Roche reports strong sales growth in base business of both divisions in the first quarter; Group sales decline due to expected drop in demand for COVID-19 tests

2023/4/27 11:57:39 Views£º1146

Original from: Roche

- As expected, significantly lower demand for COVID-19 tests leads to a decrease in Group sales(-3%1 at constant exchange rates [CER] and -7% in Swiss francs); excluding this effect, Group sales grow 8%

- Pharmaceuticals Division sales up 9%; strong demand for newer medicines; Vabysmo for severe eye diseases is already the strongest growth driver

- Diagnostics Division base business grows 4%, while divisional sales are 28% lower due to exceptionally high demand for COVID-19 tests in the first quarter of 2022

- Highlights in the first quarter:

¡¤ US approval of Polivy (first-line treatment for an aggressive form of blood cancer)

¡¤ EU approval of Hemlibra (moderate haemophilia A)

¡¤ Positive phase III data for Vabysmo (retinal vein occlusion, a serious eye disease), Tecentriq plus Avastin (adjuvant therapy for certain forms of liver cancer) and crovalimab (paroxysmal nocturnal haemoglobinuria, a rare blood disease)

¡¤ Positive four-year efficacy and safety data for Evrysdi (spinal muscular atrophy)

¡¤ Launch of new assays to identify clinically relevant mutations in brain cancers

- Outlook for 2023 confirmed

Roche CEO Thomas Schinecker: ¡°We saw strong growth in the first quarter in both divisions¡¯ base business, which largely compensated for the expected drop in sales of COVID-19 tests. We made progress in our pipeline in the first quarter, especially in blood cancer. Besides our recent approvals for our bispecific antibody medicines, Lunsumio and Columvi, we have also just received US approval of Polivy as first-line treatment for an aggressive form of blood cancer. In ophthalmology, Vabysmo, a medicine for severe eye diseases, has shown positive phase III data in retinal vein occlusion. If approved, this would be the third indication for Vabysmo which has already become our strongest growth driver just a year after its launch. We confirm our outlook for 2023.¡±

Due to the sharp decline in sales of COVID-19 products of roughly CHF 5 billion, Roche expects a decrease in Group sales in the low single digit range (at constant exchange rates). Excluding this COVID-19 sales decline, Roche anticipates solid sales growth in both divisions¡¯ base business.

Core earnings per share are targeted to develop broadly in line with the sales decline (at constant exchange rates). Roche expects to further increase its dividend in Swiss francs.

In the first three months of the year, Group sales declined by 3% (-7% in CHF) to CHF 15.3 billion. The appreciation of the Swiss franc against most currencies had a negative impact on the results reported in Swiss francs compared to constant exchange rates.

As expected, the first quarter 2023 results reflected the exceptionally high demand for COVID-19 tests in the same quarter of 2022, when the Omicron wave was at its peak.

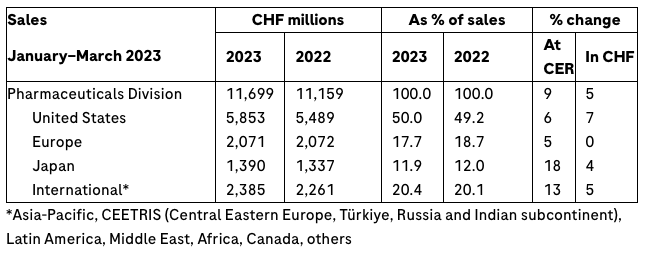

Pharmaceuticals Division sales increased markedly by 9% to CHF 11.7 billion, driven by strong global demand for newer medicines to treat severe diseases.

The eye medicine Vabysmo, which was only launched in early 2022, became the division¡¯s biggest growth driver. The top five contributors to growth ¨C Vabysmo, Ocrevus (multiple sclerosis), Hemlibra (haemophilia), Evrysdi (spinal muscular atrophy) and Tecentriq (cancer immunotherapy) ¨C generated additional sales of CHF 1.1 billion.

The impact of the competition from biosimilars for the established cancer medicines Avastin, Herceptin and MabThera/Rituxan slowed down further (combined approx. CHF 330 million of sales reduction).

In the United States, sales increased by 6%. Newer medicines, such as Vabysmo, Ocrevus, Hemlibra and the cancer medicines Tecentriq and Phesgo, were the main contributors. This contrasted with declining sales of Actemra/RoActemra (COVID-19) and of medicines for which patent protection has expired.

In Europe, sales were up by 5%. Growth of Evrysdi, Vabysmo, Hemlibra, Phesgo, Ocrevus and other innovative medicines was partially offset by lower Ronapreve (COVID-19) sales and the biosimilars impact.

Sales in Japan increased (+18%), mainly due to higher supply of Ronapreve to the government than in the previous year, followed by sales growth of Polivy, Tamiflu (influenza), Vabysmo and Hemlibra.

Sales in the International region increased by 13%. The key factors were sales growth of Perjeta, Evrysdi, Tamiflu, Kadcyla and Ocrevus. In China, sales were up 4% due to high demand for Tamiflu, Actemra/RoActemra and Xofluza (influenza), which more than offset the impact of biosimilars.

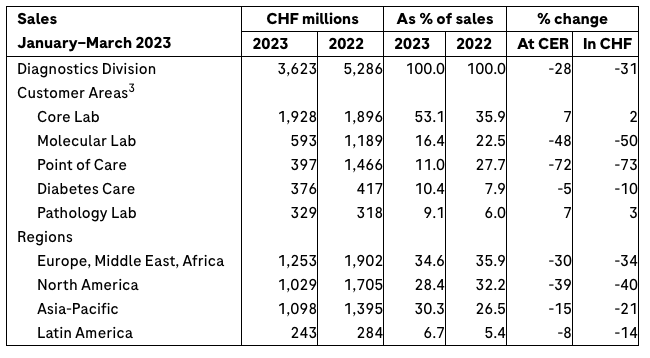

The Diagnostics Division¡¯s base business recorded continued good growth (+4%).

Divisional sales were CHF 3.6 billion, down by 28% as sales of COVID-19 tests dropped to CHF 0.3 billion in the first quarter of 2023 from CHF 1.9 billion in the same period last year, when demand was exceptionally high.

Immunodiagnostic products, particularly cardiac tests, were the main growth drivers (+9%). Additional growth impulses came from the virology base business (+12%), blood screening (+15%) and diagnostics solutions for the detection and monitoring of cervical cancer (+22%).

The decline in sales across all regions is primarily due to the lower demand for COVID-19 tests. The Europe, Middle East and Africa (EMEA) and North America regions decreased by 30% and 39%, respectively. Asia-Pacific fell by 15%; Latin America reported a minus of 8%.

Pharmaceuticals: key development milestones in the first quarter of 2023

The Pharmaceuticals Division achieved a number of important product development milestones in the first three months of the year, including the US approval of Polivy (aggressive form of blood cancer), the EU approval of Hemlibra (moderate haemophilia A) as well as positive study results on Vabysmofor a serious retinal vascular condition and on crovalimab in PNH, a rare, life-threatening blood condition.

In the first quarter of the year, the Diagnostics Division launched important products in the areas of oncology and virology.

- CAIVD WeChat

Subscription Account

- CAIVD WeChat

Channels

China Association of In-vitro Diagnostics

Part of the information in our website is from the internet.

If by any chance it violates your rights, please contact us.