Siemens Healthineers off to a strong start in fiscal year 2025

2025/2/7 11:26:58 Views£º1115

Original from: Siemens Healthineers

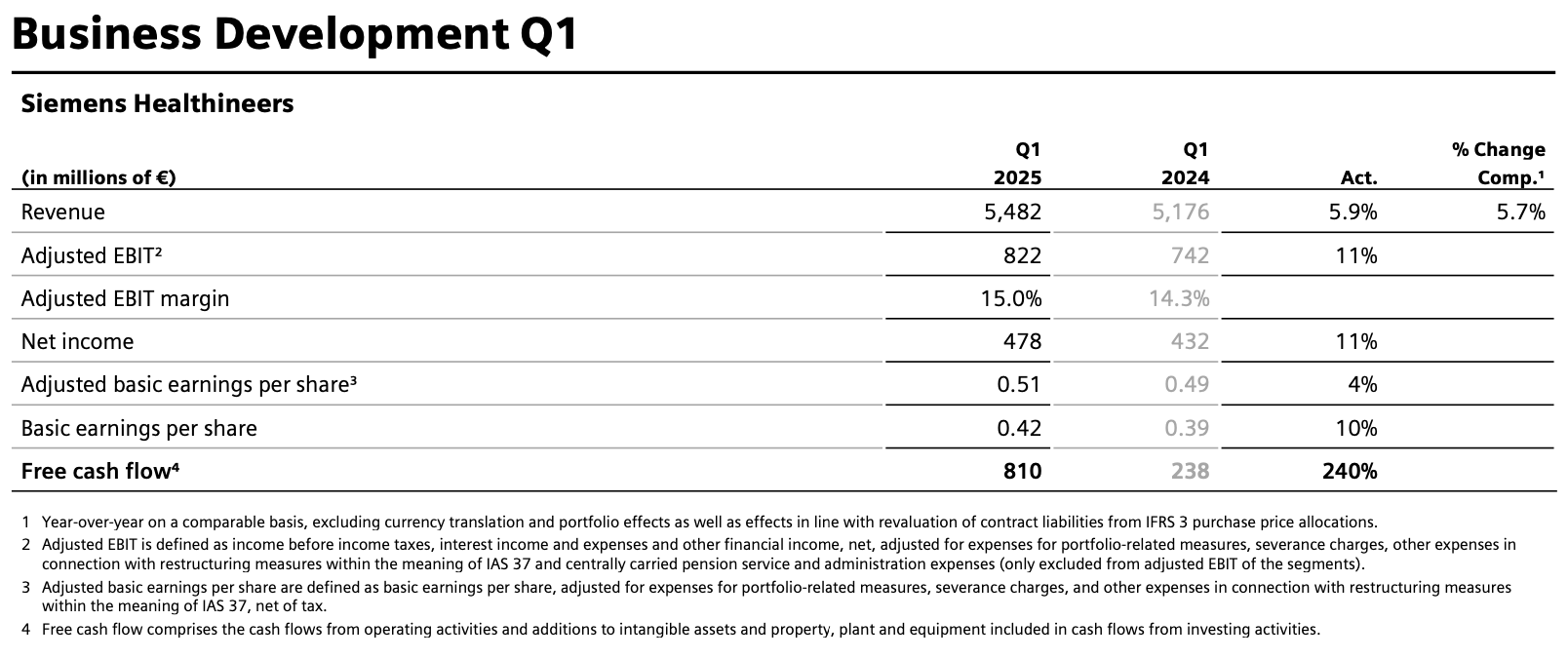

Siemens Healthineers AG today announces its results for the first quarter of fiscal year 2025 ended December 31, 2024.

Q1 Fiscal Year 2025

• Excellent equipment book-to-bill ratio of 1.21

• Comparable revenue growth of 5.7%

• Imaging comparable revenue growth of 7.6%; adjusted EBIT margin of 18.7% impacted by special items

