Illumina Reports Financial Results for Fourth Quarter and Fiscal Year 2024

2025/2/10 11:29:34 Views£º794

Original from: Illumina

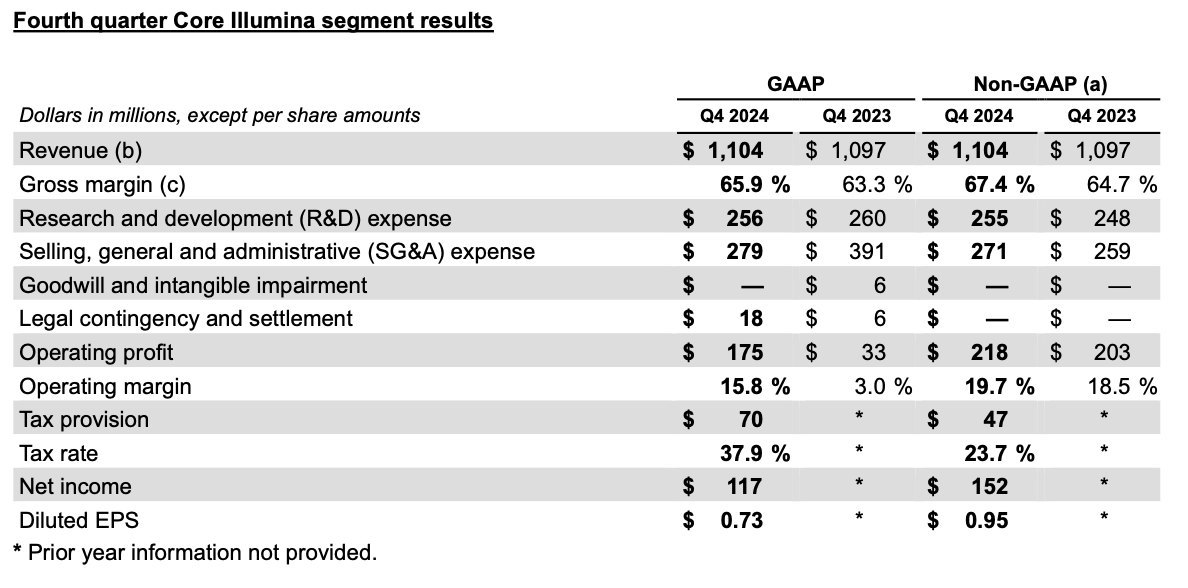

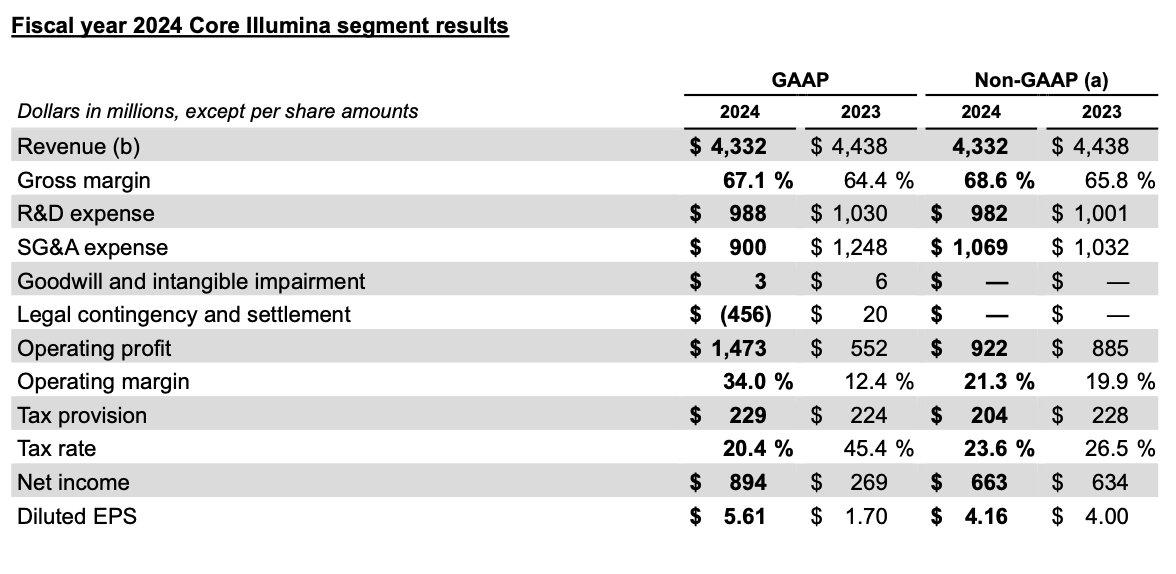

¡¤ Core Illumina revenue of $1.1 billion for Q4 2024, up 1% from Q4 2023 on both a reported and constant currency basis; revenue of $4.3 billion for fiscal year 2024, down 2% from fiscal year 2023 on both a reported and constant currency basis

¡¤ Core Illumina GAAP operating margin of 15.8% and non-GAAP operating margin of 19.7% for Q4 2024; GAAP operating margin of 34.0% and non-GAAP operating margin of 21.3% for fiscal year 2024

