Natera Reports Fourth Quarter and Full Year 2024 Financial Results

2025/2/28 16:39:09 Views£º1150

Original from: Natera

Natera, Inc. (NASDAQ: NTRA), a global leader in cell-free DNA and genetic testing, today reported its financial results for the fourth quarter and full year ended December 31, 2024.

Recent Financial Highlights

¡¤ Generated total revenues of $476.1 million in the fourth quarter of 2024, compared to $311.1 million in the fourth quarter of 2023, an increase of 53.0%. Product revenues grew 53.9% over the same period.

¡¤ Generated a gross margin of 62.9% in the fourth quarter of 2024, compared to a gross margin of 51.4% in the fourth quarter of 2023.

¡¤ Generated total revenues of $1,696.9 million in the full year of 2024, compared to $1,082.6 million in the full year 2023, an increase of 56.7%. Product revenues grew 57.7% over the same period.

¡¤ Generated a gross margin of 60.3% in the full year of 2024, compared to a gross margin of 45.5% in the full year of 2023.

¡¤ Processed approximately 792,800 tests in the fourth quarter of 2024, compared to approximately 626,800 tests in the fourth quarter of 2023, an increase of 26.5%.

¡¤ Processed approximately 3,064,600 tests in the full year of 2024, compared to approximately 2,496,100 tests in the full year of 2023, an increase of 22.8%.

¡¤ Performed approximately 150,800 oncology tests in the fourth quarter of 2024, compared to approximately 97,500 in the fourth quarter of 2023, an increase of 54.7%.

¡¤ Performed approximately 528,200 oncology tests in the full year 2024, compared to approximately 341,000 in the full year 2023, an increase of 54.9%.

¡¤ Achieved positive cash flow of approximately $45.7 million1in the fourth quarter of 2024.

¡°We had a strong finish to the year, with excellent performance across the board,¡± said Steve Chapman, chief executive officer of Natera. ¡°Our ongoing success can be attributed to the mission-driven mindset of our team and our focus on patients. We have significant momentum, with several potential catalysts in 2025 and beyond.¡±

Fourth Quarter and Year Ended December 31, 2024 Financial Results

Total revenues were $476.1 million in the fourth quarter of 2024 compared to $311.1 million in the fourth quarter of 2023, an increase of 53.0%. The increase in total revenues was driven primarily by a 53.9% increase in product revenues, which were $472.9 million in the fourth quarter of 2024 compared to $307.3 million in the fourth quarter of 2023. The increase in product revenues was primarily driven by an increase in volume and average selling price improvements.

