Roche reports strong growth in both divisions* base business; Group sales and profit reflect declining demand for COVID-19 products

2023/7/28 10:03:30 Viewsㄩ1224

Original from: Roche

﹞ Excluding COVID-19 products, Group sales increase strongly by 8%1 at constant exchange rates (CER)

﹞ In line with the expected declining demand for COVID-19 products, Group sales decrease 2% (-8% in Swiss francs)

﹞ Pharmaceuticals Division sales grow strongly by 8% due to continued high demand for newer medicines; new eye medicine Vabysmo is the strongest growth driver

﹞ Diagnostics Division*s base business continues its good growth momentum with an increase of 6%, while total divisional sales are 23% lower due to exceptionally high demand for COVID-19 tests in the first half of 2022

﹞ Core earnings per share decrease 5%, driven by lower demand for COVID-19 products and a base effect from a patent settlement in 2022; IFRS net income down 9% due to lower core operating profit and higher interest expenses

﹞ Highlights in the second quarter of 2023:

- US and EU approvals of Columvi (aggressive form of blood cancer)

- US approval of Elevidys for Roche partner Sarepta (first gene therapy for children with Duchenne muscular dystrophy)

- Positive phase III data for subcutaneous injection of Ocrevus (multiple sclerosis); positive long-term efficacy and safety data for Evrysdi (spinal muscular atrophy) and positive phase II data for fenebrutinib (multiple sclerosis)

- Start of phase III study of tiragolumab in combination with Tecentriq and Avastin (liver cancer)

- Partnership with Alnylam to co-develop phase II RNAi therapeutic zilebesiran (hypertension in patients with high cardiovascular risk)

- WHO prequalification of cobas HPV test enables improved access to cervical cancer screening in low and lower-middle income countries

﹞ Outlook for 2023 confirmed

Roche CEO Thomas Schinecker: ※In the first half of 2023, sales in the base business of both our divisions grew strongly, largely offsetting the impact of declining demand for COVID-19 products. Vabysmo continues its strong momentum 每 now providing treatment for patients with severe eye conditions in over 70 countries. We reached several important pipeline milestones, including the US and EU approvals of our blood cancer medicine Columvi. I am also excited about our partnership with Alnylam to develop a potentially transformative medicine for patients living with hypertension, which affects 1.2 billion adults worldwide and is the leading cause of death from cardiovascular disease. We confirm our outlook for 2023.§

Outlook for 2023 confirmed

Due to the sharp decline in sales of COVID-19 products of roughly CHF 5 billion, Roche expects a decrease in Group sales in the low single digit range (at CER). Excluding this COVID-19 sales decline, Roche anticipates solid sales growth in both divisions* base business.

Core earnings per share are targeted to develop broadly in line with the sales decline (at CER). Roche expects to further increase its dividend in Swiss francs.

Group results

In the first half of 2023, the Roche Group*s base business achieved strong sales growth of 8%. This partially compensated for the expected decline of COVID-19 sales.

