Abbott reports third-quarter 2023 results and raises midpoint of full-year EPS guidance range

2023/10/19 10:10:06 Views:1156

Original from: Abbott

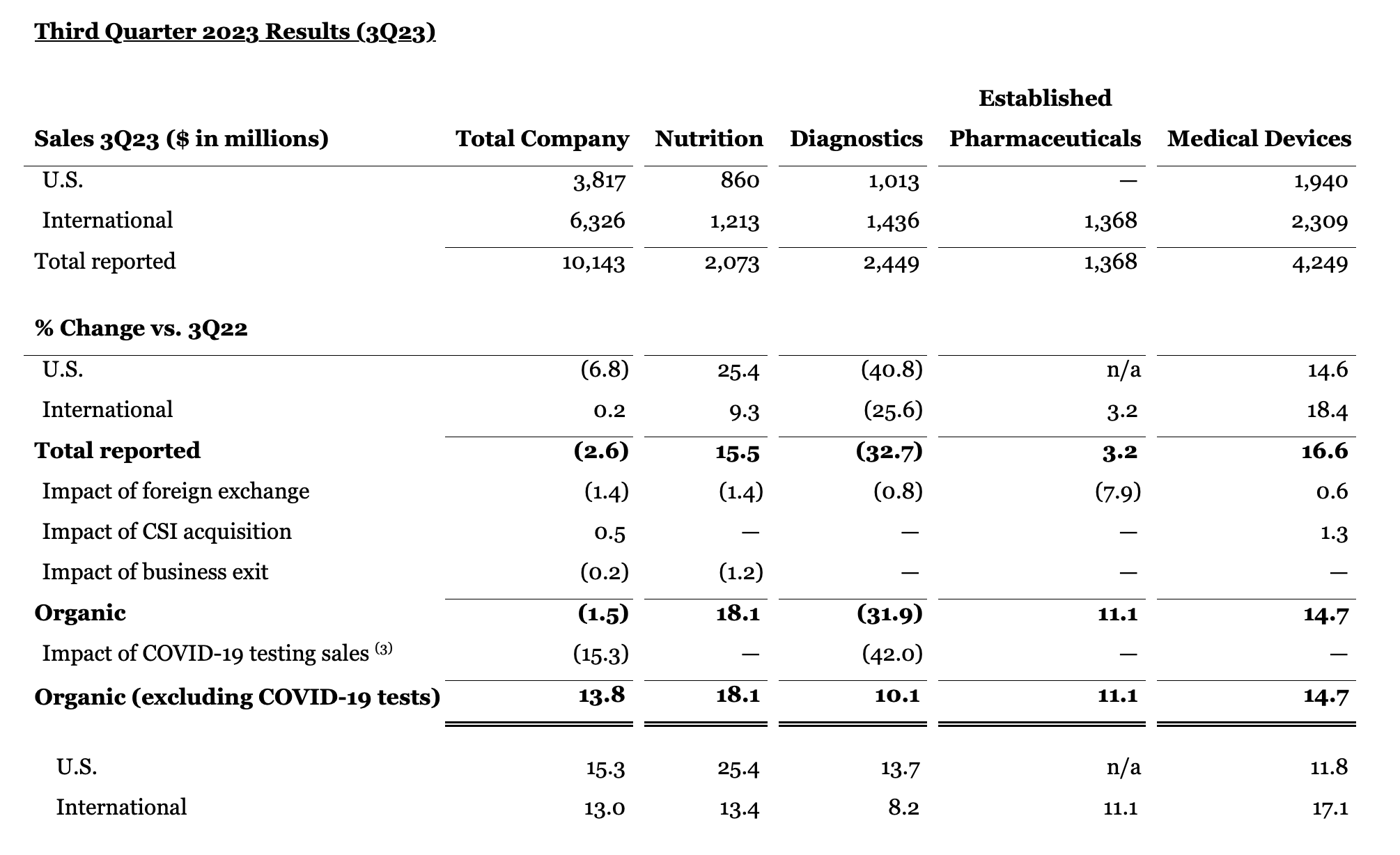

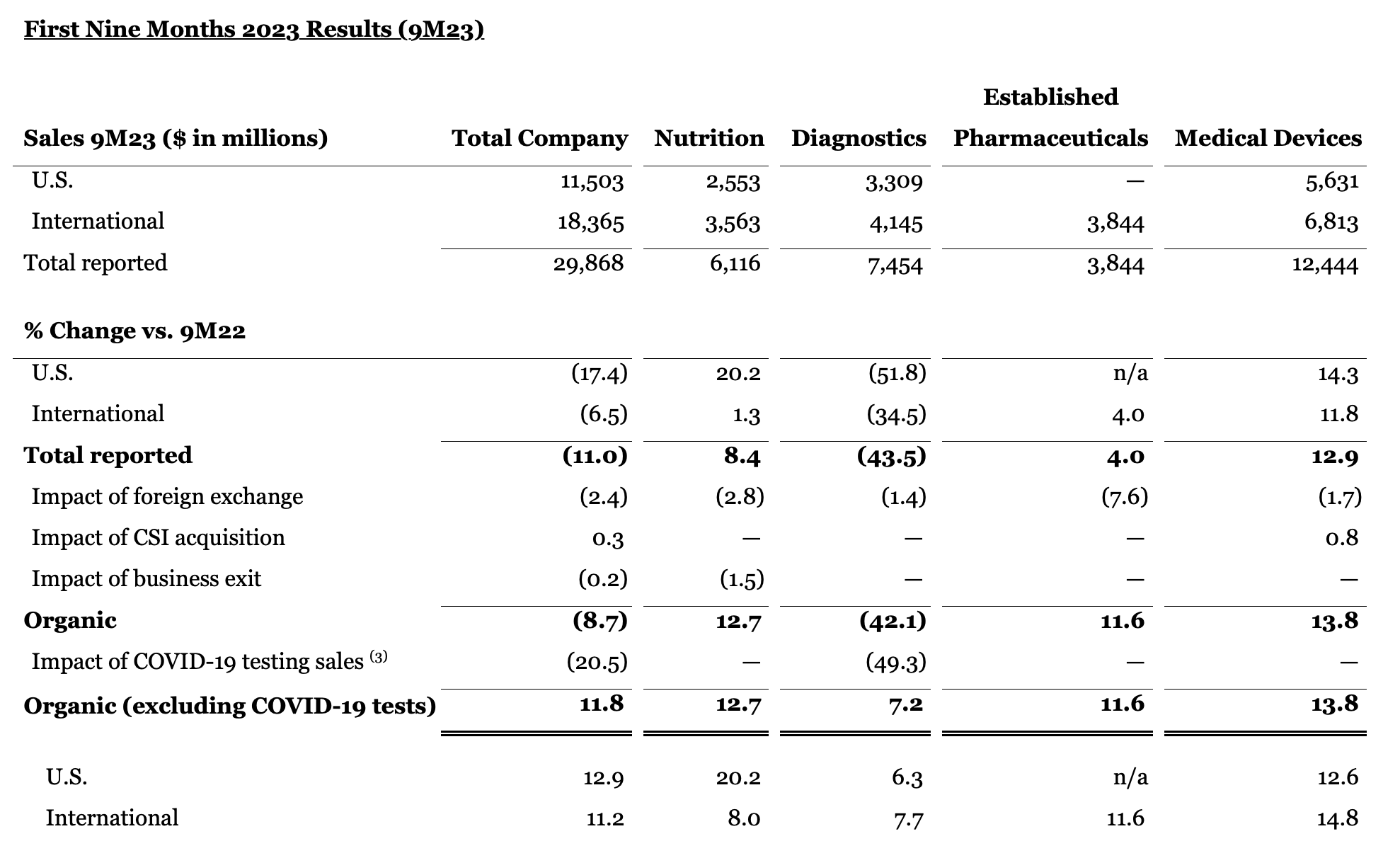

Abbott (NYSE: ABT) today announced financial results for the third quarter ended Sept. 30, 2023.

