BD Reports Fourth Quarter and Full Year Fiscal 2023 Financial Results

2023/11/10 10:23:26 Views:1597

Original from: Becton, Dickinson and Company

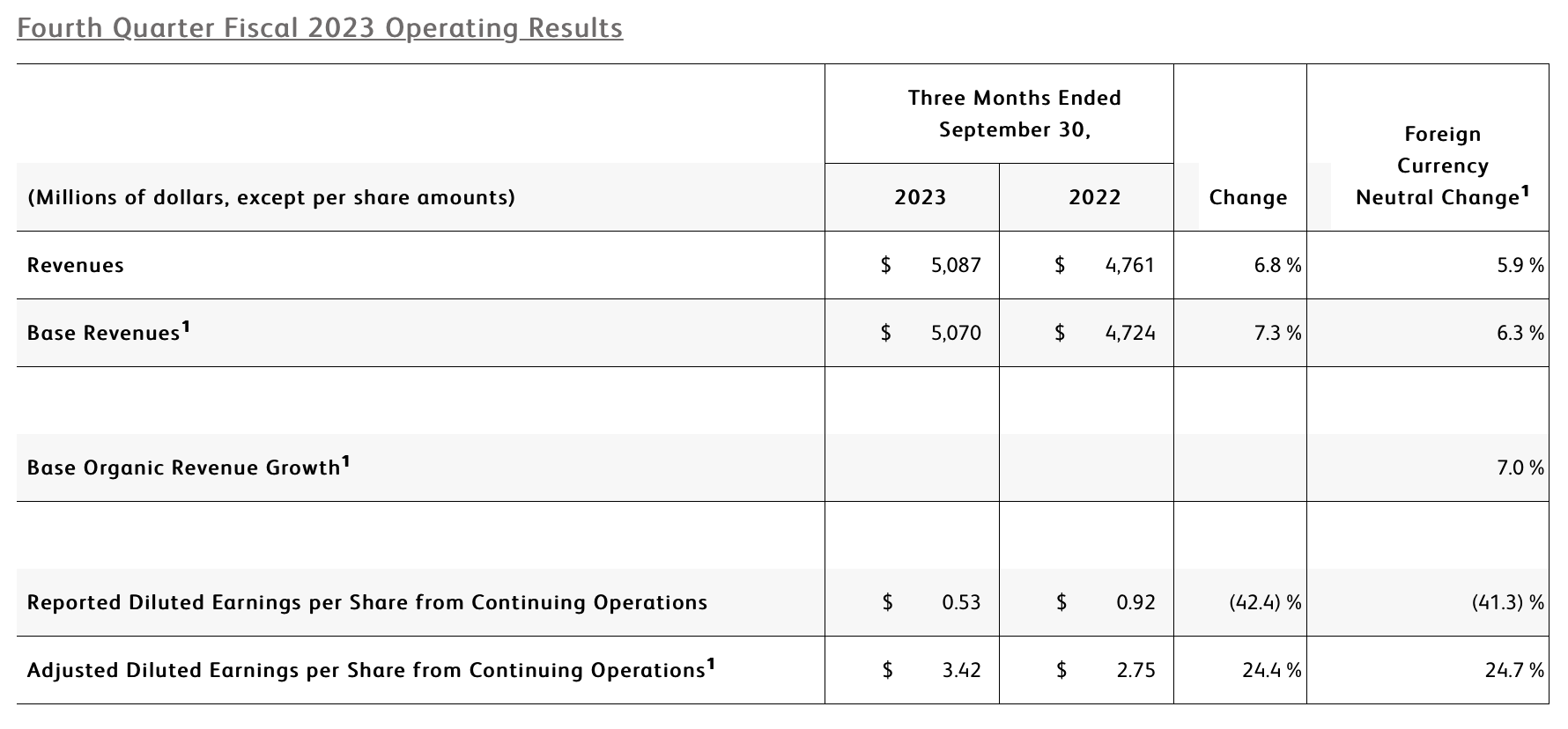

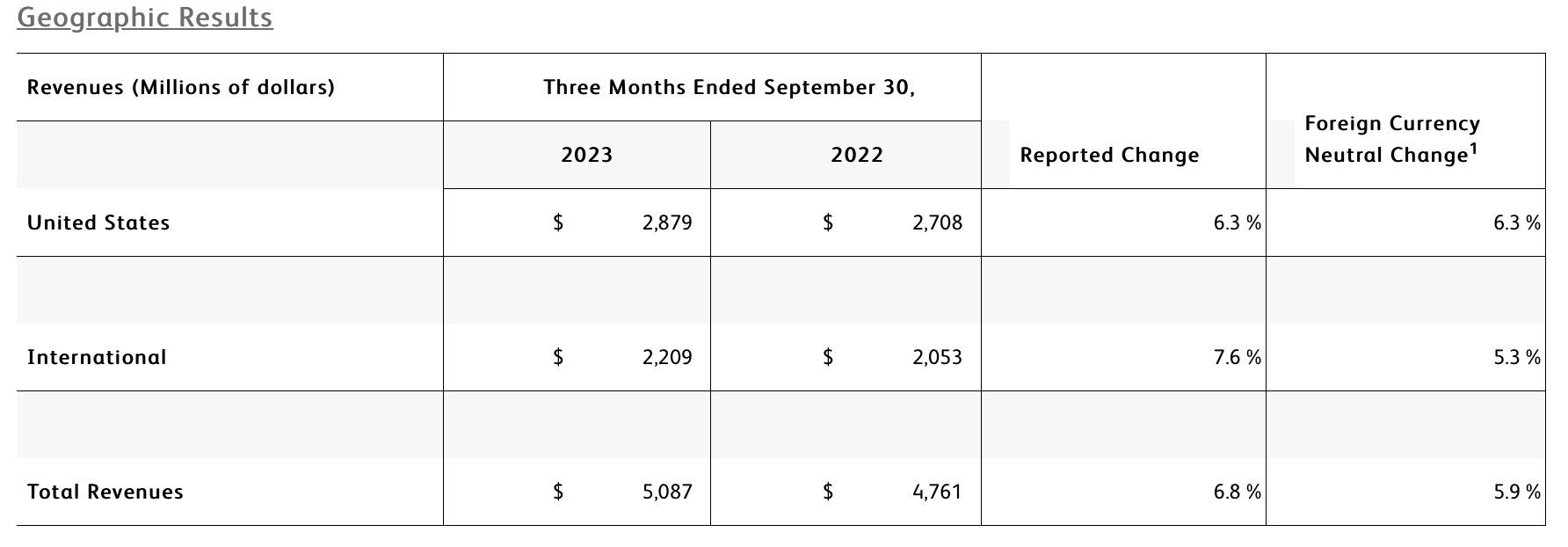

- Q4 revenue of $5.1 billion increased 6.8% as reported and 5.9% on a currency-neutral basis

- Q4 revenue from base business (which excludes COVID-only diagnostic testing) grew 7.3% as reported, 6.3% currency-neutral or 7.0% organic

- Q4 GAAP and adjusted diluted EPS from continuing operations of $0.53 and $3.42, respectively

- FY23 revenue of $19.4 billion increased 2.7% as reported and 4.5% on a currency-neutral basis

- FY23 revenue from base business grew 5.1% as reported, 7.0% currency-neutral or 5.8% organic

- FY23 GAAP and adjusted diluted EPS from continuing operations of $5.10 and $12.21, respectively

- Company issues FY24 guidance including 5.75% organic revenue growth at midpoint of 5.25% to 6.25% range; announces 52nd consecutive year of dividend increases

BD (Becton, Dickinson and Company) (NYSE: BDX), a leading global medical technology company, today announced results for its fourth quarter and full year of fiscal 2023, which ended September 30, 2023.

"We achieved another quarter, and another year, of strong performance through our talented team's execution of our BD2025 strategy and differentiated portfolio of medical technologies that are increasing healthcare efficiency and improving the lives of patients around the world," said Tom Polen, chairman, CEO and president of BD. "Looking ahead, continued execution of our category leadership strategy in higher-growth markets, advancement of our strong innovation pipeline and delivery against our simplification programs position us well to deliver durable growth in fiscal 2024 and beyond."

