Merck Announces Third-Quarter 2023 Financial Results

2023/10/27 10:43:15 Views£º1119

Original from: Merck

- Sales Reflect Sustained Growth, Particularly in Oncology and Vaccines

- Total Worldwide Sales Were $16.0 Billion, an Increase of 7% From Third Quarter 2022; Excluding LAGEVRIO, Growth Was 6%; Excluding LAGEVRIO and the Impact of Foreign Exchange, Growth Was 8%

¡¤ KEYTRUDA Sales Grew 17% to $6.3 Billion; Excluding the Impact of Foreign Exchange, Sales Also Grew 17%

¡¤ GARDASIL/GARDASIL 9 Sales Grew 13% to $2.6 Billion; Excluding the Impact of Foreign Exchange, Sales Grew 16%

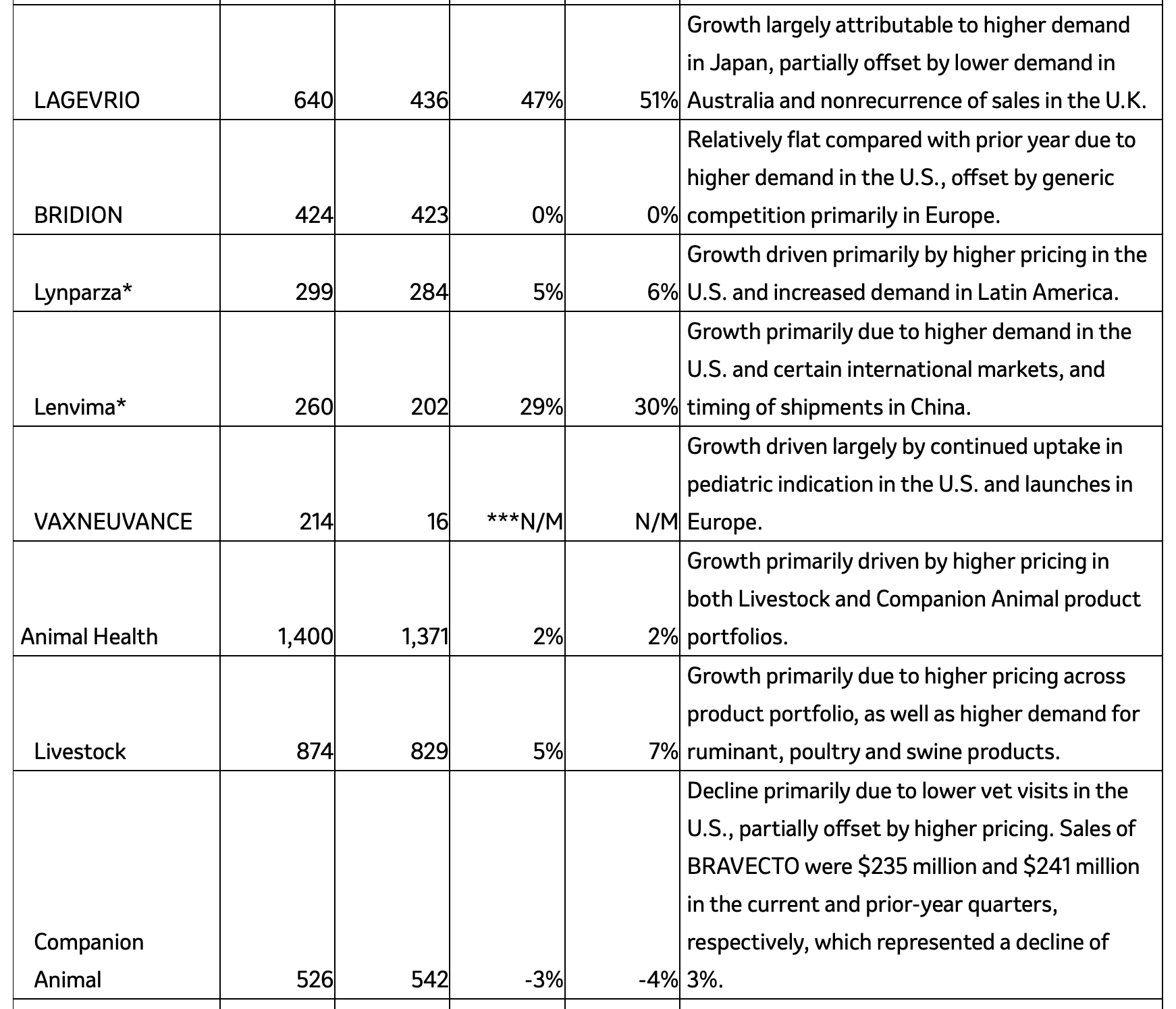

¡¤ LAGEVRIO Sales Grew 47% to $640 Million; Excluding the Impact of Foreign Exchange, Sales Grew 51%