・ Third-quarter GAAP diluted EPS of $0.82 and adjusted diluted EPS of $1.14, which excludes specified items.

・ Abbott narrowed its full-year 2023 EPS guidance range. Abbott projects full-year diluted EPS on a GAAP basis of $3.14 to $3.18 and projects adjusted diluted EPS of $4.42 to $4.46, which represents an increase at the midpoint of the guidance range.

・ Abbott continues to project full-year 2023 organic sales growth, excluding COVID-19 testing-related sales1, to be in the low double-digits2.

・ In July, Abbott obtained CE Mark for its AVEIR™ single-chamber leadless pacemaker for treating patients with slow heart rhythms. Unlike traditional pacemakers, leadless pacemakers do not require an incision in the chest to implant or leads (wires) to deliver therapy.

・ In September, Abbott acquired Bigfoot Biomedical, a leader in developing insulin management systems, furthering Abbott's efforts to develop connected solutions for making diabetes management even more personal and precise.

・ In September, Abbott expanded its existing collaboration with global biotech leader mAbxience Holdings S.L. to commercialize several biosimilar molecules, with the goal of broadening access to these therapies for people in emerging markets.

・ In September, Abbott published an analysis showing a complementary relationship between the company's FreeStyle Libre® continuous glucose monitoring system and GLP-1 medications. The analysis also showed that a growing number of people are using these tools together to support behavior change to optimize the treatment of diabetes and improve overall health.

"The investments we made during the pandemic continue to drive broad-based growth across our underlying base business," said Robert B. Ford, chairman and chief executive officer, Abbott. "We're on track to deliver on the financial commitments we set at the beginning of the year, and the momentum we're building across the portfolio positions us well as we head into 2024."

Management believes that measuring sales growth rates on an organic basis, which excludes the impact of foreign exchange, the impact of exiting the pediatric nutrition business in China, and the impact of the acquisition of Cardiovascular Systems, Inc. (CSI), is an appropriate way for investors to best understand the core underlying performance of the business. Management further believes that measuring sales growth rates on an organic basis excluding COVID-19 tests is an appropriate way for investors to best understand underlying base business performance as the COVID-19 pandemic has shifted to an endemic state, resulting in significantly lower demand for COVID-19 tests.

Note: In order to compute results excluding the impact of exchange rates, current year U.S. dollar sales are multiplied or divided, as appropriate, by the current year average foreign exchange rates and then those amounts are multiplied or divided, as appropriate, by the prior year average foreign exchange rates.

