Original from: Bio-Rad

Bio-Rad Laboratories, Inc. (NYSE: BIO and BIO.B), a global leader in life science research and clinical diagnostics products, today announced financial results for the third quarter ended September 30, 2024.

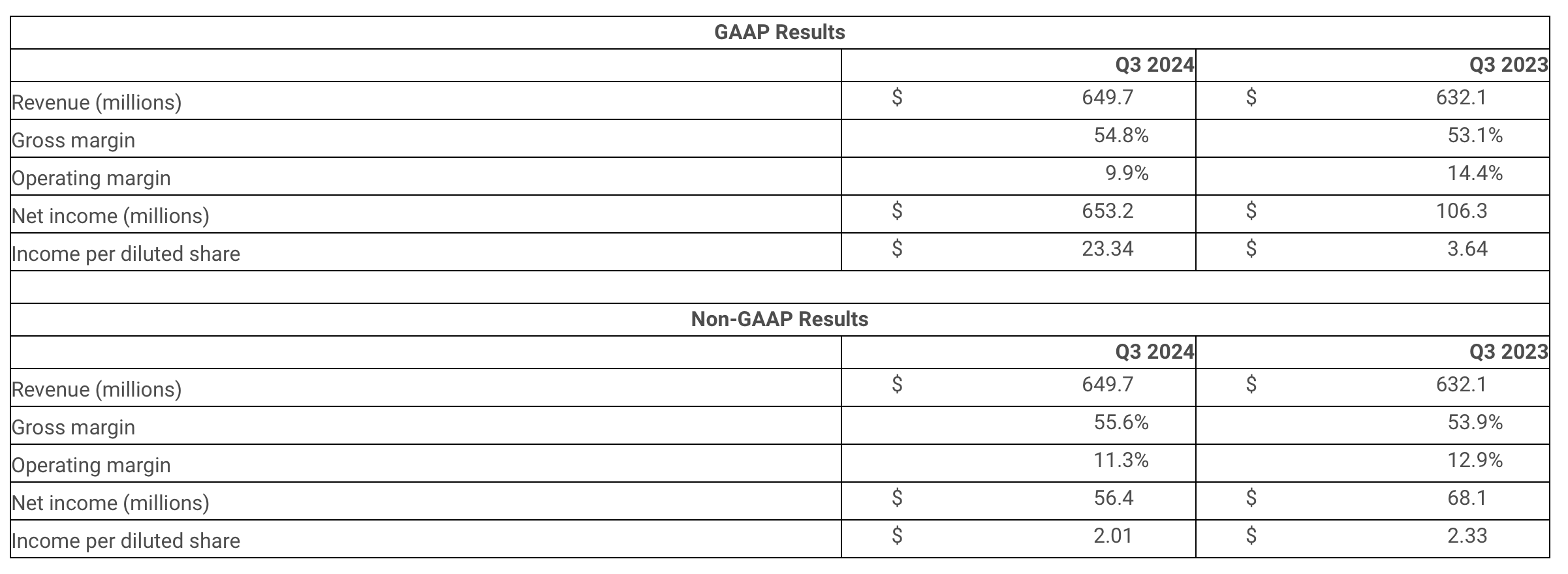

Third-quarter 2024 total net sales were $649.7 million, an increase of 2.8 percent compared to $632.1 million reported for the third quarter of 2023. On a currency-neutral basis, quarterly sales increased 3.4 percent compared to the same period in 2023. The increase in net sales was driven by higher sales in our Clinical Diagnostics segment.

Life Science segment net sales for the third quarter were $260.9 million, a decrease of 1.0 percent compared to the same period in 2023. On a currency-neutral basis, sales decreased by 0.6 percent compared to the same quarter in 2023, driven by ongoing weakness in the biotech and biopharma end markets. Currency neutral sales decreased in the Americas, offset by increases in EMEA.

Clinical Diagnostics segment net sales for the third quarter were $388.8 million, an increase of 5.6 percent compared to the same period in 2023. On a currency-neutral basis, sales increased 6.4 percent compared to the same quarter last year. The currency neutral sales increase was primarily driven by increased demand for quality control products, and a favorable compare for our immunology products, which were impacted by supply constraints in the third quarter of 2023. Currency neutral sales increased across all regions.

Third-quarter gross margin was 54.8 percent compared to 53.1 percent during the third quarter of 2023.

Income from operations during the third quarter of 2024 was $64.5 million versus $90.9 million during the same quarter last year.

During the third quarter of 2024, the company recognized a change in the fair market value of its investment in Sartorius AG, which substantially contributed to a net income of $653.2 million, or $23.34 per share, on a diluted basis, versus a net income of $106.3 million, or $3.64 per share, on a diluted basis, reported for the same period of 2023.

The effective tax rate for the third quarter of 2024 was 24.2 percent, compared to 22.5 percent for the same period in 2023. The effective tax rate reported in these periods was primarily affected by the accounting treatment of our equity securities.

¡°Our third-quarter revenue performance was slightly ahead of expectations, driven by steady growth in clinical diagnostics products, while our life science business continued to improve reflecting a gradual recovery in the biopharma end market,¡± said Norman Schwartz, Bio-Rad¡¯s Chairman and Chief Executive Officer. "During the quarter, we also welcomed Jon DiVincenzo as President and Chief Operating Officer. Jon joins Bio-Rad's other recently hired senior executives who collectively bring a wealth of life science, clinical diagnostics, and operations experience. With the new senior leadership team in place, we are focused on margin expansion, commercial excellence, and creating long-term shareholder value."

The non-GAAP financial measures discussed below exclude certain items detailed later in this press release under the heading ¡°Use of Non-GAAP and Currency-Neutral Reporting.¡± A reconciliation between historical GAAP operating results and non-GAAP operating results is provided following the financial statements that are part of this press release.

Non-GAAP gross margin was 55.6 percent for the third quarter of 2024 compared to 53.9 percent during the third quarter of 2023.

Non-GAAP income from operations during the third quarter of 2024 was $73.3 million versus $81.6 million during the comparable prior-year period.

Non-GAAP net income for the third quarter of 2024 was $56.4 million, or $2.01 per share, on a diluted basis, compared to $68.1 million, or $2.33 per share, on a diluted basis, during the same period in 2023.

The non-GAAP effective tax rate for the third quarter of 2024 was 28.8 percent, compared to 23.9 percent for the same period in 2023. The higher rate in 2024 was driven by geographical mix of earnings and a one-time acquired in-process research and development expense.

Updated Full-Year 2024 Financial Outlook

Bio-Rad continues to expect its non-GAAP revenue to decline by approximately 2.5 to 4.0 percent on a currency-neutral basis. The company estimates a non-GAAP operating margin of between 12.75 to 13.25 percent, which now also includes the impact of a one-time acquired in-process research and development expense related to an acquisition completed during the third quarter.

Source: Bio-Rad Reports Third-Quarter 2024 Financial Results