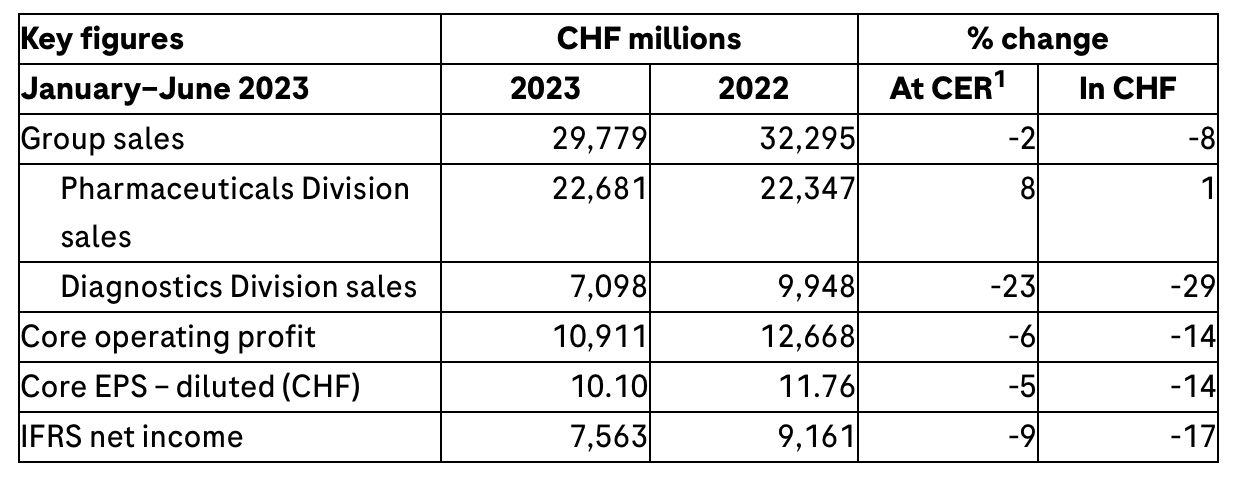

Overall, Roche reported a 2% decline in Group sales (-8% in CHF).

The appreciation of the Swiss franc against most currencies had a significant adverse impact on the results presented in Swiss francs compared to constant exchange rates.

Core operating profit was down 6% (-14% in CHF), reflecting the sales decline in COVID-19 products and the income from the patent settlement in Japan in the first half of 2022.

Core earnings per share decreased 5%, also driven by lower demand for COVID-19 products and the base effect from the above-mentioned patent settlement; IFRS net income declined 9% due to lower core operating profit and higher interest expenses.

Sales in the Pharmaceuticals Division increased by 8% to CHF 22.7 billion. Newer medicines to treat severe diseases continued their strong growth.

The eye medicine Vabysmo, launched only in early 2022, was again the major driver of growth, with sales of CHF 1.0 billion, mainly in the US.

The top five growth drivers 每 Vabysmo, Ocrevus (multiple sclerosis), Hemlibra (haemophilia), Evrysdi (spinal muscular atrophy) and Phesgo (breast cancer) 每 generated total sales of CHF 7.5 billion, representing an increase of CHF 2.2 billion from the first half of 2022.

In the United States, sales grew 7%. Vabysmo generated CHF 0.8 billion in sales. The positive impact of the growth of Vabysmo, Ocrevus, Hemlibra, Tecentriq (cancer immunotherapy) and Activase/TNKase (cardiac diseases) was partly offset by lower sales of medicines for which patent protection has expired.

In Europe, sales increased by 5%, driven by the launch of Vabysmo and the continued uptake of Evrysdi, Phesgo, Hemlibra and Ocrevus. This was partially offset by the biosimilars impact and lower sales of Ronapreve (COVID-19).

Sales in Japan rose 14%, mainly due to supplies of Ronapreve to the government and supported by sales growth of Polivy, Vabysmo and Hemlibra. These more than offset the impact of biosimilars and government price cuts.

Sales in the International region grew by 9%. This positive trend was observed across all major markets. Perjeta (breast cancer), Evrysdi, Ocrevus, Hemlibra and Kadcyla (breast cancer) were the main drivers. Sales in China increased by 3%, driven by Tamiflu (influenza), Perjeta, Xofluza (influenza), Actemra/RoActemra (COVID-19/rheumatoid arthritis) and Polivy. This more than offset the impact of biosimilars.

The Diagnostics Division*s base business 每 up 6% 每 achieved strong results over the first six months across all regions.

The main contributors to growth were immunodiagnostics, particularly cardiac tests, and diagnostics solutions for clinical chemistry.

Overall, the Diagnostics Division reported sales of CHF 7.1 billion, a decline of 23% reflecting the expected tapering of demand for COVID-19 tests (CHF 0.4 billion in the first half of 2023, compared to CHF 3.1 billion in the first half of 2022).

The impact of COVID-19 was evident in most regions: The North America, Asia-Pacific and Europe, Middle East and Africa (EMEA) regions experienced a sales decline of 30%, 23% and 22%, respectively. Sales in Latin America remained stable.

- CAIVD WeChat

Subscription Account

- CAIVD WeChat

Channels

China Association of In-vitro Diagnostics

Part of the information in our website is from the internet.

If by any chance it violates your rights, please contact us.