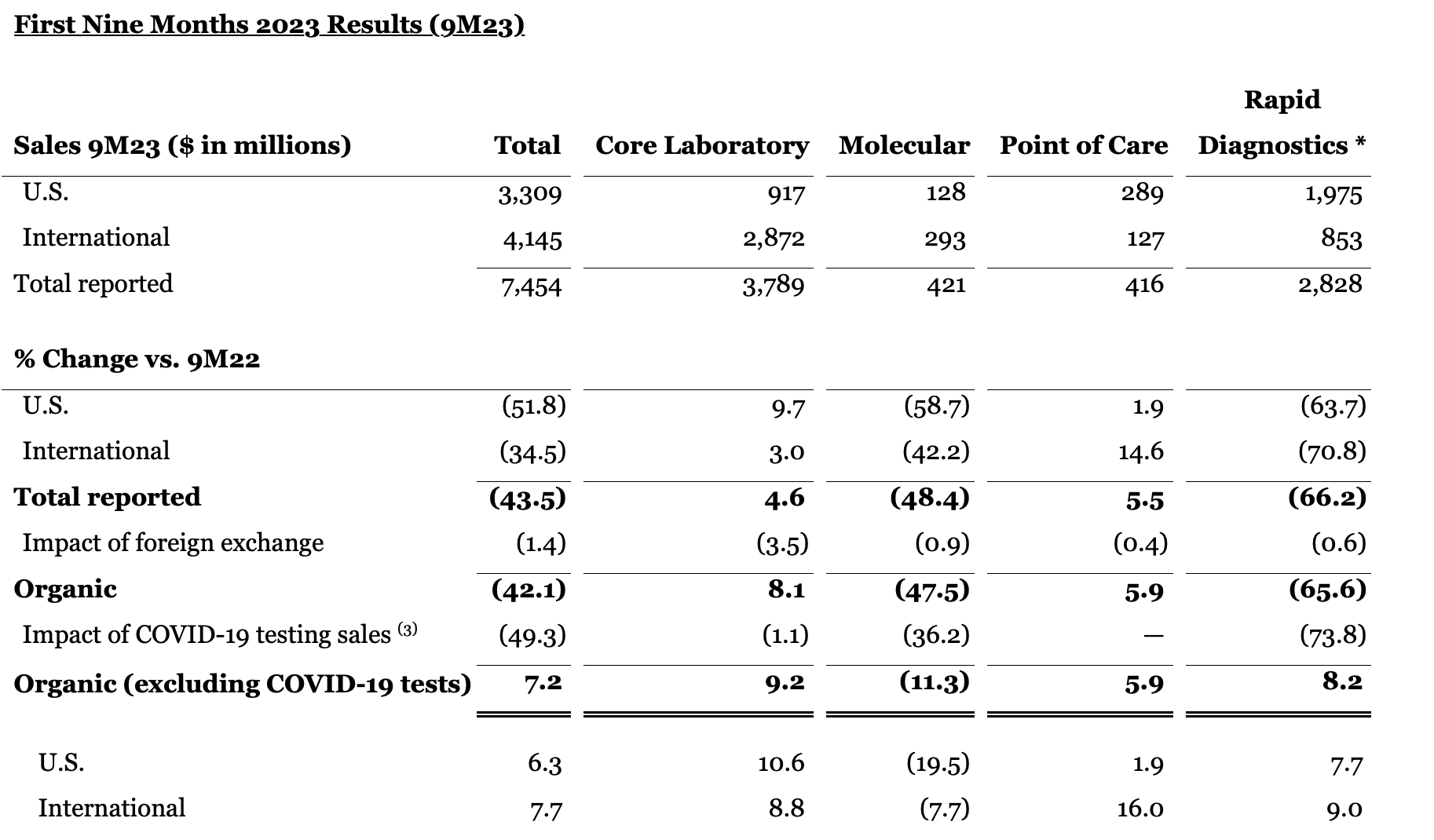

As expected, Diagnostics sales growth in the third quarter was negatively impacted by year-over-year declines in COVID-19 testing-related sales3. Worldwide COVID-19 testing sales were $305 million in the third quarter of 2023 compared to $1.671 billion in the third quarter of the prior year.

Excluding COVID-19 testing-related sales, global Diagnostics sales increased 8.8 percent on a reported basis and 10.1 percent on an organic basis.

Worldwide Medical Devices sales increased 16.6 percent on a reported basis and 14.7 percent on an organic basis in the third quarter. Sales growth was led by double-digit organic growth in Diabetes Care, Electrophysiology, Structural Heart, and Neuromodulation. Several recently launched products and new indications contributed to the strong performance, including Amplatzer® Amulet®, Navitor®, TriClip®, and AVEIR.

In Electrophysiology, internationally, sales grew more than 20 percent on a reported and organic basis, which includes mid-teens growth in Europe.

In Diabetes Care, FreeStyle Libre sales were $1.4 billion, which represents sales growth of 30.5 percent on a reported basis and 28.5 percent on an organic basis.

ABBOTT'S EARNINGS-PER-SHARE GUIDANCE

Source: Abbott reports third-quarter 2023 results and raises midpoint of full-year EPS guidance range

- CAIVD WeChat

Subscription Account

- CAIVD WeChat

Channels

China Association of In-vitro Diagnostics

Part of the information in our website is from the internet.

If by any chance it violates your rights, please contact us.