Illumina Reports Financial Results for Third Quarter of Fiscal Year 2023

2023/11/10 10:56:17 Views£ļ1230

Original from: PR Newswire

- Welcomed new CEO Jacob Thaysen, Ph.D., who started with Illumina on September 25, 2023

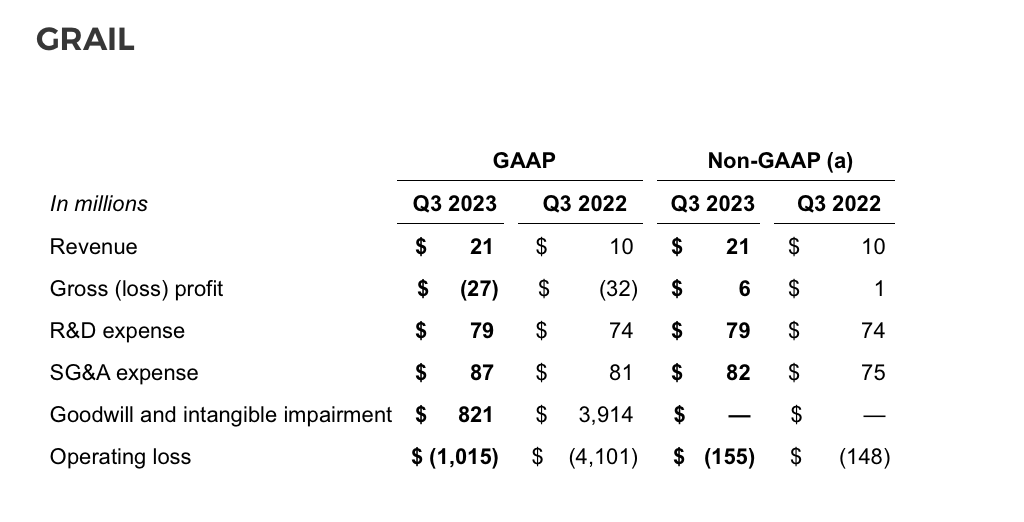

- With respect to GRAIL, continue to proceed quickly: retained advisors and preparing for sale and capital markets transaction options for GRAIL, including filing a Form 10, in accordance with the European Commission's divestiture order; a Board special committee has been established to expedite decisions; in parallel, ongoing appeals preserve flexibility for any divestiture of GRAIL and future transactions