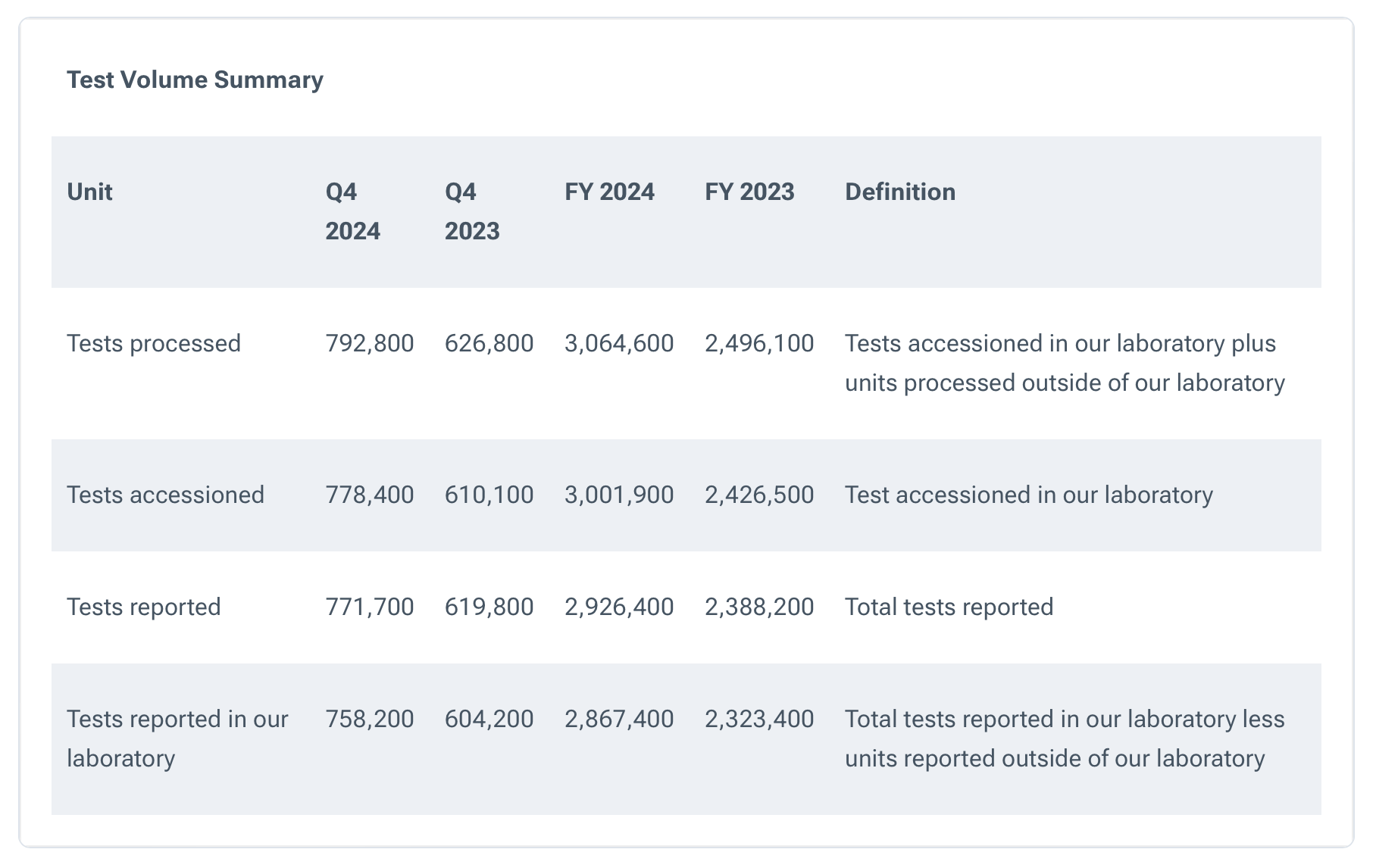

Natera processed approximately 792,800 tests in the fourth quarter of 2024, including approximately 778,400 tests accessioned in its laboratory, compared to approximately 626,800 tests processed, including approximately 610,100 tests accessioned in its laboratory, in the fourth quarter of 2023.

In the fourth quarter of 2024, Natera recognized revenue on approximately 771,700 tests for which results were reported to customers in the period (tests reported), including approximately 758,200 tests reported from its laboratory, compared to approximately 619,800 tests reported, including approximately 604,200 tests reported from its laboratory, in the fourth quarter of 2023, an increase of 24.5% from the prior period.

Total revenues were $1,696.9 million in the full year 2024 compared to $1,082.6 million in the full year 2023, an increase of 56.7%. The increase in total revenues was driven primarily by a 57.7% increase in product revenues, which were $1,685.1 million in the full year 2024 compared to $1,068.5 million in the full year 2023. The increase in product revenues was primarily driven by an increase in volume and average selling price improvements.

Natera processed approximately 3,064,600 tests in the full year 2024, including approximately 3,001,900 tests accessioned in its laboratory, compared to approximately 2,496,100 tests processed, including approximately 2,426,500 tests accessioned in its laboratory, in the full year 2023.

In the full year 2024, Natera recognized revenue on approximately 2,926,400 tests for which results were reported to customers in the period (tests reported), including approximately 2,867,400 tests reported from its laboratory, compared to approximately 2,388,200 tests reported, including approximately 2,323,400 tests reported from its laboratory, in the full year 2023, an increase of 22.5% from the prior period.

Gross profit2 for the three months ended December 31, 2024 and 2023 was $299.6 million and $159.9 million, respectively, representing a gross margin of 62.9% and 51.4%, respectively. Gross profit2 for the year ended December 31, 2024 and 2023 was $1,023.2 million and $492.7 million, respectively, representing a gross margin of 60.3% and 45.5%, respectively. Natera had higher gross margin in the fourth quarter of 2024 and for the full year 2024 primarily as a result of higher revenues and continued progress in reducing cost of revenues associated with tests processed. Total operating expenses, representing research and development expenses and selling, general and administrative expenses, for the fourth quarter of 2024 were $364.4 million, compared to $244.4 million in the same period of the prior year, an increase of 49.1%. Total operating expenses, representing research and development expenses and selling, general and administrative expenses, for the full year 2024 were $1,245.5 million, compared to $939.0 million in the same period of the prior year, an increase of 32.6%. The increases in both periods were primarily driven by headcount growth to support new product offerings as well as increases in consulting and legal expenses.

Loss from operations for the fourth quarter of 2024 was $64.7 million compared to $84.5 million for the same period of the prior year. Loss from operations for full year 2024 was $222.3 million compared to $446.3 million for the same period of the prior year.

Natera reported a net loss for the fourth quarter of 2024 of $53.8 million, or ($0.41) per diluted share, compared to a net loss of $78.0 million, or ($0.65) per diluted share, for the same period in 2023. Weighted average shares outstanding were approximately 131.4 million in the fourth quarter of 2024 compared to 119.3 million in the fourth quarter of the prior year. Natera¡¯s net loss for the full year 2024 was $190.4 million, or ($1.53) per diluted share, compared to a net loss of $434.8 million, or ($3.78) per diluted share, in 2023. Weighted average shares outstanding were 124.7 million in the full year 2024 compared to 115.0 million for the same period in the prior year.

At December 31, 2024, Natera held approximately $968.3 million in cash, cash equivalents, short-term investments and restricted cash, compared to $879.0 million as of December 31, 2023. As of December 31, 2024, Natera had a total outstanding debt balance of $80.4 million including accrued interest under its line of credit with UBS at a variable interest rate of 30-day SOFR plus 50 bps. The Company previously had convertible senior notes which were redeemed or converted on October 11, 2024.

Financial Outlook

Natera anticipates 2025 total revenue of $1.87 billion to $1.95 billion; 2025 gross margin to be approximately 60% to 64% of revenues; selling, general and administrative costs to be approximately $950 million to $975 million; research and development costs to be $525 million to $550 million; and net cash inflow to be positive.

Source: Natera Reports Fourth Quarter and Full Year 2024 Financial Results

- CAIVD WeChat

Subscription Account

- CAIVD WeChat

Channels

China Association of In-vitro Diagnostics

Part of the information in our website is from the internet.

If by any chance it violates your rights, please contact us.