Orginal from: Qiagen

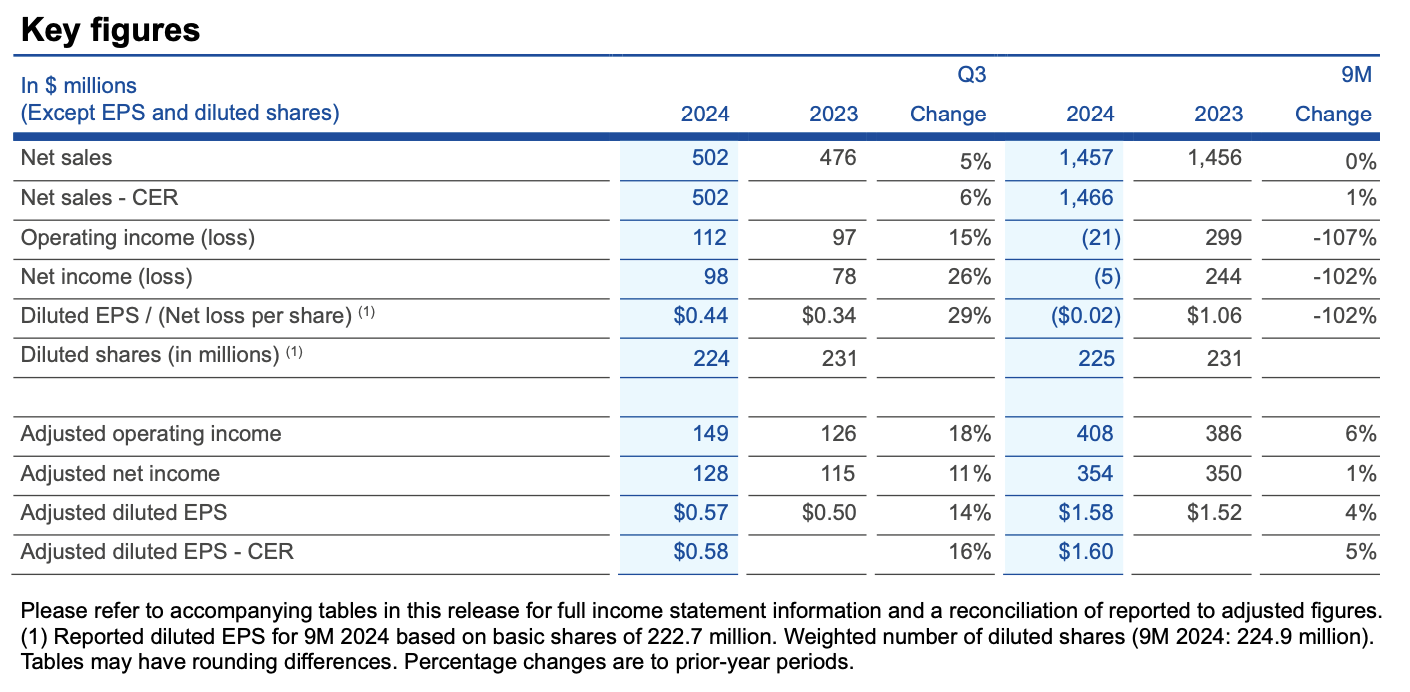

¡¤ Q3 2024: Net sales of $502 million (+5% actual rates, +6% constant exchange rates, CER); diluted EPS of $0.44 and adjusted diluted EPS of $0.57

¡¤ Net sales of $502 million CER ahead of outlook for at least $495 million CER and adjusted diluted EPS of $0.58 CER ahead of outlook for at least $0.55 CER

¡¤ +10% CER growth in Diagnostic solutions leads results among product groups

¡¤ 29.6% adj. operating income margin up 3 percentage points vs. 26.6% in Q3 2023

¡¤ Free cash flow up 73% to $364 million in first nine months of 2024 vs. same 2023 period

¡¤ FY 2024 net sales outlook reaffirmed for at least $1.985 billion CER onsolid core business trends; adj. diluted EPS outlook increased to at least $2.19 CER

QIAGEN N.V. (NYSE: QGEN; Frankfurt Prime Standard: QIA) today announced results for the third quarter and first nine months of 2024.

Net sales rose 5% to $502 million in Q3 2024 over Q3 2023, while results at constant exchanges rates (CER) of $502 million rose 6% and were above the outlook for at least $495 million CER. The adjusted operating income margin rose three percentage points to 29.6% on benefits from the recent decision to discontinue the NeuMoDx system as well as broader efficiency gains that have improved profitability and freed up resources for targeted reinvestment. Adjusted diluted earnings per share (EPS) were $0.57, and results at CER of $0.58 were above the outlook for at least $0.55 CER.

