Natera Reports Fourth Quarter and Full Year 2023 Financial Results

2024/2/29 10:55:09 Views£º1703

Original from: Natera

Natera, Inc. (NASDAQ: NTRA), a global leader in cell-free DNA testing, today reported its financial results for the fourth quarter and year ended December 31, 2023.

Recent Strategic and Financial Highlights

¡¤ Generated total revenues of $311.1 million in the fourth quarter of 2023, compared to $217.3 million in the fourth quarter of 2022, an increase of 43.2%. Product revenues grew 44.3% over the same period.

¡¤ Generated total revenues of $1,082.6 million in the full year 2023 compared to $820.2 million in 2022, an increase of 32.0%. Product revenues grew 34.0% over the same period.

¡¤ Generated gross margins of 51.4% in the fourth quarter of 2023, compared to gross margins of 41.4% in the fourth quarter of 2022.

¡¤ Processed approximately 2,496,100 tests in the full year 2023, compared to approximately 2,066,500 tests in 2022, an increase of 20.8%.

¡¤ Performed approximately 97,500 oncology tests in the fourth quarter of 2023, compared to approximately 64,000 in the fourth quarter of 2022, an increase of 52.3%.

¡¤ Performed approximately 340,700 oncology tests in the full year 2023, compared to approximately 196,400 in 2022, an increase of 73.5%.

¡¤ Guiding 2024 total revenue of $1.32 billion-$1.35 billion, gross margin of 50% to 53%, and reiterating expectations to achieve a cash flow breakeven quarter in 2024.

¡¤ Acquired Invitae¡¯s reproductive health assets.

¡¤ Received Medicare Coverage for Signatera in two new indications, ovarian cancer and neoadjuvant breast cancer.

¡°We are really pleased with our performance in the quarter and with the continued positive impact we make on patient care,¡± said Steve Chapman, chief executive officer of Natera. ¡°We believe we are in an excellent position to continue this momentum into 2024.¡±