Recent Business and ESG Highlights

- BD Medical:

・ The Medication Management Solutions business unit began shipping the updated BD Alaris™ Infusion System at the end of September as part of its remediation process.

・ The Medication Delivery Solutions business unit advanced its "One-Stick Hospital Stay" vision with the launch of its next-generation needle-free blood draw technology. With FDA 510(k) clearance, the new PIVO™ Pro Needle-free Blood Collection Device delivers the first and only compatibility with integrated catheters, including the new Nexiva™ Closed IV Catheter System with NearPort™ IV Access, bringing an elevated standard of care to more U.S. hospitals.

- BD Life Sciences:

・ The Integrated Diagnostics Solutions business unit received FDA 510(k) clearance for the BD Respiratory Viral Panel for BD MAX™ System, a single molecular diagnostic combination test that identifies and distinguishes COVID-19, Influenza A/B and RSV.

- BD Interventional:

・ The Peripheral Intervention business unit began investigation of the safety and effectiveness of the BD Liverty™ Transjugular Intrahepatic Portosystemic Shunt (TIPS) Stent Graft to reduce complications associated with portal hypertension with first patient enrollment in the ARCH study.

- Ranked in the top 10 for overall transparency and awarded Best Code of Conduct among S&P 250 companies in the fifth annual U.S. Transparency Awards by Labrador.