QIAGEN has reaffirmed its FY 2024 sales outlook for at least $1.985 billion CER based on the solid core business performance in the first nine months of the year. The outlook for adjusted diluted EPS has been increased to at least $2.19 CER (previously $2.10 CER at start of 2024), while the adjusted operating income margin target has been reaffirmed for at least 28.5% compared to 26.9% in 2023.

¡°QIAGEN delivered another solid performance in the third quarter of 2024, exceeding our goals for net sales and adjusted earnings thanks to the strong trends in our business and the resilience of our portfolio with over 85% of sales from highly recurring revenues. We are executing quarter after quarter in this challenging macro environment on delivering sales growth combined with market share gains and operational efficiency thanks to a differentiated portfolio,¡± said Thierry Bernard, CEO of QIAGEN.

¡°The value of our portfolio was again underscored with three QIAGEN customers recently being awarded Nobel Prizes for their groundbreaking contributions to advancing science and improving healthcare. Our teams are constantly enhancing this portfolio, and recent developments include the launch of 100 new assays for the QIAcuity digital PCR system along with the new QIAcuityDx version for clinical applications. We have expanded the utility of our QIAstat-Dx system beyond syndromic testing through new pharma partnerships with AstraZeneca and Eli Lilly. This progress in 2024 to achieve our goals marks a key step toward achieving our 2028 targets and delivering on our commitment to solid profitable growth,¡± Bernard said.

¡°Our 2024 results to date reflect a positive quarterly trend in sales and adjusted earnings, along with a 73% increase in free cash flow. We are well-positioned to achieve the updated outlook for 2024 as we once again increase our adjusted EPS target," said Roland Sackers, CFO of QIAGEN. "We are implementing initiatives to simplify QIAGEN and increase efficiency, and these initiatives are putting us on track to increase our adjusted operating income margin above 31% by the end of 2028, reaffirming our commitment to solid profitable growth.¡±

¡¤ Sales: Q3 2024 results delivered 6% CER sales growth over the same 2023 period, and also rose 6% CER excluding NeuMoDx sales. Diagnostic solutions led the performance among product groups, rising 10% CER and driven by QuantiFERON (+10% CER) and QIAstat-Dx (+40% CER), along with higher sales in Sample technologies and PCR product groups. Consumables and related revenues grew 8% CER over Q3 2023, supported by improved trends in all regions. Instrument sales declined 9% CER, and in line with the results for the first nine months of 2024 amid ongoing cautious customer capital spending trends.

¡¤ Operating income: For Q3 2024, operating income rose 15% to $112 million, and included $21 million of pre-tax charges (of which over 60% was non-cash) primarily related to the decision in June 2024 to discontinue NeuMoDx. Adjusted operating income rose 18% to $149 million, while the adjusted operating income margin rose to 29.6% of sales from 26.6% in Q3 2023. This increase reflected efficiency gains across QIAGEN to improve profitability and free up resources to reinvest in growth initiatives as well as benefits from the NeuMoDx decision. In terms of components, the adjusted gross margin rose to 66.5% in Q3 2024 from 66.1% in Q3 2023 on higher production capacity utilization. R&D investments were 8.9% in Q3 2024 compared to 10.1% in Q3 2023. Sales and marketing expenses were 22.2% compared to 23.4% in Q3 2023, while General and administrative expenses were steady at 5.9% of sales.

¡¤ EPS: Diluted EPS rose to $0.44 per share in Q3 2024 from $0.34 in Q3 2023. Adjusted diluted EPS for Q3 2024 were $0.57, while adjusted diluted EPS of $0.58 CER were above the outlook for at least $0.55 CER. The adjusted tax rate was 20% in Q3 2024, and above the quarterly estimate for about 19%.

¡¤ Sample technologies: Higher consumables sales in Q3 2024 led the performance with 1% CER growth over the year-ago period. Instrument sales declined modestly despite ongoing solid placement trends for the QIAcube Connect and EZ2 systems.

¡¤ Diagnostic solutions: Q3 2024 sales grew 10% CER, and were up 11% CER excluding NeuMoDx, led by double-digit CER gains in consumables sales but lower instrument sales over the year-ago period. Among the key drivers, sales of the QuantiFERON test for latent tuberculosis (TB) detection maintained a solid 10% CER growth rate and the sixth consecutive quarter with sales above $100 million on solid demand in all regions on conversion from the tuberculin skin test. QIAstat-Dx grew a dynamic 40% CER on double-digit sales gains in both consumables and instrument sales for the syndromic testing system. QIAstat-Dx placements were robust in Q3 2024 and remain on track to achieve the 2024 goal of at least 600 new systems. NeuMoDx results reflected the decision in Q2 2024 to discontinue this system and support customers during a transition period into 2025.