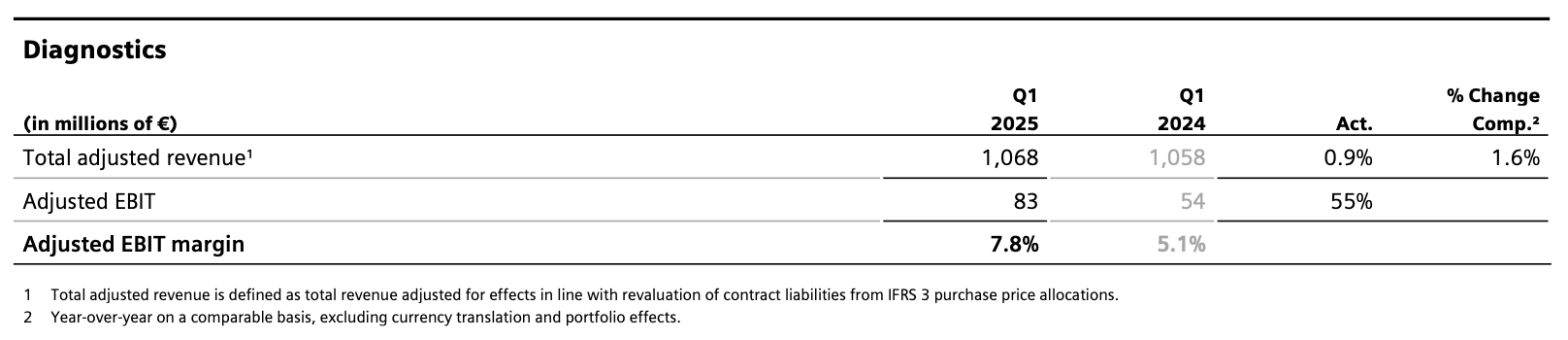

• Diagnostics comparable revenue growth of 1.6%; adjusted EBIT margin of 7.8%

• Varian comparable revenue growth of 6.2%; adjusted EBIT margin of 17.1%

• Advanced Therapies comparable revenue growth of 5.1%; adjusted EBIT margin of 14.1%

• Overall adjusted EBIT margin of 15.0%, above prior-year quarter

• Free cash flow of around €810 million, more than tripled from prior-year quarter

• Adjusted basic earnings per share of €0.51, above prior-year quarter

Outlook for Fiscal Year 2025

We confirm our expectation of comparable revenue growth of between 5% to 6% compared with fiscal year 2024 and adjusted basic earnings per share of between €2.35 and €2.50.

Bernd Montag, CEO of Siemens Healthineers AG:

¡±We have made a strong start to the year. Our performance is consistently improving from a high base thanks to the efforts of the whole Healthineers team.¡±

Revenue rose 5.7% in the first quarter of fiscal year 2025 to almost €5.5 billion. Growth in the Imaging and Varian segments in particular contributed to this strong growth.

From a geographical perspective, the Americas region achieved significant comparable revenue growth, and the Asia Pacific Japan region very strong revenue growth. Revenue in the EMEA region was flat after significant growth in the prior-year quarter, while revenue in the China region declined by a mid-single-digit percentage due to continued delays in customer orders.

Equipment order intake in the first quarter markedly exceeded equipment revenue. The equipment book-to-bill ratio was an excellent 1.21.

Adjusted EBIT rose 11% to around €822 million in the first quarter from the prior-year period. This resulted in an adjusted EBIT margin of 15.0%, also higher than in the prior-year quarter. Contributions from overall strong revenue development as well as cost reductions related to the transformation program of the Diagnostics business had a positive effect.

Net income was €478 million, up 11% from the prior-year period. The tax rate was 22%, above the 20% rate in the prior-year quarter.

Adjusted basic earnings per share rose slightly to €0.51 from €0.49 in the prior-year period due to higher earnings contributions from the operating business.

Free cash flow reached around €810 million, more than three times as high as in the prior-year quarter.

In the Diagnostics segment, revenue in the first quarter rose 1.6% on a comparable basis to almost €1.1 billion. In the EMEA and Asia Pacific Japan regions, revenue rose strongly on a comparable basis. Revenue in the Americas region fell slightly and, in the China region, declined by a mid-single-digit percentage.

The segment¡¯s adjusted EBIT margin of 7.8% was above the prior-year quarter. Cost reductions related to the transformation program as well as positive contributions from revenue growth outweighed negative currency effects.

Outlook

For fiscal year 2025, we continue to expect comparable revenue growth of between 5% and 6% over fiscal year 2024. The expectation for adjusted basic earnings per share remains unchanged in the range of €2.35 to €2.50.

The outlook is based on several assumptions. This includes the expectation that the current macroeconomic environment, including the interest rate level, will remain largely unchanged.

In addition, the outlook is based on assumptions about exchange rate developments, which currently lead to a slightly positive currency effect on the expected adjusted basic earnings per share for fiscal year 2025 compared with fiscal year 2024. Furthermore, this outlook excludes potential portfolio measures. In addition, the outlook is based on the assumption that developments related to the war in Ukraine and conflicts in the Middle East will not have a material impact on our business activities. The outlook is based on the number of shares outstanding at the end of fiscal year 2024. This outlook also excludes charges from legal, tax and regulatory issues and framework conditions.

Source: Siemens Healthineers off to a strong start in fiscal year 2025

- CAIVD WeChat

Subscription Account

- CAIVD WeChat

Channels

China Association of In-vitro Diagnostics

Part of the information in our website is from the internet.

If by any chance it violates your rights, please contact us.