Original from: Diasorin

The Board of Directors of DiaSorin S.p.A. (FTSE MIB: DIA), examined and approved the Group¡¯s Consolidated Financial Statements at June 30, 2024.

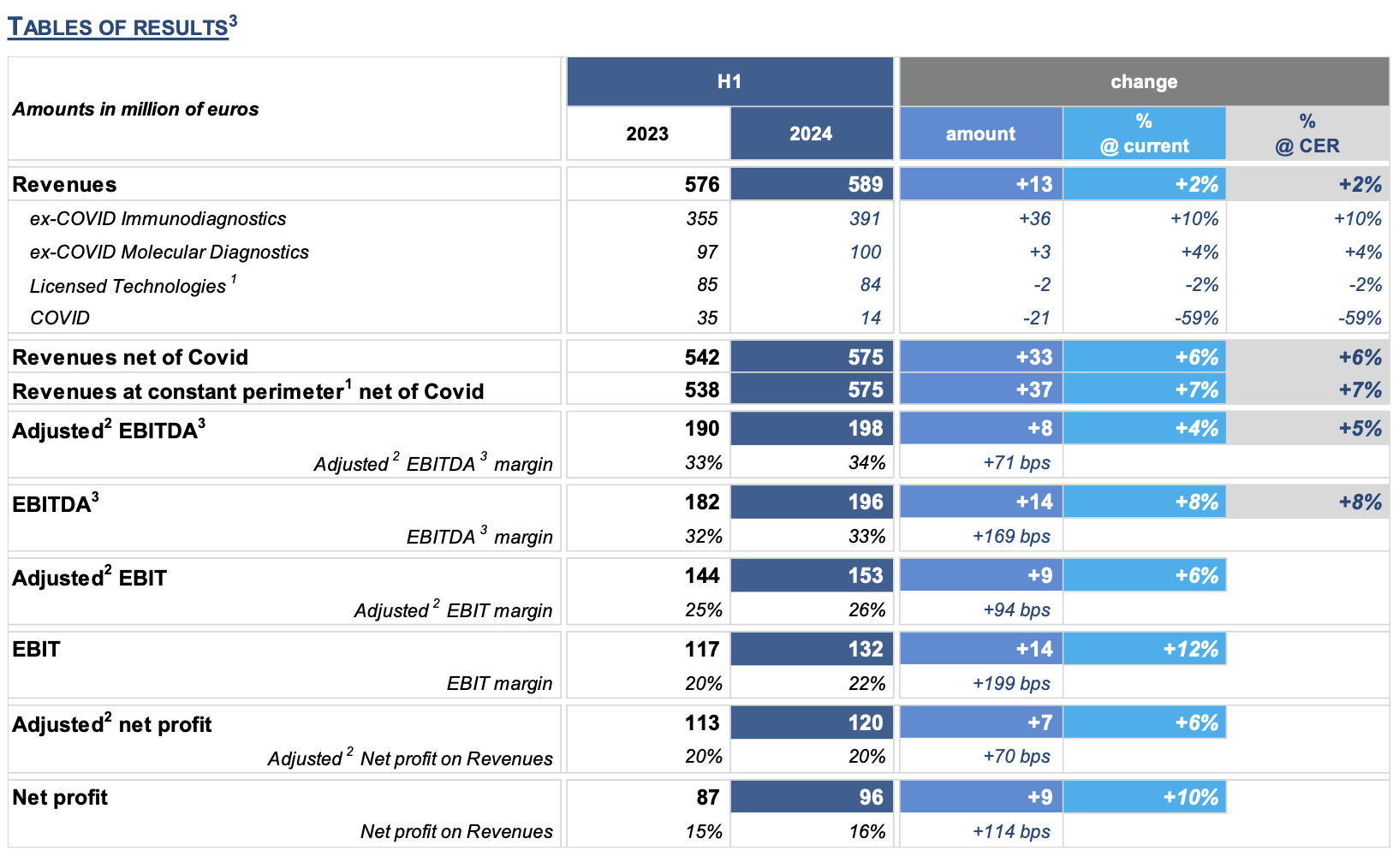

REVENUES: € 589 million, +2% (at current and constant exchange rates). At constant perimeter of consolidation and excluding the COVID business, H1 2024 revenues grew +7% at constant exchange rates compared to the same period of the previous year, a result in line with the high range of the FY 2024 guidance.

