Analysis of the Chinese Molecular Diagnostics Market in 2023

2023/7/18 17:51:08 Views£ļ1420

Original from: Huaon

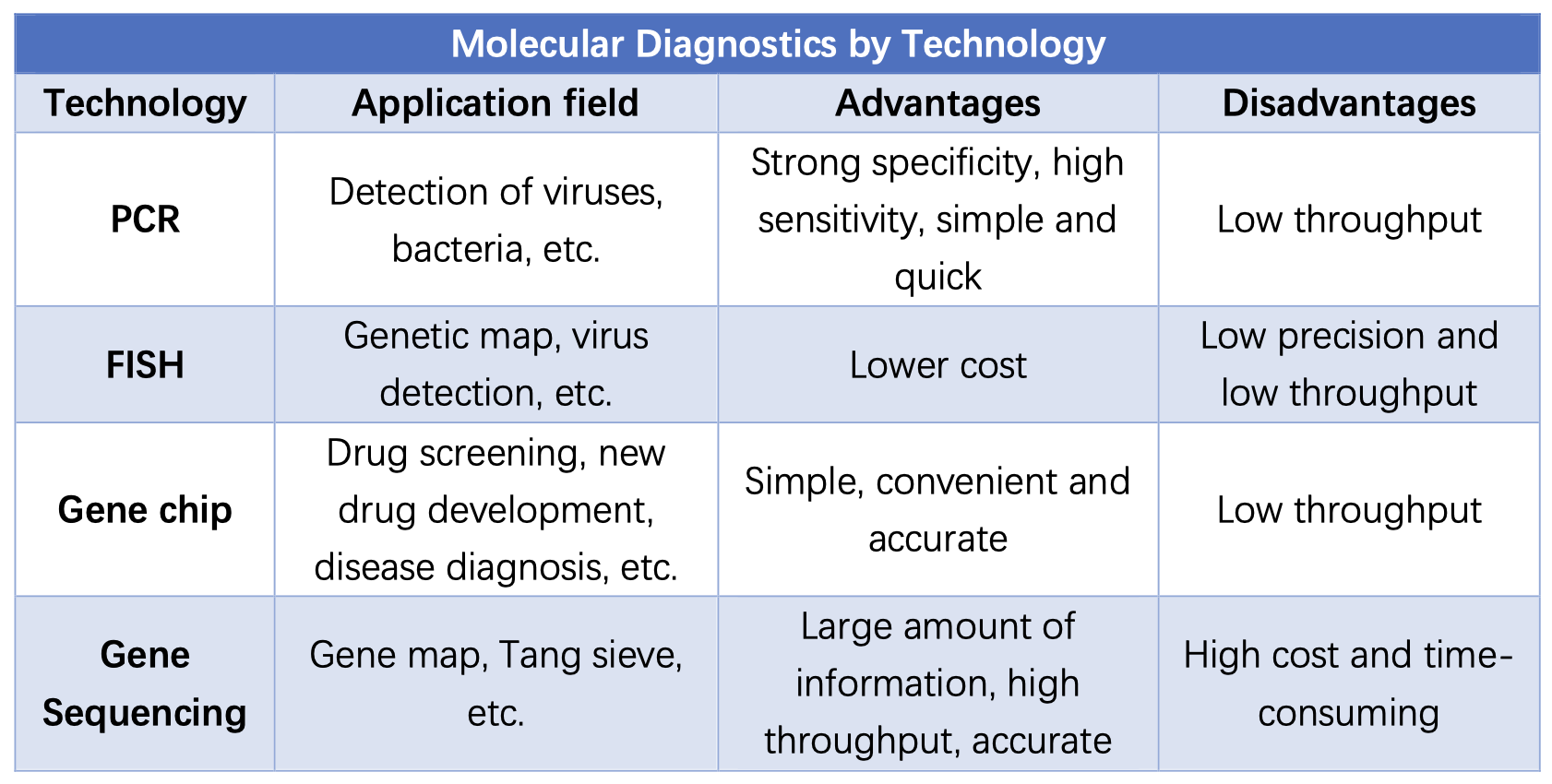

Molecular diagnosis refers to the technique of using molecular biological methods to detect changes in the structure or expression level of genetic material in patients to make a diagnosis. Molecular diagnosis is the main method of predictive diagnosis, which can be used for diagnosis of individual genetic diseases and prenatal diagnosis. Molecular diagnosis can be divided into PCR (polymerase chain reaction), FISH (fluorescence in situ hybridization), gene chips, gene sequencing, etc.