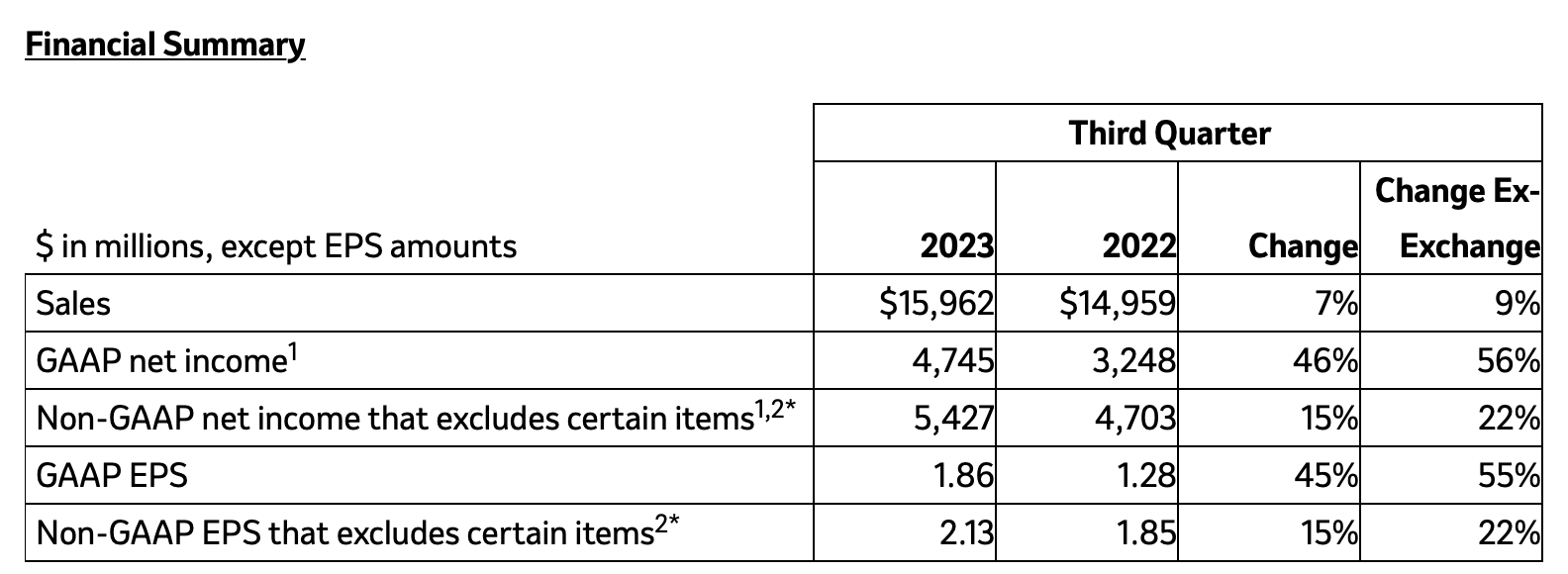

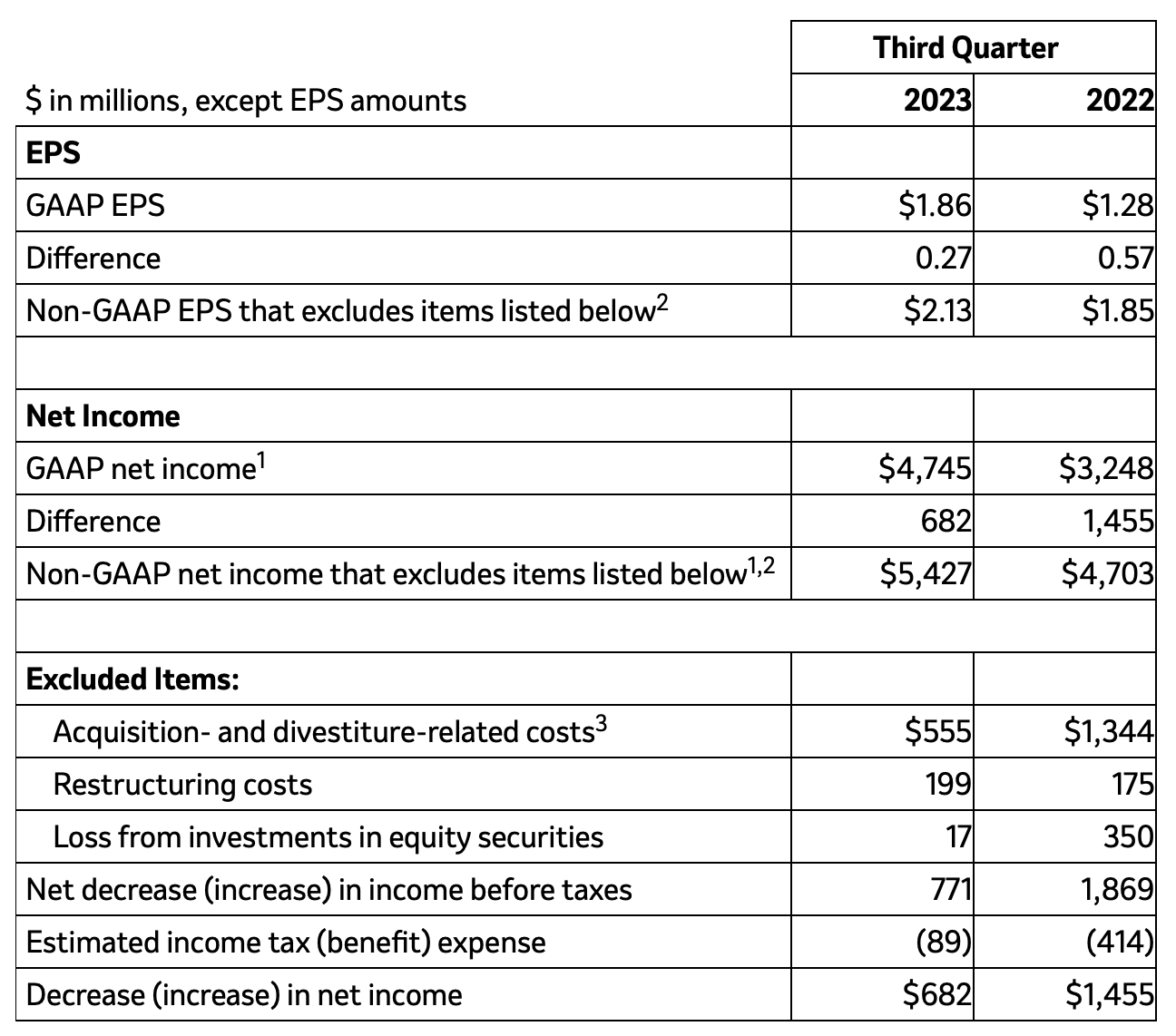

- GAAP EPS Was $1.86; Non-GAAP EPS Was $2.13

- Announced Collaboration Agreement With Daiichi Sankyo for Three Clinical-Stage ADC Candidates

- Received FDA Approval of KEYTRUDA for Perioperative Treatment of Certain Patients With NSCLC in Combination With Chemotherapy, Based on KEYNOTE-671 Trial

- Obtained FDA Priority Review of Biologics License Application for Sotatercept

- Presented Compelling Data at ESMO 2023 Congress, Including:

¡¤ Phase 3 KEYNOTE-671 Trial

¡¤ Phase 3 KEYNOTE-A39/EV-302 Trial Conducted in Collaboration With Seagen and Astellas