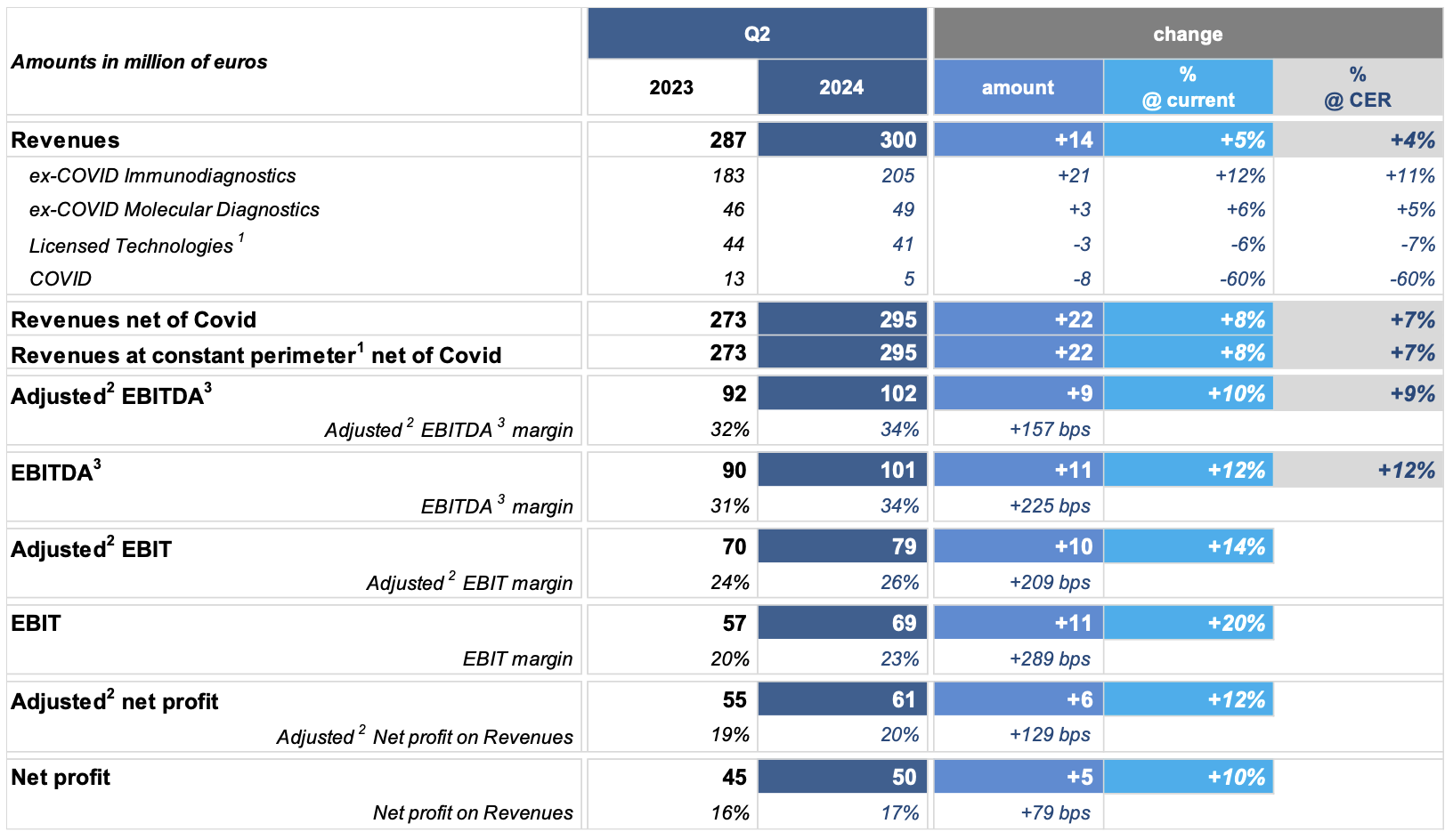

In Q2 2024, revenue growth at constant perimeter of consolidation1 and net of COVID business was equal to +8% (+7% at constant exchange rates). The increase is mostly attributable to the excellent performance of the immunodiagnostic and molecular diagnostic businesses, driven by the specialty menu and innovative solutions for the market of laboratories.