¡¤ Core Illumina GAAP diluted earnings per share (EPS) of $0.73 and non-GAAP diluted EPS of $0.95 for Q4 2024; GAAP diluted EPS of $5.61 and non-GAAP diluted EPS of $4.16 for fiscal year 2024

¡¤ Core Illumina cash provided by operations of $1.2 billion and free cash flow of $1.1 billion for fiscal year 2024

¡¤ Fiscal year 2025 guidance does not attempt to reflect any impact from the recent China Ministry of Commerce announcement and assumes a continuation of the current macroeconomic and political environments

¡¤ For fiscal year 2025, continue to expect Core Illumina constant currency revenue growth in the low single digits (reported revenue in the range of approximately $4.28 billion to $4.4 billion) and non-GAAP operating margin of approximately 23%; expect non-GAAP diluted EPS in the range of $4.50 to $4.65

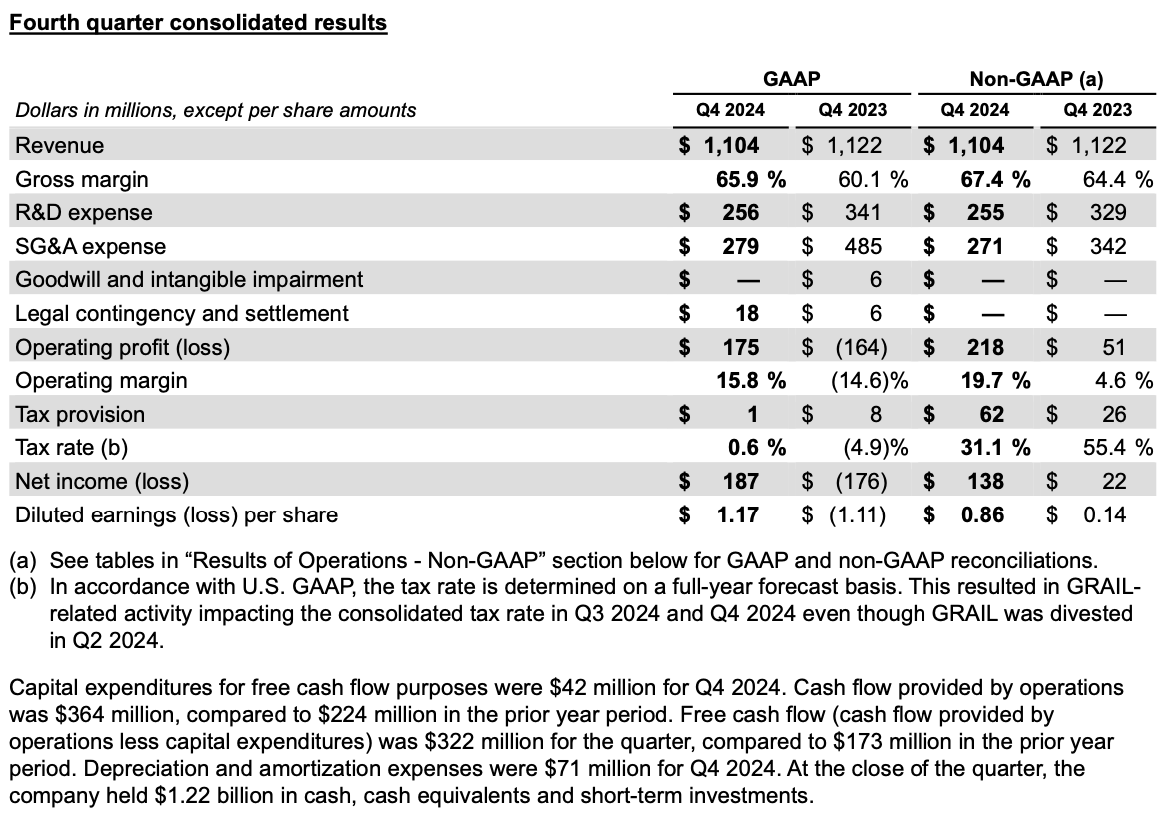

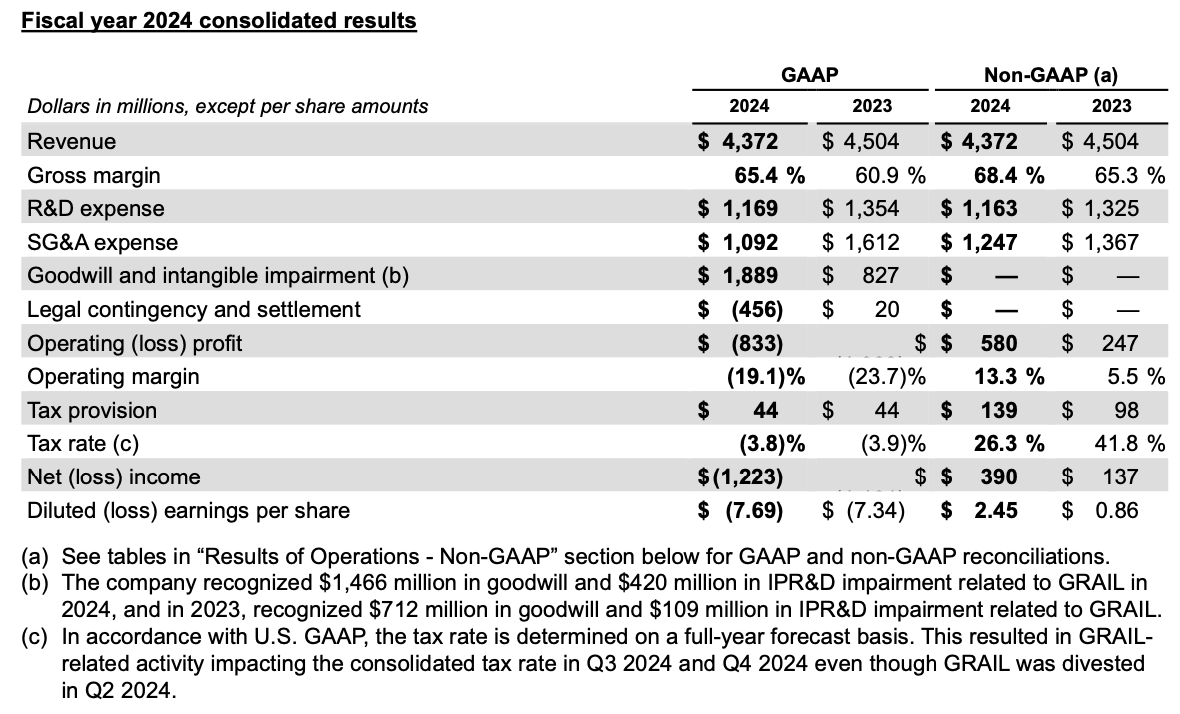

Illumina, Inc. (Nasdaq: ILMN) (¡°Illumina¡± or the ¡°company¡±) today announced its financial results for the fourth quarter and fiscal year 2024. The financial results for fiscal year 2024 and Q4 2023 and fiscal year 2023 include the financial results for GRAIL which was spun off on June 24, 2024.

¡°The Illumina team delivered fourth quarter revenue that exceeded our expectations, and we made significant progress in 2024 toward our goals to drive customer-centric innovation, margin expansion, and EPS growth,¡± said Jacob Thaysen, Chief Executive Officer. ¡°For 2025, we will continue our transformation, executing our refreshed strategy that prioritizes a sharp focus on customers and our own operational excellence in order to drive Illumina forward.¡±

Capital expenditures for free cash flow purposes were $142 million for fiscal year 2024. Cash flow provided by operations was $837 million, compared to $478 million in the prior year. Free cash flow was $695 million, compared to $283 million in the prior year. Depreciation and amortization expenses were $354 million for fiscal year 2024.

Key announcements since our last earnings release

¡¤ Announced collaboration with NVIDIA to enhance the analysis and interpretation of multiomic data

¡¤ Launched pilot proteomics program with UK Biobank and biopharma collaborators to analyze 50,000 samples