Fourth Quarter and Year Ended December 31, 2023 Financial Results

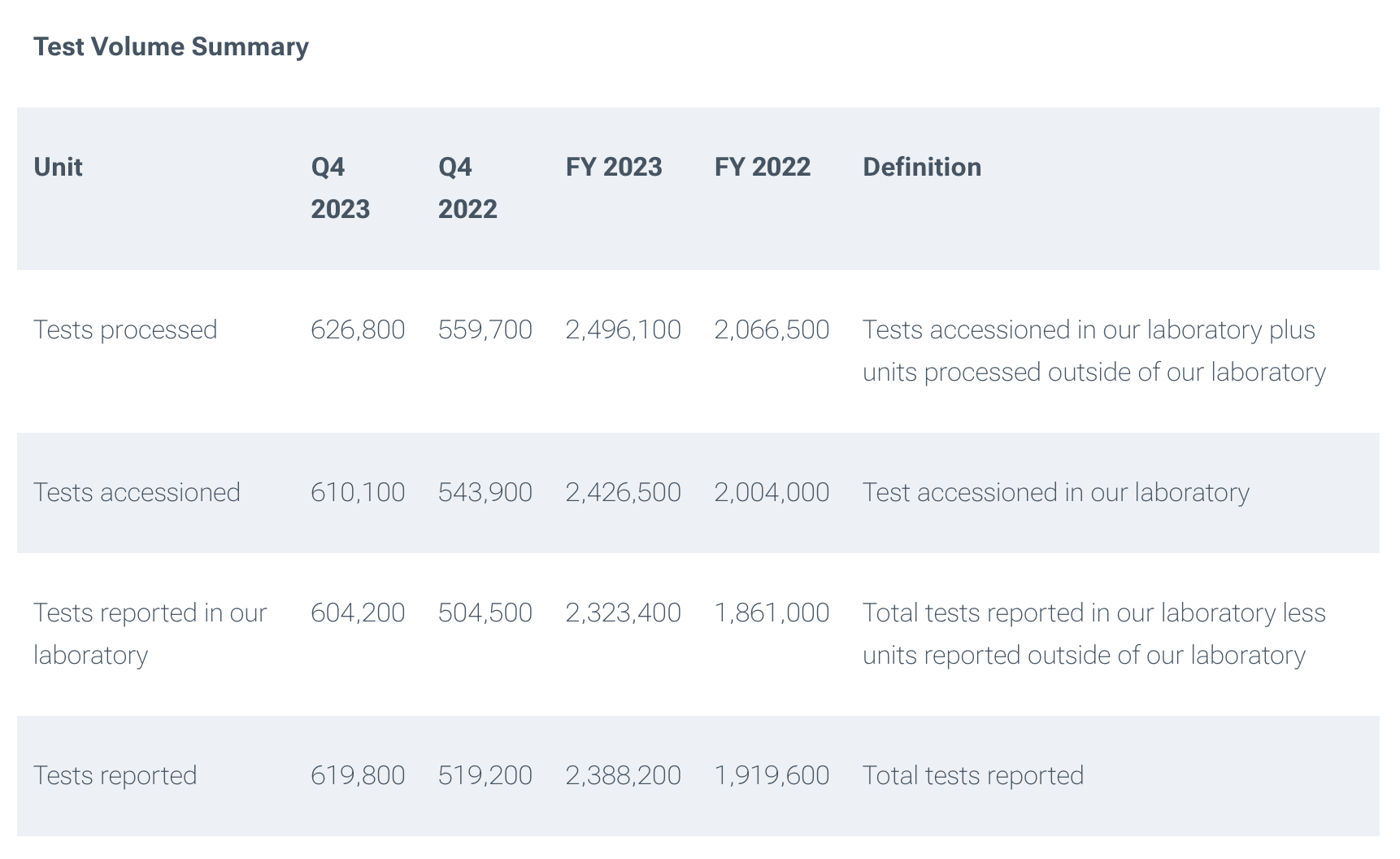

Total revenues were $311.1 million in the fourth quarter of 2023 compared to $217.3 million in the fourth quarter of 2022, an increase of 43.2%. The increase in total revenues was driven primarily by a 44.3% increase in product revenues, which were $307.3 million in the fourth quarter of 2023 compared to $212.9 million in the fourth quarter of 2022. The increase in product revenues was driven by average selling price improvements as well as an increase in test volumes. Natera processed approximately 626,800 tests in the fourth quarter of 2023, including approximately 610,100 tests accessioned in its laboratory, compared to approximately 559,700 tests processed, including approximately 543,900 tests accessioned in its laboratory, in the fourth quarter of 2022.

In the fourth quarter of 2023, Natera recognized revenue on approximately 619,800 tests for which results were reported to customers in the period (tests reported), including approximately 604,200 tests reported from its laboratory, compared to approximately 519,200 tests reported, including approximately 504,500 tests reported from its laboratory, in the fourth quarter of 2022, an overall increase of 19.4% from the prior period.

Total revenues in 2023 were approximately $1,082.6 million compared to $820.2 million in 2022, which represents an increase of 32.0%. The increase in total revenues was driven primarily by a 34.0% increase in product revenues, which were $1,068.5 million in the full year 2023 compared to $797.3 million in 2022. The increase in product revenues was driven by an increase in test volumes as well as average selling price improvements compared to 2022. For the full year 2023, Natera processed approximately 2,496,100 tests, including approximately 2,426,500 tests accessioned in its laboratory, compared to approximately 2,066,500 tests processed in 2022, including approximately 2,004,000 tests accessioned in its laboratory.

For the full year 2023, Natera recognized revenue on approximately 2,388,200 tests reported, including approximately 2,323,400 tests reported from its laboratory, compared to approximately 1,919,600 tests reported, including approximately 1,861,000 tests reported from its laboratory, in 2022, an overall increase of 24.4%.

Gross profit* for the three months ended December 31, 2023 and 2022 was $159.9 million and $90.0 million, respectively, representing a gross margin of 51.4% and 41.4%, respectively. Gross profit for the year ended December 31, 2023 and 2022 was $492.7 million and $364.0 million, respectively, representing a gross margin of 45.5% and 44.4%, respectively. Natera had higher gross margin in the fourth quarter of 2023 and for the full year 2023 primarily as a result of higher revenues and continuous progress in reducing cost of goods sold associated with tests processed. Total operating expenses, representing research and development expenses and selling, general and administrative expenses, for the fourth quarter of 2023 were $244.4 million, compared to $231.7 million in the same period of the prior year, an increase of 5.5%. Total operating expenses for the full year 2023 were $939.0 million, compared to $905.0 million in 2022, an increase of 3.8%. The increases for both periods were primarily driven by headcount growth to support new product offerings.

Loss from operations for the fourth quarter of 2023 was $84.5 million compared to $141.8 million for the same period of the prior year. Loss from operations for the full year 2023 was $446.2 million compared to $541.0 million in 2022.

Natera reported a net loss for the fourth quarter of 2023 of $78.0 million, or ($0.65) per diluted share, compared to a net loss of $142.6 million, or ($1.37) per diluted share, for the same period in 2022. Weighted average shares outstanding were approximately 119.3 million in the fourth quarter of 2023 compared to 104.3 million in the fourth quarter of the prior year. Natera¡¯s net loss for the full year 2023 was $434.8 million, or ($3.78) per diluted share, compared to a net loss of $547.8 million, or ($5.57) per diluted share, in 2022. Weighted average shares outstanding were 115.0 million in 2023 compared to 98.4 million in 2022.

At December 31, 2023, Natera held approximately $879.0 million in cash, cash equivalents, short-term investments and restricted cash, compared to $898.4 million as of December 31, 2022. As of December 31, 2023, Natera had a total outstanding debt balance of $363.3 million, comprised of $80.4 million including accrued interest under its line of credit with UBS at a variable interest rate of 30-day SOFR plus 50 bps and a net carrying amount of $282.9 million under its seven-year convertible senior notes issued in April 2020. The gross principal balance outstanding for the convertible senior notes was $287.5 million as of December 31, 2023.

Financial Outlook

Natera anticipates 2024 total revenue of $1.32 billion to $1.35 billion; 2024 gross margin to be approximately 50% to 53% of revenues; selling, general and administrative costs to be approximately $630 million to $650 million; research and development costs to be $325 million to $345 million, and net cash consumption to be $50 million to $75 million**.

* Gross profit is calculated as GAAP total revenues less GAAP cost of revenues. Gross margin is calculated as gross profit divided by GAAP total revenues.

** Cash consumption is calculated as the sum of GAAP net cash used by operating activities (estimated for 2024 to be up to $25 million) and GAAP net purchases of property and equipment (estimated for 2024 to be up to $50 million).

Source: Natera Reports Fourth Quarter and Full Year 2023 Financial Results

- CAIVD WeChat

Subscription Account

- CAIVD WeChat

Channels

China Association of In-vitro Diagnostics

Part of the information in our website is from the internet.

If by any chance it violates your rights, please contact us.