- Initiating Phase 3 Trials in 2023 Across Multiple Therapeutic Areas, Including Oncology, Cardiometabolic and Immunology

- Full-Year 2023 Financial Outlook:

¡¤ Raises and Narrows Expected Worldwide Sales Range To Be Between $59.7 Billion and $60.2 Billion, Including Negative Impact of Foreign Exchange of Approximately 2 Percentage Points; Outlook Includes Approximately $1.3 Billion of LAGEVRIO Sales

¡¤ Now Expects Non-GAAP EPS To Be Between $1.33 and $1.38, Including the Negative Impact of Foreign Exchange of Approximately 6 Percentage Points; Outlook Reflects Negative Impact From Upfront Charge of $5.5 Billion, or $1.70 per Share, Related to the Collaboration Agreement With Daiichi Sankyo

Merck (NYSE: MRK), known as MSD outside the United States and Canada, today announced financial results for the third quarter of 2023.

¡°Our strong results this quarter reflect our talented team¡¯s commitment to bringing forward important innovation and pursuing breakthroughs for all those who count on us,¡± said Robert M. Davis, chairman and chief executive officer, Merck. ¡°We continue to push the boundaries of science, making disciplined investments to augment our diverse pipeline and applying our expertise to accelerate potentially transformative treatments to address patient needs ¨C including through our recently announced collaboration with Daiichi Sankyo. I am proud of our progress as we continue to execute at the highest level and work to generate strong and sustainable value, today and well into the future.¡±

Generally Accepted Accounting Principles (GAAP) earnings per share (EPS) assuming dilution was $1.86 for the third quarter of 2023. Non-GAAP EPS was $2.13 for the third quarter of 2023. The increases in GAAP and non-GAAP EPS in the third quarter versus the prior year were primarily due to operational strength in the business, as well as $0.22 of charges recorded in 2022 related to collaboration and licensing agreements with Moderna, Inc. (Moderna), Orna Therapeutics (Orna) and Orion Corporation (Orion). The increase in GAAP EPS in the third quarter of 2023 was also driven by the impacts of intangible asset impairment charges recorded in 2022, compared with no such charges recorded in 2023, and lower losses from investments in equity securities in 2023. The increases in both GAAP and non-GAAP EPS in the third quarter were partially offset by the unfavorable impact of foreign exchange.

Non-GAAP EPS excludes acquisition- and divestiture-related costs, costs related to restructuring programs, as well as income and losses from investments in equity securities.

Year-to-date results can be found in the attached tables.

Third-Quarter Sales Performance

The following table reflects sales of the company¡¯s top products and significant performance drivers.