China molecular diagnostic market size

Although the Chinese molecular diagnostics started late, driven by multiple factors such as consumption upgrades, molecular diagnostic technology advancements, policy support, and capital pursuits, molecular diagnostic industry has good prospects for development and is growing rapidly. In 2020, under the impact of the emerging diagnostic demand brought about by COVID-19, the market size of molecular diagnostic industry increased significantly, reaching 22.6 billion yuan. In 2021, the market size dropped to 17.5 billion yuan.

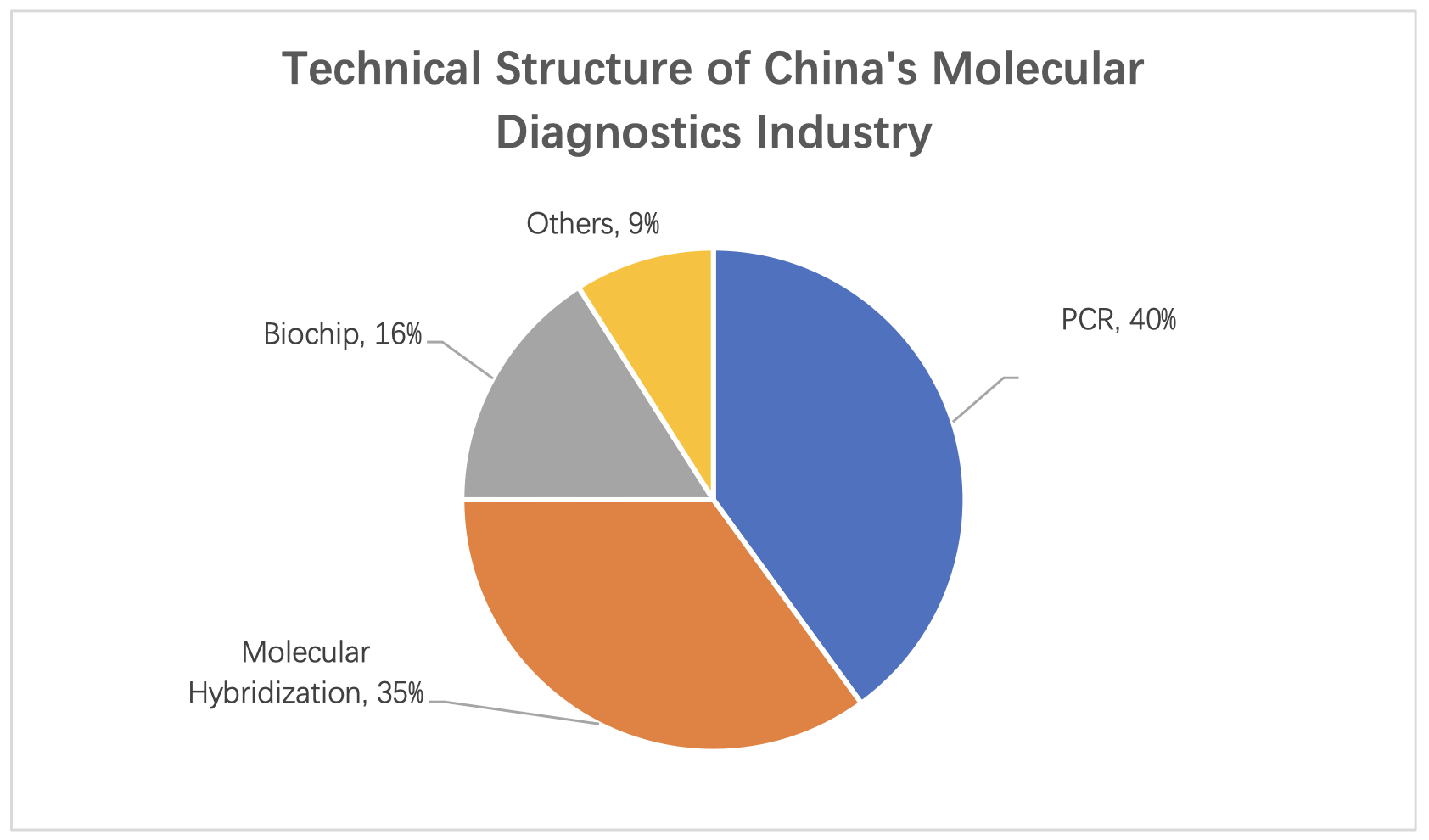

From the proportion of molecular diagnostic technology structure, PCR technology is currently the most mature and widely used technology. At present, China's molecular diagnosis market is mainly dominated by PCR technology, accounting for 40% of the overall market, which is the main part of molecular diagnosis; followed by molecular hybridization, accounting for 35%; biochip accounting for 16%

