Original from: QuidelOrtho

Third Quarter 2024 Results and Recent Developments

(all comparisons are to the prior year period)

¡¤ Reported revenue was $727 million

- Recurring revenue1 was $598 million as reported with no significant change in constant currency, excluding COVID-19 and U.S. Donor Screening revenue

- Labs revenue grew 4% as reported and 5% in constant currency

¡¤ GAAP operating expenses2 of $242 million decreased by $13 million; non-GAAP operating expenses of $232 million decreased by $17 million, reflecting ongoing implementation of cost efficiencies

¡¤ GAAP net loss margin was (3%); GAAP operating margin was 2%; adjusted EBITDA margin was 23.5%, an increase of 80 basis points

¡¤ GAAP net cash provided by operating activities was $118 million; adjusted free cash flow was $120 million

¡¤ Strengthened leadership team with the addition of a new Chief Technology Officer and Chief Human Resources Officer

QuidelOrtho Corporation (Nasdaq: QDEL) (the ¡°Company¡± or ¡°QuidelOrtho¡±), a global provider of innovative in-vitro diagnostic technologies designed for point-of-care settings, clinical labs, and transfusion medicine, today announced financial results for the third quarter ended September 29, 2024.

¡°We delivered solid third quarter results, giving us confidence that our strategic priorities and focus on our customers, business growth and margin improvement are gaining traction,¡± said Brian J. Blaser, President and Chief Executive Officer, QuidelOrtho. ¡°We remain focused on our top business-critical priorities, including delivering on our customer commitments with the highest levels of quality and compliance, as well as executing on company-wide cost-savings and business efficiency initiatives. Further, we continue to reinforce the strength of our leadership team with key talent hires, while also aligning our organization to be more agile, reducing complexity and increasing customer focus.¡±

Third Quarter 2024

The Company reported total revenue for the third quarter of 2024 of $727 million, compared to $744 million in the prior year period. The decrease in total revenue was primarily due to higher COVID-19 and influenza revenue in the prior year period. Foreign currency translation impacted the Company¡¯s Labs business by 100 basis points but did not significantly impact the Company¡¯s overall third quarter 2024 revenue.

GAAP diluted loss per share for the third quarter of 2024 was ($0.30), compared to diluted loss per share of ($0.19) in the prior year period. GAAP net loss for the third quarter of 2024 was $20 million, compared to $13 million in the prior year period. GAAP operating income for the third quarter of 2024 was $15 million, compared to an operating income of $26 million in the prior year period, and GAAP operating margin was 2%, compared to 4% in the prior year period. Third quarter 2024 results included $37 million in integration-related charges.

Adjusted diluted earnings per share (¡°EPS¡±) for the third quarter of 2024 was $0.85, compared to adjusted diluted EPS of $0.90 in the prior year period. Adjusted EBITDA for the third quarter of 2024 was $171 million, compared to $169 million in the prior year period. Adjusted EBITDA margin for the third quarter of 2024 was 23.5%, compared to 22.7% in the prior year period.

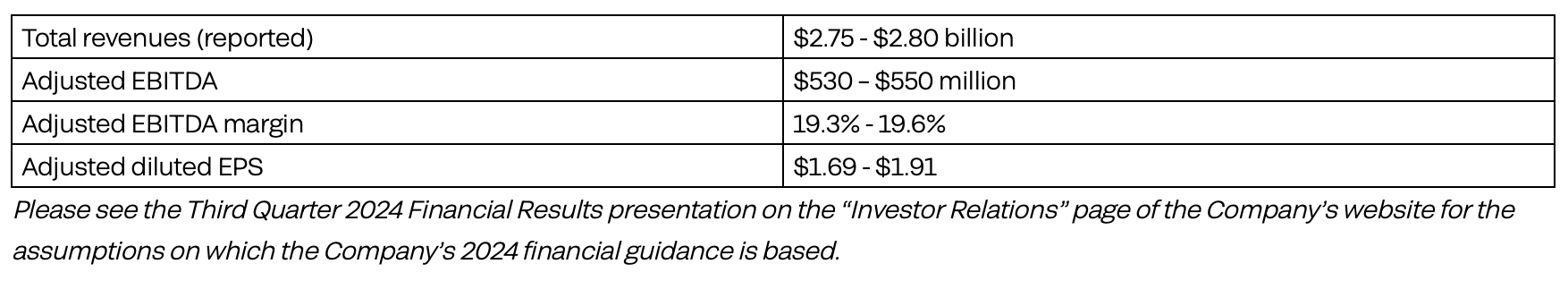

Full-year 2024 Financial Guidance

The Company reinstated its full year 2024 financial guidance as of November 7, 2024, as follows:

Joseph Busky, Chief Financial Officer of QuidelOrtho remarked, ¡°Our decision to reinstate our full year financial guidance reflects our solid performance in the first nine months of the year, and more importantly, increased visibility into the impact of our cost-savings initiatives. This 2024 financial guidance is in line with the commentary we shared earlier this year. Looking forward, the cost-savings initiatives support our previously announced plan to achieve $100 million in annualized cost-savings and position us to realize incremental cost-savings in the future.¡±

A reconciliation of forward-looking non-GAAP measures, including adjusted EBITDA, adjusted EBITDA margin and adjusted diluted EPS, to the most directly comparable GAAP measures is not provided because comparable GAAP measures for such measures are not reasonably accessible or reliable due to the inherent difficulty in forecasting and quantifying measures that would be necessary for such reconciliation. We are not, without unreasonable effort, able to reliably predict the impact of impairment charges and related tax benefits, employee compensation costs and other adjustments. These items are uncertain, depend on various factors and may have a material impact on our future GAAP results. In addition, the Company believes any such reconciliation would imply a degree of precision and certainty that could be confusing to investors. See "Forward-Looking Statements" and "Non-GAAP Financial Measures."

Source: QuidelOrtho Reports Third Quarter 2024 Financial Results