- Named among the 100 Best Corporate Citizens of 2023 by 3BL and top two in the health care equipment and services industry.

- Completed industry-first circular economy pilot, partnering with Casella Waste Systems, Inc. to manage discarded needles and syringes that led to 40,000 pounds of medical waste being recycled.

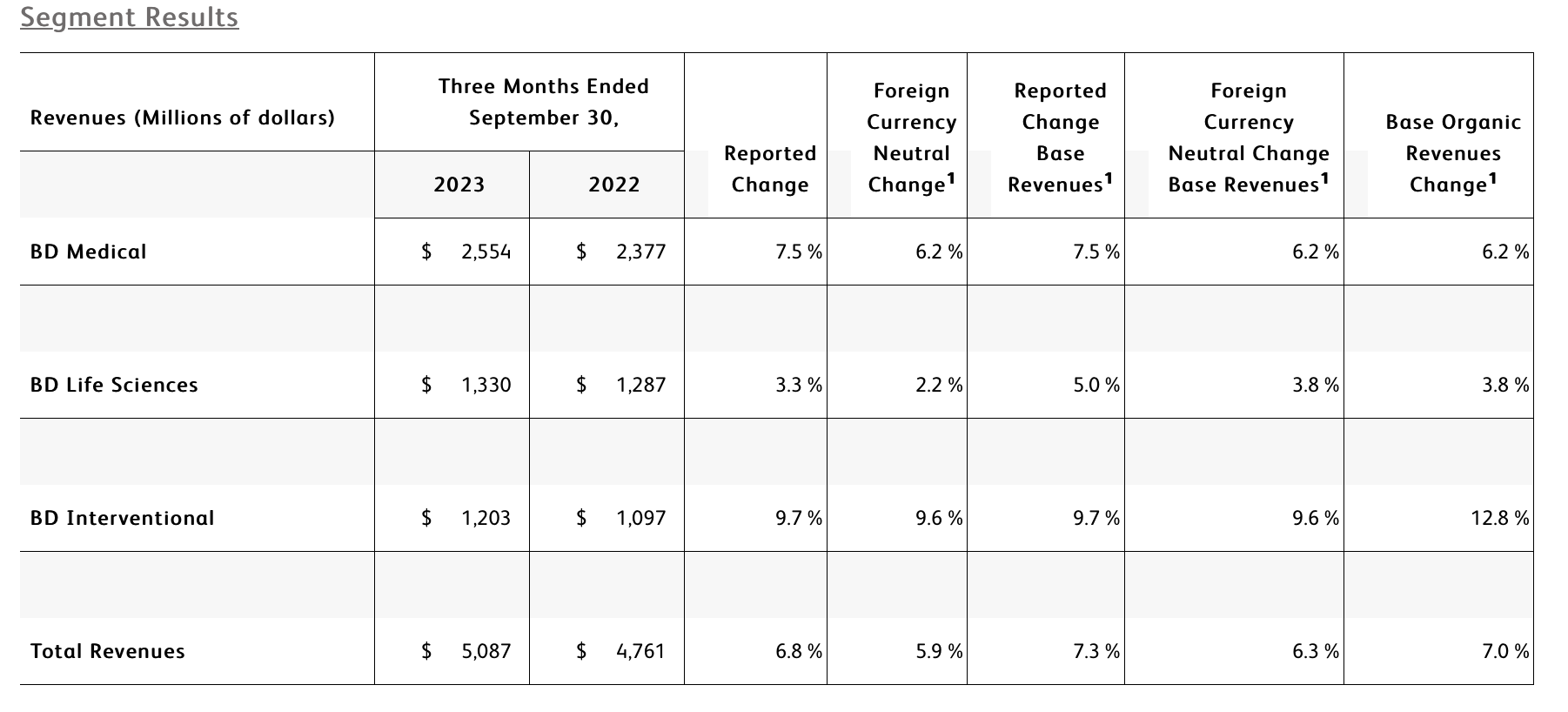

The BD Medical segment includes the Medication Delivery Solutions (MDS), Medication Management Solutions (MMS), and Pharmaceutical Systems (PS) business units. BD Medical revenue growth was driven by strong double-digit growth in MMS and PS.

- MDS performance reflects softness in China driven by market dynamics including volume-based procurement. This was partially offset by strong performance in Catheter Solutions in North America and Europe through continued execution of our Vascular Access Management strategy.

- MMS performance reflects double-digit growth in Dispensing driven by BD Pyxis™ which focuses on improving workflows and efficiencies, and double-digit growth in Pharmacy Automation, driven by our Parata and BD ROWA™ solutions that help pharmacies address rising costs and labor shortages.

- PS performance reflects continued strong demand for pre-fillable solutions for biologics such as BD Hypak™ and innovative products like BD Neopak™, partially offset by a slowdown in China exports of anticoagulants.