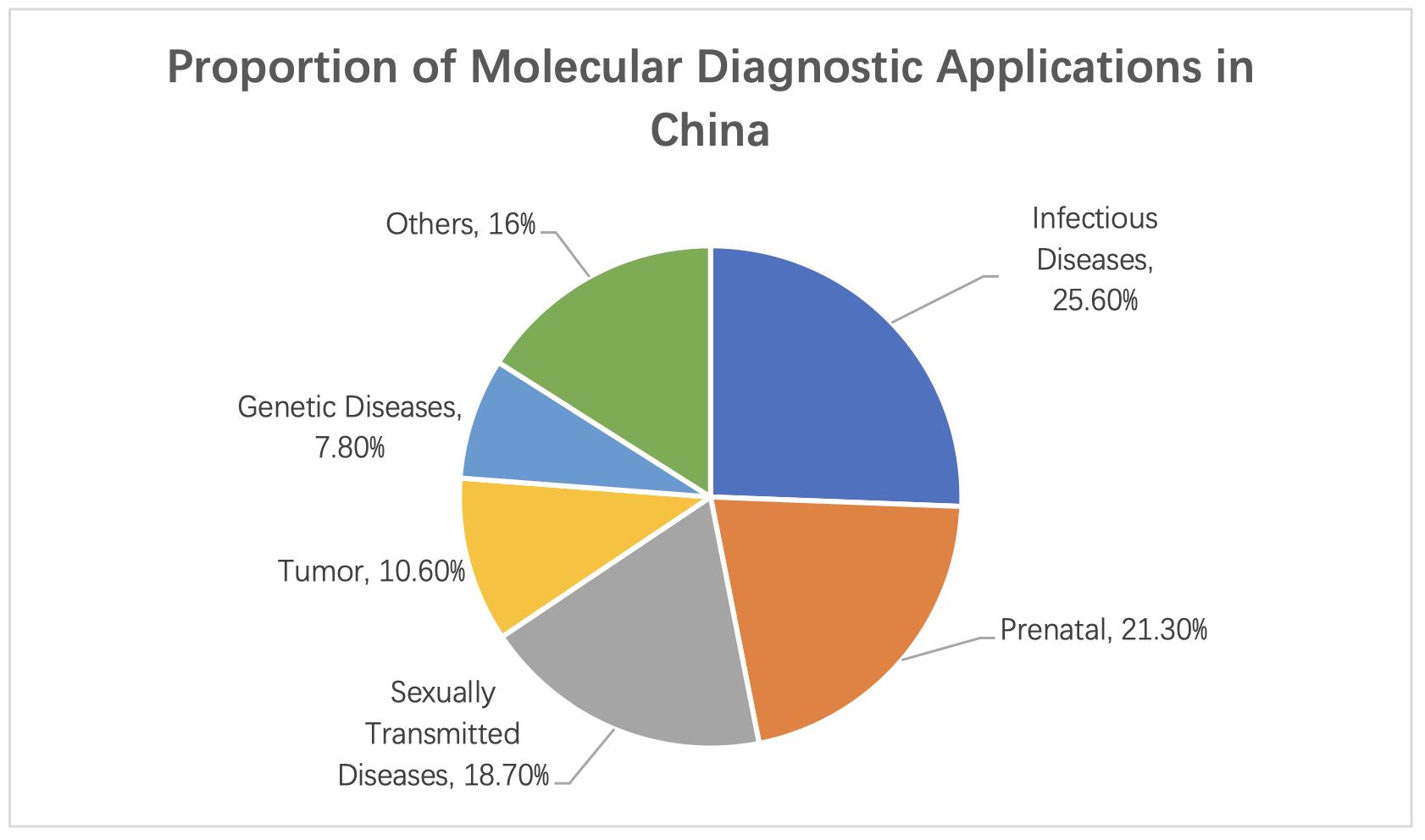

Molecular diagnosis is mainly used in infectious diseases, tumors, blood screening, prenatal, genetic diseases, pharmacogenomics and other fields. Among them, the field of infectious diseases accounted for the highest proportion of 25.6%, followed by prenatal screening and sexually transmitted diseases, accounting for 21.3% and 18.7% respectively