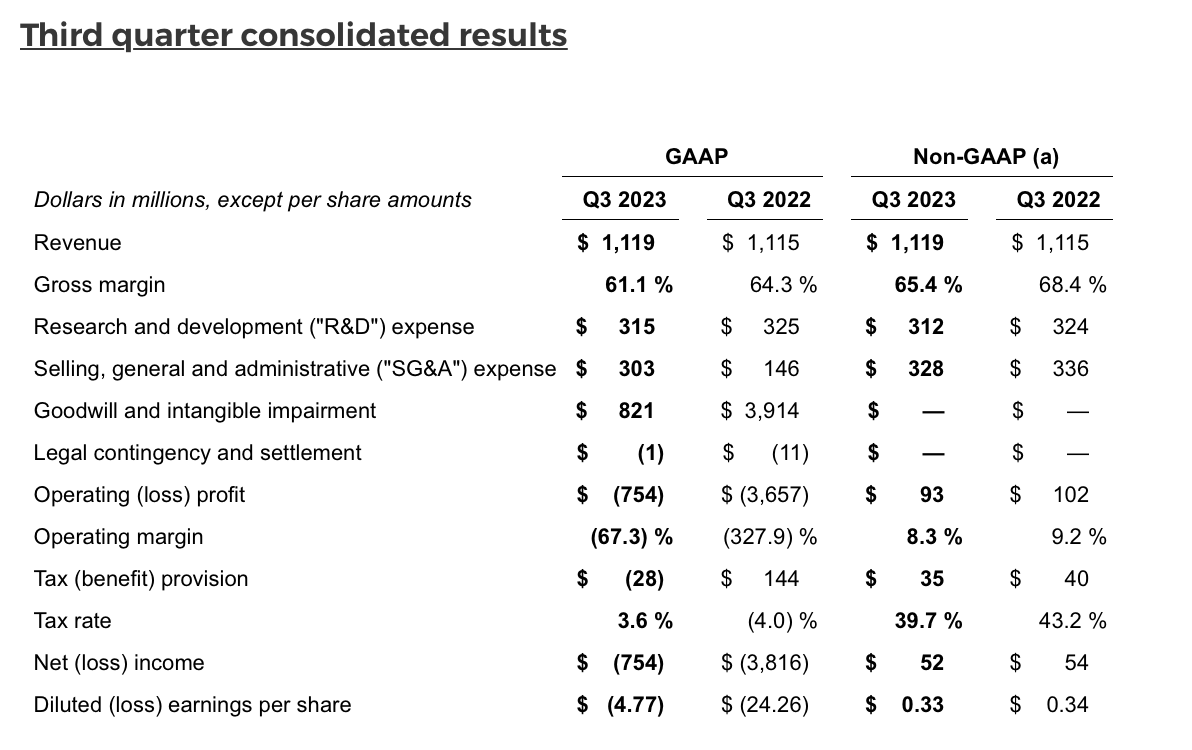

- Revenue of $1.12 billion for Q3 2023, flat compared to Q3 2022 (up 1% on a constant currency basis) and down 5% from Q2 2023

- Shipped 97 NovaSeq X instruments in Q3 2023; now expect to ship 330 to 340 instruments for fiscal year 2023

- GAAP diluted loss per share of $(4.77) for Q3 2023, which included goodwill and intangible impairments of $821 million related to the GRAIL segment, compared to GAAP diluted loss per share of $(24.26) for Q3 2022, which included goodwill impairment of $3.91 billion related to the GRAIL segment

- Non-GAAP diluted earnings per share of $0.33 for Q3 2023, compared to non-GAAP diluted earnings per share of $0.34 for Q3 2022

- Now expect fiscal year 2023 consolidated revenue to decrease 2% to 3% from 2022, including Core Illumina revenue to decrease 3% to 4% from 2022 and GRAIL revenue at the low end of the $90 million to $110 millionrange

- Now expect GAAP diluted loss per share of $(6.67) to $(6.57) for fiscal year 2023, which includes goodwill and intangible impairments of $821 million related to the GRAIL segment

- Now expect non-GAAP diluted earnings per share of $0.60 to $0.70 for fiscal year 2023

Illumina, Inc. (Nasdaq: ILMN) ("Illumina" or the "company") today announced its financial results for the third quarter of fiscal year 2023, which include the consolidated financial results for GRAIL.

"While the environment remains challenging, I am confident in our ability to navigate it and position the company for long-term success," said Jacob Thaysen, Chief Executive Officer. "I came to Illumina for the opportunity presented by our core business. While I evaluate the company's strategy, we will remain focused on driving on further placements of the NovaSeq X, which will boost consumables demand. We will also continue optimizing our operations and drive stronger execution."

During the third quarter of 2023, the company recognized $712 million in goodwill and $109 million in intangible asset (IPR&D) impairment related to the GRAIL segment. The goodwill impairment was primarily due to a decrease in the company's consolidated market capitalization and a higher discount rate selected for the fair value calculation of the GRAIL reporting unit. The IPR&D impairment was primarily due to a decrease in projected cash flows and a higher discount rate selected for the fair value calculation of the GRAIL IPR&D asset. During the third quarter of 2022, the company recognized $3.91 billion in goodwill impairment related to the GRAIL segment.

Capital expenditures for free cash flow purposes were $45 million for Q3 2023. Cash flow provided by operations was $139 million, compared to cash flow used in operations of $(52) million in the prior year period, which included a one-time payment related to the litigation settlement with BGI. Free cash flow (cash flow provided by (used in) operations less capital expenditures) was $94 million for the quarter, compared to $(119) million in the prior year period. Depreciation and amortization expenses were $108 million for Q3 2023. At the close of the quarter, the company held $933 million in cash, cash equivalents and short-term investments. During the third quarter of 2023, the company used $750 million in cash to repay the outstanding principal of convertible notes that matured in August 2023.