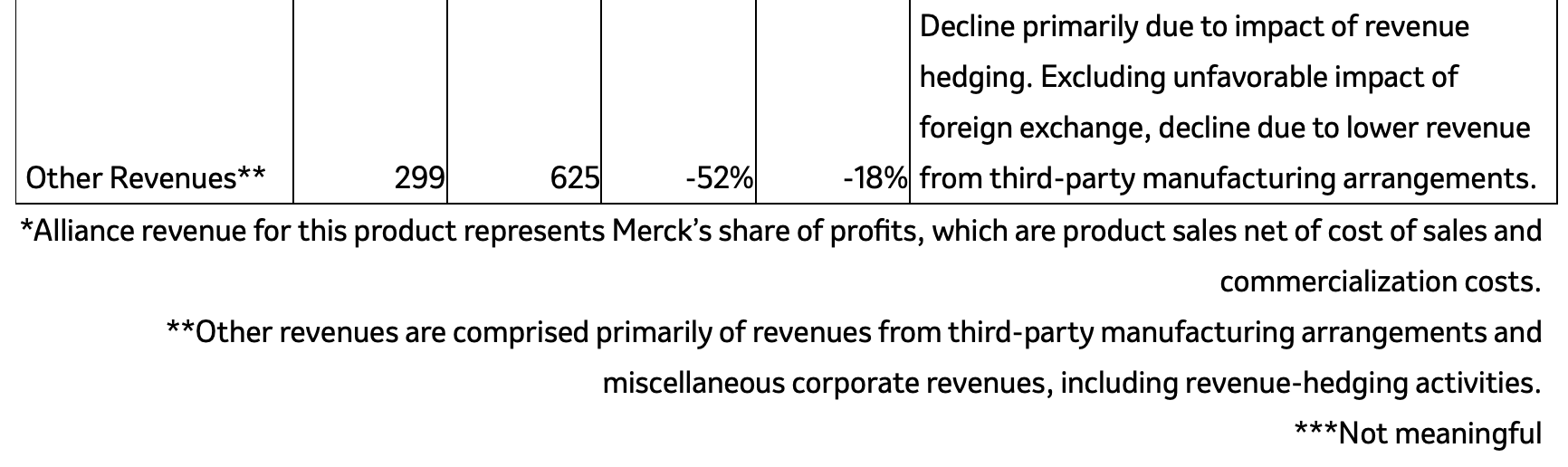

Third-Quarter Expense, EPS and Related Information

The table below presents selected expense information.

GAAP Expense, EPS and Related Information

Gross margin was 73.3% for the third quarter of 2023 compared with 73.7% for the third quarter of 2022. The decrease was primarily due to the unfavorable impact of foreign exchange, higher LAGEVRIO sales, which have a low gross margin, and higher acquisition- and divestiture-related costs. The gross margin decline was partially offset by lower revenue from third-party manufacturing arrangements, lower manufacturing-related costs and the favorable impact of product mix.

Selling, general and administrative (SG&A) expenses were $2.5 billion in both the third quarters of 2023 and 2022, primarily reflecting increased promotional spending, offset by lower administrative costs.

Research and development (R&D) expenses were $3.3 billion in the third quarter of 2023 compared with $4.4 billion in the third quarter of 2022. The decrease was primarily due to charges recorded in 2022 of $887 million for intangible asset impairments, largely related to nemtabrutinib, and $690 million for collaboration and licensing agreements with Moderna, Orna and Orion. The decrease in R&D expenses was partially offset by higher compensation and benefit costs in 2023, reflecting in part increased headcount, higher investments in discovery research and early drug development and higher clinical development spending.

Other (income) expense, net, was $126 million of expense in the third quarter of 2023 compared with $429 million of expense in the third quarter of 2022, primarily due to lower net losses from investments in equity securities.

The effective tax rate was 15.5% for the third quarter of 2023 compared with 9.2% in the third quarter of 2022.

GAAP EPS was $1.86 for the third quarter of 2023 compared with $1.28 for the third quarter of 2022.

Non-GAAP Expense, EPS and Related Information

Non-GAAP gross margin was 77.0% for both the third quarters of 2023 and 2022, due to the unfavorable impact of foreign exchange, and higher LAGEVRIO sales, which have a low gross margin, offset by lower revenue from third-party manufacturing arrangements, lower manufacturing-related costs and the favorable impact of product mix.

Non-GAAP SG&A expenses were $2.5 billion in both the third quarters of 2023 and 2022, primarily reflecting increased promotional spending, offset by lower administrative costs.

Non-GAAP R&D expenses were $3.3 billion in the third quarter of 2023 compared with $3.5 billion in the third quarter of 2022. The decrease was primarily due to charges of $690 million in 2022 related to collaboration and licensing agreements with Moderna, Orna and Orion. The decrease in R&D expenses was partially offset by higher compensation and benefit costs in 2023, reflecting in part increased headcount, higher investments in discovery research and early drug development and higher clinical development spending.

Non-GAAP other (income) expense, net, was $133 million of expense in the third quarter of 2023 compared with $105 million of expense in the third quarter of 2022.

The non-GAAP effective tax rate was 15.0% for the third quarter of 2023 compared with 13.6% in the third quarter of 2022.

Non-GAAP EPS was $2.13 for the third quarter of 2023 compared with $1.85 for the third quarter of 2022.

A reconciliation of GAAP to non-GAAP net income and EPS is provided in the table that follows.

Source: Merck Announces Third-Quarter 2023 Financial Results

- CAIVD WeChat

Subscription Account

- CAIVD WeChat

Channels

China Association of In-vitro Diagnostics

Part of the information in our website is from the internet.

If by any chance it violates your rights, please contact us.