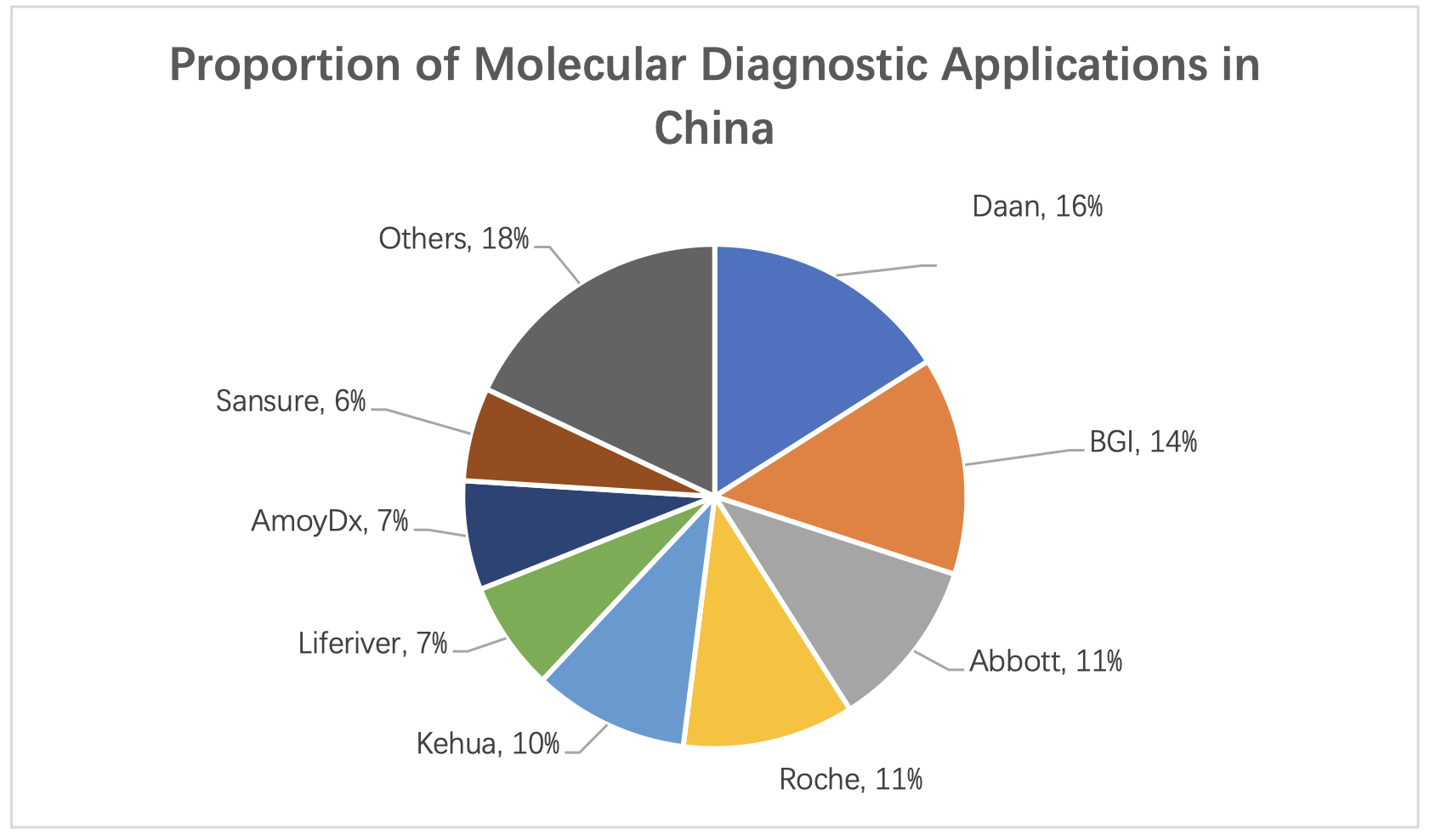

At present, the Chinese molecular diagnosis industry market is dominated by domestic brands, but the concentration is low and the industry competition is relatively fierce. The main reason is that both domestic and overseas manufacturers have their own areas of expertise, and it is difficult to cover all fields, so a monopoly pattern has not yet been formed. Among them, the top three companies in terms of market share are Daan Gene, BGI and Abbott, with market shares of 16%, 14% and 11% respectively.

In recent years, Chinese government has issued several plans and policies to include molecular diagnosis in the plan, including prenatal screening, early tumor screening, etc. Diagnostic instruments and genetic technology are listed as one of the key frontier planning and industrial research areas, and many supporting policies are provided. In the "14th Five-Year Plan", it has also been mentioned many times to vigorously develop the gene and biotechnology to achieve technological breakthroughs. With the strong support of policies, the scale of the Chinese molecular diagnostic market continues to grow, attracting new companies to invest in the molecular diagnostics industry, and promoting the technology development.

The upstream of the molecular diagnostics industry mainly includes raw materials such as enzymes, primers, probes, fine chemicals, and instrument parts. The midstream includes molecular diagnostic reagents and molecular diagnostic instruments. The downstream is mainly used in hospitals, independent laboratories, CDC, pharmaceutical companies and other scenarios.