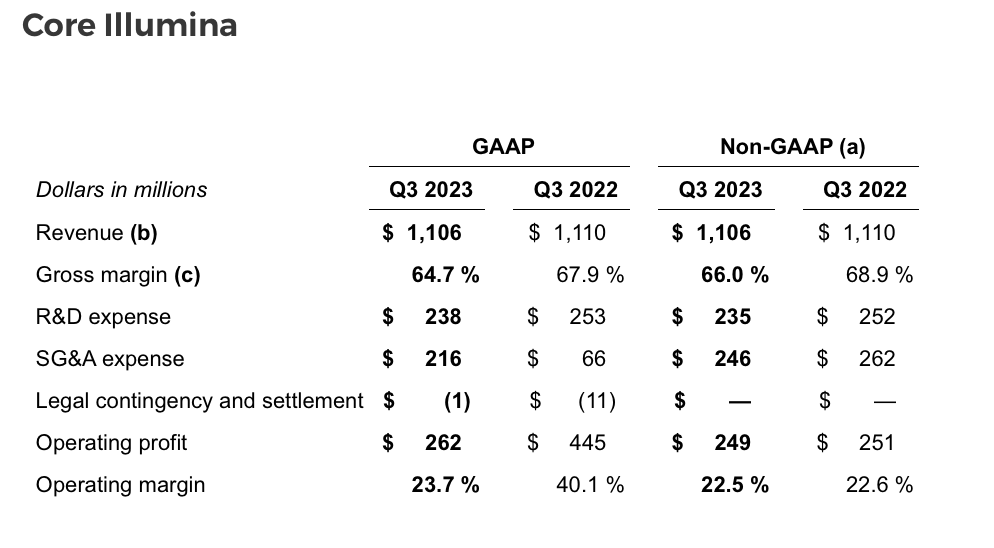

Third quarter segment results

Illumina has two reportable segments, Core Illumina and GRAIL.

As previously stated, Illumina is committed to moving as quickly as possible through the legal and regulatory processes associated with its acquisition of GRAIL. At this point, Illumina expects decisions on its appeals from the US Court of Appeals for the Fifth Circuit by the end of 2023 and from the European Court of Justice (ECJ) in mid-2024.

Key announcements by Illumina since Illumina's last earnings release

- Received order from the European Commission to divest GRAIL; Illumina is committed to resolving all issues in a timely manner, with the objective of achieving the maximum value for shareholders and the best outcome for GRAIL

- Launched TruSight Oncology 500 (TSO 500) ctDNA Version 2, a liquid biopsy assay that enables comprehensive genomic profiling of circulating tumor DNA; key improvements include a faster turnaround time of less than four days, higher sensitivity with lower input requirements, and a more streamlined workflow

- Opened new office and state-of-the-art Illumina Solutions Center in Bengaluru, India to grow the genomics market in the most populous country in the world, unlocking opportunities for advancing health care and combating the effects of climate change in South Asia

- Appointed Jacob Thaysen, Ph.D. as Chief Executive Officer and Dr. Steve Barnard as Chief Technology Officer

- Launched the 25B flow cell (300-cycle kit) for the NovaSeq X, enabling customers to generate tens of thousands of whole genomes per year at the lowest cost per sample of any Illumina platform

Key announcements by GRAIL since Illumina's last earnings release

- Collaboration with HCA Healthcare, Inc. to make GRAIL's Galleri® multi-cancer early detection (MCED) available to patients who meet screening criteria at select HCA Healthcare physician practices

- Published final results from PATHFINDER Study, which demonstrated that an earlier version of Galleri identified many cancer types that do not currently have recommended screening tests, enabled targeted cancer diagnostic evaluations, and supported diagnostic resolution for the majority of participants in less than three months

- Expanded pilot with Point32Health to offer Galleri to members meeting eligibility requirements, making Point32Health the first commercial health plan in the U.S. to offer Galleri in addition to recommended cancer screenings

Financial outlook and guidance

The non-GAAP financial guidance discussed below reflects certain pro forma adjustments to assist in analyzing and assessing our core operational performance, including the company's Core Illumina and GRAIL segments. Please see our Reconciliation of Consolidated Non-GAAP Financial Guidance included in this release for a reconciliation of these GAAP and non-GAAP financial measures.

For fiscal year 2023, the company now expects consolidated revenue to decrease 2% to 3% compared to fiscal year 2022. The company now expects Core Illumina revenue to decrease 3% to 4% compared to fiscal year 2022. GRAIL revenue is now expected to be at the low end of the $90 million to $110 million range.

The company now expects GAAP diluted loss per share of $(6.67) to $(6.57) and non-GAAP diluted earnings per share of $0.60 to $0.70.

Source: Illumina Reports Financial Results for Third Quarter of Fiscal Year 2023

- CAIVD WeChat

Subscription Account

- CAIVD WeChat

Channels

China Association of In-vitro Diagnostics

Part of the information in our website is from the internet.

If by any chance it violates your rights, please contact us.