¡¤ Announced collaboration with Regeneron and investment in Truveta Genome Project to extend DNA sequence-linked healthcare database to advance scientific innovation and healthcare delivery

¡¤ Advanced NovaSeq X Series, delivering single-flow-cell system, software upgrade, and new kits to enable multiomic applications

¡¤ Announced expansion of TruSight Oncology, the latest solution to enable comprehensive genomic profiling of tumors

¡¤ Presented real-world data with Providence and Microsoft Research finding that cancer patients with early genomic testing received better precision treatment

A full list of recent announcements can be found in the company¡¯s News Center.

Financial outlook and guidance

Fiscal year 2025 guidance does not attempt to reflect any impact from the recent China Ministry of Commerce announcement and assumes a continuation of the current macroeconomic and political environments. For fiscal year 2025, the company continues to expect Core Illumina constant currency revenue growth in the low single digits (reported revenue in the range of approximately $4.28 billion to $4.4 billion) and non-GAAP operating margin of approximately 23%. The company expects non-GAAP diluted EPS in the range of $4.50 to $4.65.

The company provides forward-looking guidance on a non-GAAP basis. The company is unable to provide a reconciliation of forward-looking non-GAAP financial measures to the most directly comparable GAAP reported financial measures because it is unable to predict with reasonable certainty the impact of items such as acquisition-related expenses, gains and losses from strategic investments, fair value adjustments to contingent consideration, potential future asset impairments, restructuring activities, and the ultimate outcome of pending litigation without unreasonable effort. These items are uncertain, inherently difficult to predict, depend on various factors, and could have a material impact on GAAP reported results for the guidance period. For the same reasons, the company is unable to address the significance of the unavailable information, which could be material to future results.

- CAIVD WeChat

Subscription Account

- CAIVD WeChat

Channels

China Association of In-vitro Diagnostics

Part of the information in our website is from the internet.

If by any chance it violates your rights, please contact us.