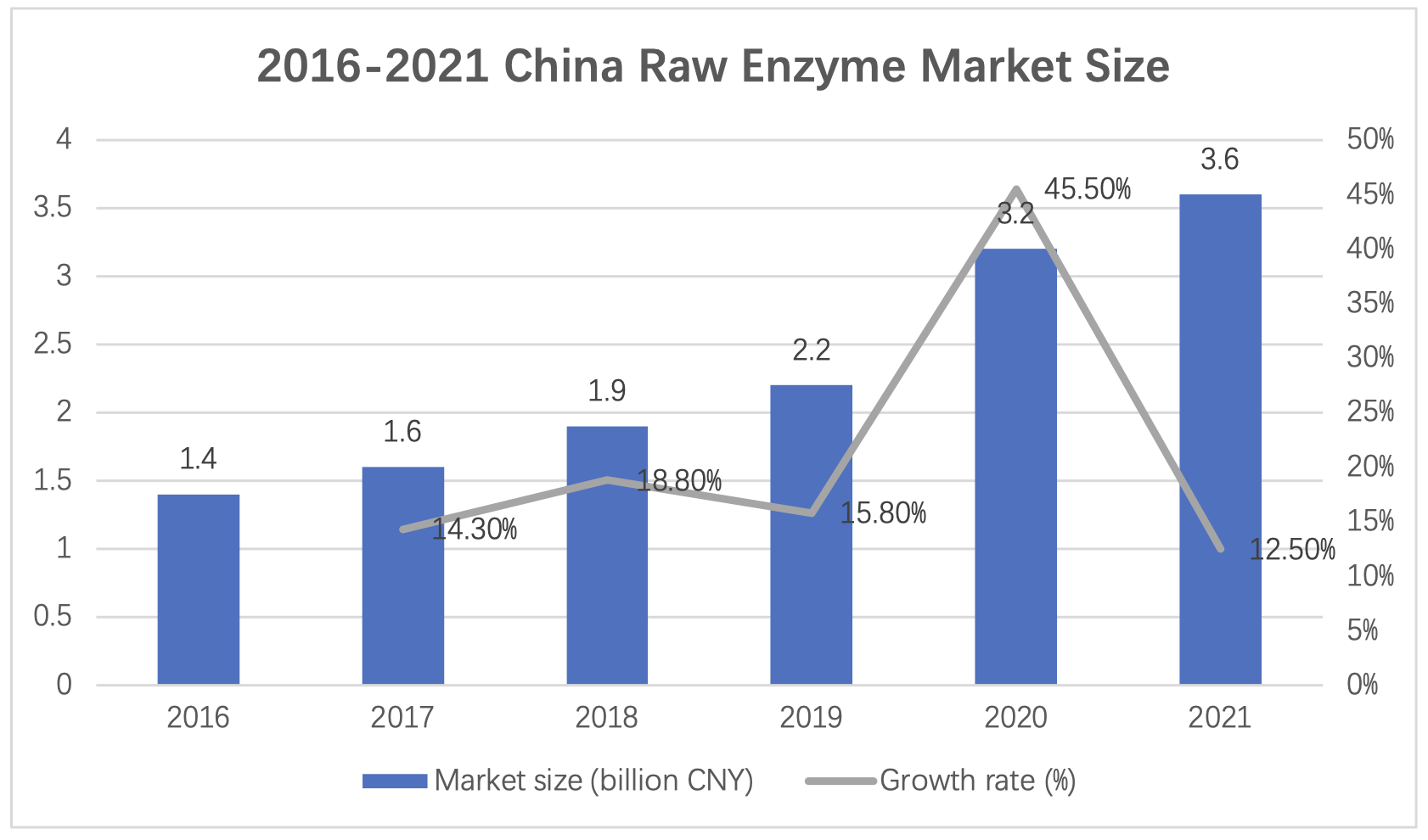

Enzymes, primers, probes, substrates, etc. are the main raw materials for molecular detection reagents. Among them, enzymes are biologically active components in molecular detection raw materials, which directly affect the performance levels of molecular detection reagents, including sensitivity, stability, and detection time. It also determines the accuracy of molecular detection results and is the core component of molecular detection reagent raw materials. According to open statistics, in 2021 the market size of the Chinese raw enzymes reached 3.6 billion yuan, with a year-on-year increase of 12.5%.