The following are the revenue trends of the different business lines:

¡¤ Ex-COVID Immunodiagnostics: € 391 million, an increase of € 36 million, equal to +10% (at current and constant exchange rates) vs. H1 2023, driven by the excellent performance of CLIA sales.

In Q2 2024, business grew by +12% (+11% at constant exchange rates), accelerating when compared to Q1 2024, mainly due to the excellent performance of the U.S. market driven by the Hospital Strategy and the broad offer of specialties, and the European market due to increased volumes in most countries in the region.

¡¤ Ex-COVID Molecular Diagnostics: € 100 million, +4% (at current and constant exchange rates) vs. H1 2023.

The following is the revenue performance by geographic area, net of the contribution of COVID products:

¡¤ North America Direct: € 279 million, +9% (+10% at constant exchange rates).

At constant perimeter of consolidation, the increase is equal to +10% (at current and constant exchange rates), mostly driven by the excellent performance of the immunodiagnostic business, as a result of the success of the U.S. Hospital Strategy, of the broad offering of specialties, as well as the great performance of the molecular diagnostic business, despite not yet incorporating the contribution of LIAISON PLEX® (commercially launched on June).

In Q2 2024, it was reported an acceleration of the immunodiagnostic business (over +22% at constant exchange rates) and of the molecular diagnostic business (+6% at constant exchange rates) compared to the same period of the previous year.

¡¤ Europe Direct: € 207 million, +8% (at current and constant exchange rates).

The growth was driven by the positive performance of the Immunodiagnostic business, with a focus on the specialty tests that characterize Diasorin's offerings.

In Q2 2024, the immunodiagnostic (+12% at constant exchange rates) and molecular diagnostic (+10% at constant exchange rates) businesses show an acceleration vs. Q1 2024, supported by an increase of volumes in the majority of countries in this geographical area.

The performance of this geographic area was negatively impacted by the performance of markets in which Diasorin operates through distributors and the Chinese market, partially offset by the positive trend of markets where the Group operates directly.

ADJUSTED2 EBITDA3: € 198 million (equal to 34% of revenues), an increase of € 8 million (+4%) compared to H1 2023, with a higher incidence on revenues (33% in the previous year). In Q2 2024, growth shows a sharp acceleration to +10% compared to the same period in 2023, with EBITDA margin at 34%.

Q2 2024 is the contributor to the growth, which results in +14% over the same period of 2023.

NET FINANCIAL EXPENSES € 8 million (€ 5 million in 2023); up from H1 2023 as a result of the fair value measurement of interest rate hedging financial instruments.

ADJUSTED2 NET PROFIT: € 120 million (equal to 20% of revenues), an increase of € 7 million (+6%) vs. H1 2023.

COMMENT ON FINANCIAL RESULTS

CONSOLIDATED NET FINANCIAL DEBT: -€ 781 million (-€ 776 million at December 31, 2023).

The change, equal to -€ 5 million, is mainly related to the payment of dividends (€ 61 million) and the purchase of treasury shares (€ 8 million), offset by the operating cash flow generation in H1 2024.

FREE CASH FLOW5: € 91 million at June 30, 2024 (€ 104 million at June 30, 2023).

The change is partially attributable to increased investment activity in new technologies and upcoming products.

BUSINESS HIGHLIGHTS

IMMUNODIAGNOSTICS:

- Announcement of submission of LIAISON® LymeDetect® to the U.S. Food and Drug Administration (FDA).

MOLECULAR DIAGNOSTICS:

- Divestment of ARIES molecular diagnostics business line and consolidation of the related customer base on Diasorin LIAISON® MDX platform;

- FDA 510(k) clearance of LIAISON PLEX®, the new multiplexing platform and the respiratory panel LIAISON PLEX® Respiratory Flex Assay;

- FDA 510(k) clearance of LIAISON PLEX® Yeast Blood Culture Assay, the second multiplexing panel for the LIAISON PLEX® platform;

- FDA ¡°de-novo¡± authorization of Direct Simplexa® C. auris kit for LIAISON® MDX platform, indicated for diagnosis on patients with suspected colonization from Candida auris.

FY 2024 GUIDANCE REVISED UPWARDS AT 2023 CONSTANT EXCHANGE RATES

- EX-COVID REVENUES: between +6% and +7% (COVID revenues equal to approx. € 30 million)

- ADJUSTED2 EBITDA3 MARGIN4: approx. 33%