The BD Life Sciences segment includes the Integrated Diagnostic Solutions (IDS) and Biosciences (BDB) business units. BD Life Sciences performance reflects solid growth in the base business and a decline, as expected, in COVID-only testing revenues.

- IDS base business performance reflects high single-digit growth in our Microbiology platform driven by continued adoption of our BD Kiestra™ Total Modular Track solutions and strong ID/AST instrument placements, and continued strong growth from Molecular IVD assays leveraging the BD COR™ System and the incremental BD Max™ System installed base. This growth was partially offset by the comparison to the prior year COVID-related recovery in China and a decline in Specimen Management that was driven by distributor and customer stocking in the prior year.

- BDB performance reflects advancement of our category leadership in flow cytometry supported by double-digit growth in Research Instruments driven by strong demand for our recently launched BD FACSDiscover™ S8 Cell Sorter, and double-digit growth in Clinical Reagents leveraging our growing installed base of FACSLyric™ analyzers and FACSDuet™ automation.

The BD Interventional segment includes the Surgery, Peripheral Intervention (PI), and Urology & Critical Care (UCC) business units. BD Interventional performance was driven by strong growth across the segment.

- Surgery performance reflects double-digit growth in Advanced Repair and Reconstruction, driven by continued market adoption of the Phasix™ hernia resorbable scaffold, and double-digit growth in Infection Prevention, driven by strong demand for ChloraPrep™ and aided by the comparison to prior-year distributor inventory reductions. The unit's performance also reflects the impact from the divestiture of the Surgical Instrumentation platform.

- PI performance reflects double-digit growth in Peripheral Vascular Disease that was driven by global penetration of the Rotarex™ Atherectomy System, and strong performance in our Venous portfolio in China. Growth was aided by improved supply and distribution stabilization in EMEA following a new ERP implementation in fiscal 2022.

- UCC performance reflects double-digit growth in our PureWick™ solutions for chronic incontinence, driven by continued adoption in both the acute care and alternative care settings. The unit's performance also reflects double-digit growth in Targeted Temperature Management driven by market development, and Endourology, which reflects the success of the Aptra™ Digital Endoscope System.

Assumptions and Outlook for Full Year Fiscal 2024

The company provided the following guidance with respect to fiscal 2024.

- The company expects fiscal year 2024 revenues to be in the range of approximately $20.1 billion to $20.3 billion.

・ Organic revenue growth is expected to be 5.25% to 6.25% including a headwind of over 25 basis points from the expected decline in COVID-only diagnostic testing.

・ Total currency-neutral revenue growth is expected to be 4.5% to 5.5%. This reflects a negative impact of approximately 75 basis points from the impact of the Surgical Instrumentation platform divestiture.

・ Based on current rates, foreign exchange represents a reduction of approximately 75 basis points to total company revenue growth.

- The company expects fiscal year 2024 adjusted diluted EPS to be $12.70 to $13.00, which represents growth of approximately 4% to 6.5%. This includes absorbing an estimated 75 basis point negative impact from the divestiture of the Surgical Instrumentation platform and approximately 375 basis-points negative impact from foreign currency based on current rates.

・ On a currency-neutral basis, adjusted diluted EPS guidance represents growth of approximately 8.25% to 10.25%.

BD's outlook for fiscal 2024 reflects numerous assumptions about many factors that could affect its business, based on the information management has reviewed as of this date. Management will discuss its outlook and several of its assumptions on its fourth fiscal quarter earnings call.

The company's expected adjusted diluted EPS for fiscal 2024 excludes potential charges or gains that may be recorded during the fiscal year, such as, among other things, the non-cash amortization of intangible assets, acquisition-related charges, spin-related costs, and certain tax matters. BD does not attempt to provide reconciliations of forward-looking adjusted diluted non-GAAP EPS guidance to the comparable GAAP measure because the impact and timing of these potential charges or gains is inherently uncertain and difficult to predict and is unavailable without unreasonable efforts. In addition, the company believes such reconciliations would imply a degree of precision and certainty that could be confusing to investors. Such items could have a substantial impact on GAAP measures of BD's financial performance. We also present our estimated revenue, organic revenue growth and adjusted diluted EPS growth for our 2024 fiscal year after adjusting for the anticipated impact of foreign currency translation. BD believes that this adjustment allows investors to better evaluate BD's anticipated underlying earnings performance for our 2024 fiscal year in relation to our underlying 2023 fiscal year performance.

Source: BD Reports Fourth Quarter and Full Year Fiscal 2023 Financial Results

- CAIVD WeChat

Subscription Account

- CAIVD WeChat

Channels

China Association of In-vitro Diagnostics

Part of the information in our website is from the internet.

If by any chance it violates your rights, please contact us.