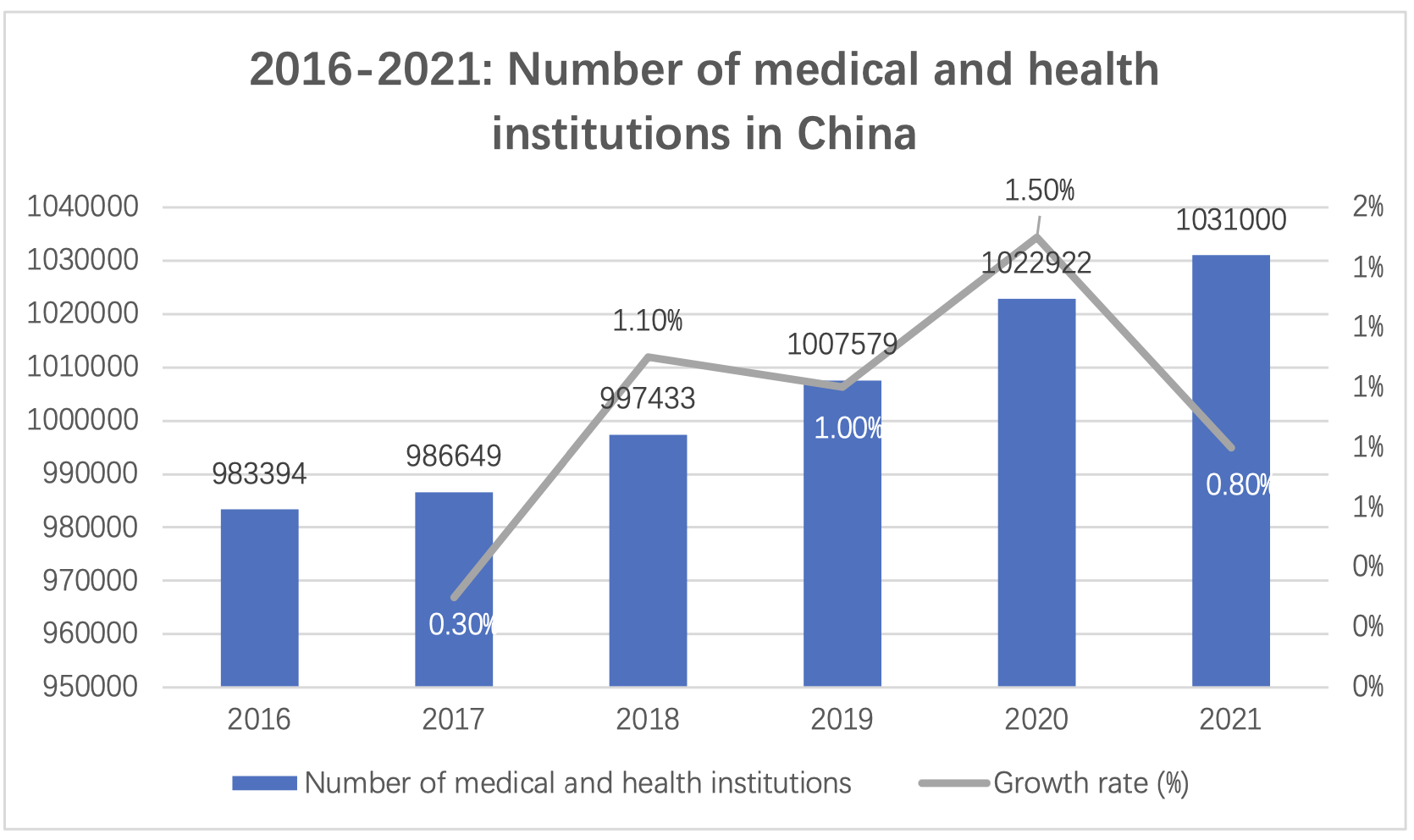

At present, medical and health institutions that provide medical services to patients are the most important application scenarios of molecular diagnosis in China. With the development of the medical industry and the continuous advancement of the medical reform system in recent years, the number of medical and health institutions in China has also continued to increase. According to open statistics, the number of medical and health institutions in China was 1,031,000 in 2021, with a year-on-year increase of 0.8%

Driven by multiple factors such as consumption upgrades, technological progress, policy support, and capital pursuits, China's molecular diagnostic industry has established a certain market size and foundation, and has entered an initial favorable stage. In the future, as the three major factors of policy, demand, and upstream core raw materials continue to be favorable, the Chinese molecular diagnostic industry will usher in a good development prospect.

- CAIVD WeChat

Subscription Account

- CAIVD WeChat

Channels

China Association of In-vitro Diagnostics

Part of the information in our website is from the internet.

If by any chance it violates your rights, please contact us.