¡¤ PCR / Nucleic acid amplification: Overall Q3 2024 sales growth of 9% CER over the year-ago period reflected solid double-digit gains in various PCR consumables. QIAcuity digital PCR consumables sales rose at a double-digit CER pace and supported by the launch of new assays, but instrument sales also declined at a double-digit CER rate compared to Q3 2023 due to the cautious instrument purchasing environment.

¡¤ Genomics / Next-generation sequencing (NGS): Sales in Q3 2024 were largely unchanged compared to Q3 2023, with single-digit CER growth in NGS consumables against a low-single-digit CER decline in QIAGEN Digital Insights (QDI) bioinformatics. Sales in the market-leading QDI business reflected higher sales among clinical customers, but also the transition, particularly in the pharmaceuticals sector, to SaaS (software-as-a-service) subscription models from longer-term licensing agreements.

Portfolio update

QIAGEN is building momentum in its Sample to Insight portfolio through targeted actions including:

¡¤ Four QIAstat-Dx panels have received FDA clearance to date in 2024, and now offers a full menu of tests in the U.S. for detection of respiratory, gastrointestinal and meningitis / encephalitis conditions. FDA clearances have now been received in 2024 for these tests:

o QIAstat-Dx Meningitis/Encephalitis Panel

o QIAstat-Dx Gastrointestinal Panel 2

o QIAstat-Dx Respiratory Panel Plus

o QIAstat-Dx Respiratory Panel Mini

Several QIAstat-Dx products - instruments as well as the Respiratory and Gastrointestinal panels ¨C also received CE-marking under the European Union¡¯s new In-Vitro Diagnostic Medical Devices Regulation (IVDR). QIAGEN has already transitioned over 80% of its overall portfolio of diagnostic products to the new regulatory framework.

Additionally, two new pharma collaborations were also announced to expand QIAstat-Dx into precision medicine and build on the initial success in syndromic testing. QIAGEN will develop companion diagnostics for AstraZeneca on QIAstat-Dx for therapies being developed to address various chronic diseases. QIAGEN also announced a new collaboration with Eli Lilly and Company to support the development on QIAstat-Dx of the first commercially available in-vitro diagnostic identify APOE genotypes, which can play a role in diagnosing Alzheimer¡¯s disease.

¡¤ The QIAcuityDx digital PCR system was launched in September, expanding the power of digital PCR into clinical diagnostics. This system streamlines clinical testing by providing highly precise, absolute quantitation of target DNA and RNA, and can support liquid biopsy applications. QIAGEN has already signed three partnerships with pharmaceutical companies to develop companion diagnostics on QIAcuityDx and is leading the entry of digital PCR into precision medicine.

The QIAcuity dPCR portfolio was also expanded with the addition of over 100 new validated assays for cancer research, inherited genetic disorders, infectious disease surveillance and other applications. QIAGEN continues to expand the portfolio of validated assays to enhance utilization across multiple application areas. These assays are available via the GeneGlobe platform.

¡¤ In the Sample technologies portfolio, PreAnalytiX (a QIAGEN and BD joint venture) launched the PAXgene® Urine Liquid Biopsy Set to address the challenge of gaining access to cell-free DNA (cfDNA) from urine, which can provide important data and information not found in blood samples.

Outlook

For FY 2024, QIAGEN reaffirms the outlook for net sales of at least $1.985 billion CER based on the solid performance in the first nine months 2024. Consumables and related revenues are expected to drive growth, while larger-scale instrument sales remain challenging. Adjusted diluted EPS are now expected to be at least $2.19 CER (previously $2.16 CER), and a significant increase from the initial 2024 outlook of at least $2.10 CER. QIAGEN also continues to expect the adjusted operating income margin of at least 28.5%, an increase of at least 1.6 percentage points from 26.9% in 2023.

Based on exchange rates as of October 31, 2024, currency movements against the U.S. dollar are expected to have a negative impact on full-year net sales of about one percentage point and a negative impact of about $0.02 per share on adjusted EPS results.

For Q4 2024, net sales are expected to be at least $520 million CER compared to $509 million in Q4 2023. Adjusted diluted EPS are expected to be at least $0.60 CER per share compared to $0.55 in Q4 2023.

Based on exchange rates as of October 31, 2024, currency movements against the U.S. dollar are expected to have a neutral impact on Q4 2024 net sales and adjusted EPS results.

Source: QIAGEN delivers solid Q3 2024 growth ahead of outlook, increases full-year 2024 adjusted EPS outlook