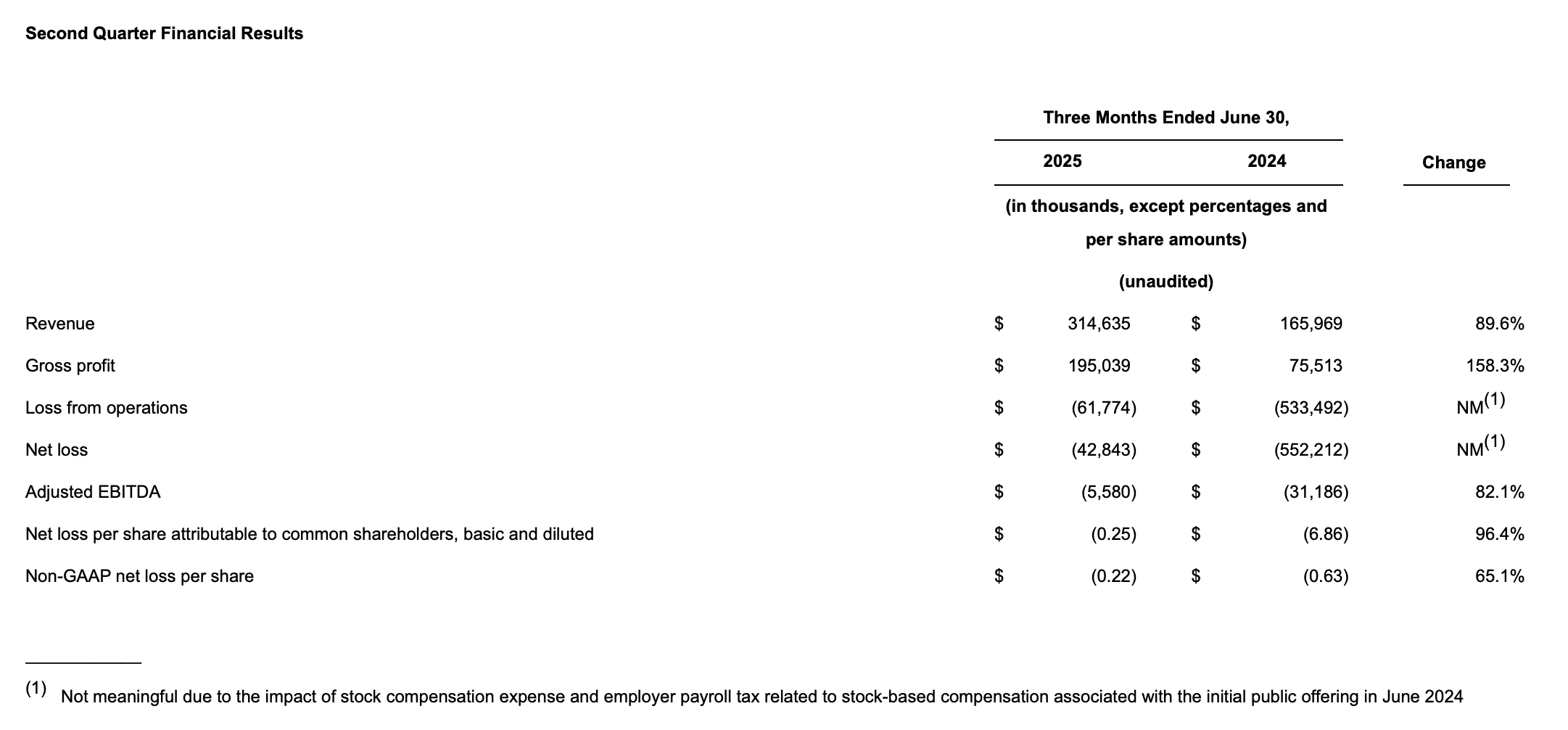

Second Quarter Summary Results

¡¤ Quarterly revenue increased 89.6% year-over-year to $314.6 million.

¡¤ Genomics contributed $241.8 million in revenue in the quarter, growing 115.3% compared to the second quarter of 2024.

- Oncology testing (Tempus genomics) delivered $133.2 million of revenue, up 32.9% year-over-year with approximately 26% volume growth versus 20% last quarter.

- Hereditary testing (Ambry genetics) contributed $97.3 million of revenue, up 33.6% year-over-year on a pro forma basis1with approximately 32% volume growth.

¡¤ Revenue from Data and services totaled $72.8 million in the second quarter, delivering 35.7% growth versus the second quarter of 2024, led by Insights (data licensing), which grew 40.7% year-over-year.

¡¤ Generated $195.0 million in quarterly gross profit, reflecting a 158.3% increase year-over-year.

¡¤ Improvement in reported net loss of ($42.8 million) in the second quarter of 2025, including fair value gains of $37.8 millionrelated to our marketable equity securities and stock compensation and employer payroll tax related to stock-based compensation of ($24.3) million, compared to a net loss of ($552.2 million) in the second quarter of 2024.

¡¤ Adjusted EBITDA of ($5.6 million) in the second quarter of 2025 compared to ($31.2 million) in the second quarter of 2024, an improvement of $25.6 million year-over-year.

Second Quarter and Recent Operational Highlights

¡¤ Strengthened Financial Flexibility: Just after quarter end, we completed an upsized offering of $750 million 0.75% convertible senior notes, enhancing our balance sheet and allowing us to replace a portion of the existing term loan with a significantly lower interest debt instrument. We also ended the quarter with $293.0 million in cash and marketable securities, an improvement of ~$70 million over last quarter.

¡¤ Expanded AI-Powered Clinical Tools: Extended Tempus Next™ care pathway intelligence platform into breast cancer, furthering AI-driven decision support across oncology. In addition, Tempus One™, our generative AI clinical assistant, was integrated into leading electronic health record (EHR) systems to enhance physician workflows and point-of-care insights.

¡¤ Advanced MRD and monitoring: Introduced Tempus xM™ for treatment and response monitoring (TRM), a liquid biopsy assay designed to monitor immunotherapy response in patients with advanced solid tumors, providing clinicians with actionable, real-time insights. We also expanded our exclusive collaboration with Personalis to include colorectal cancer as the fourth indication under the NeXT Personal® MRD commercial partnership.

¡¤ Reached new database milestone: Through more than 4,500 integrations, we are now connected to more than 40 million clinical patient records, with ~9 million de-identified and ingested, spanning ~1.1 billion healthcare documents, a significant percentage of which are connected to the ~4 million samples we have sequenced. As a result, our database now stands at >350 petabytes of connected clinical and molecular data.

¡¤ Approaching 10-Year anniversary: As we near Tempus¡¯ 10-year anniversary, we¡¯re reflecting on a decade of innovation and collaboration which now spans more than 2,000 publications including ~700 peer reviewed articles and ~180 oral presentations.

Financial Outlook and Guidance

Tempus is increasing its guidance and now expects full year 2025 revenue of approximately $1.26 billion for the consolidated business, which represents approximately 82% annual growth, and Adjusted EBITDA of $5 million for full year 2025, an improvement of approximately $110 million over 2024.

- CAIVD WeChat

Subscription Account

- CAIVD WeChat

Channels

China Association of In-vitro Diagnostics

Part of the information in our website is from the internet.

If by any chance it violates your rights, please contact us.