3. Market Situation of Biochemical Diagnosis in China

Presently, the domestic biochemical diagnosis market is highly competitive, and some of domestic brands have occupied market shares that are close to or surpass that of the international brands. In 2019, China's IVD market size exceeded 71 billion CNY, with a year-on-year growth of 15%, of which, the biochemical diagnosis market accounted for 23%; in 2020, China's IVD market size exceeded 100 billion CNY, of which, the biochemical diagnosis market accounted for 18%. Although the biochemical market share in 2020 is lower than that in 2019, the market size in 2020 has increased by nearly two billion CNY compared with 2019.

3.1 Development of Biochemical Diagnostic Companies

3.1.1 Development of IVD Listed Companies

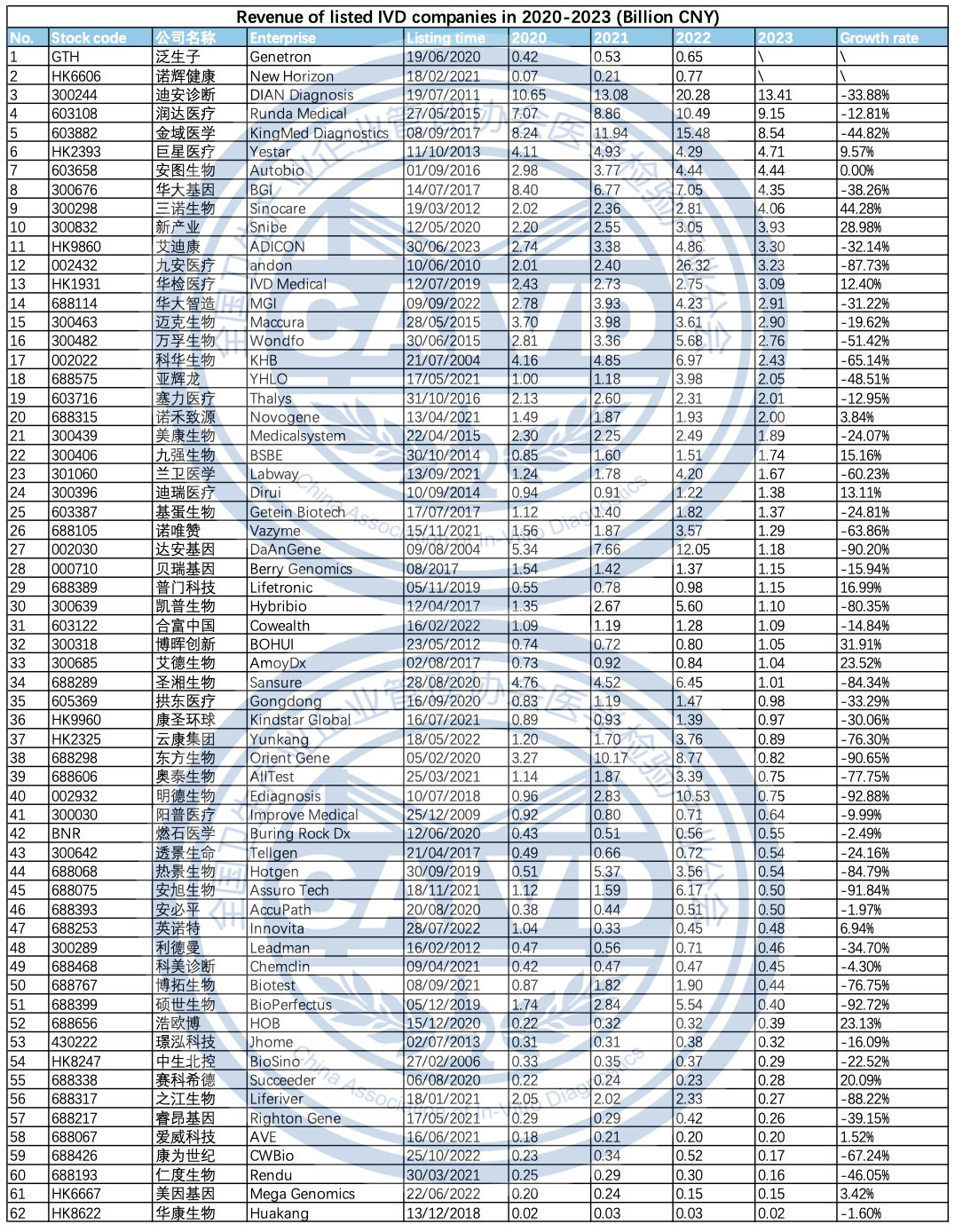

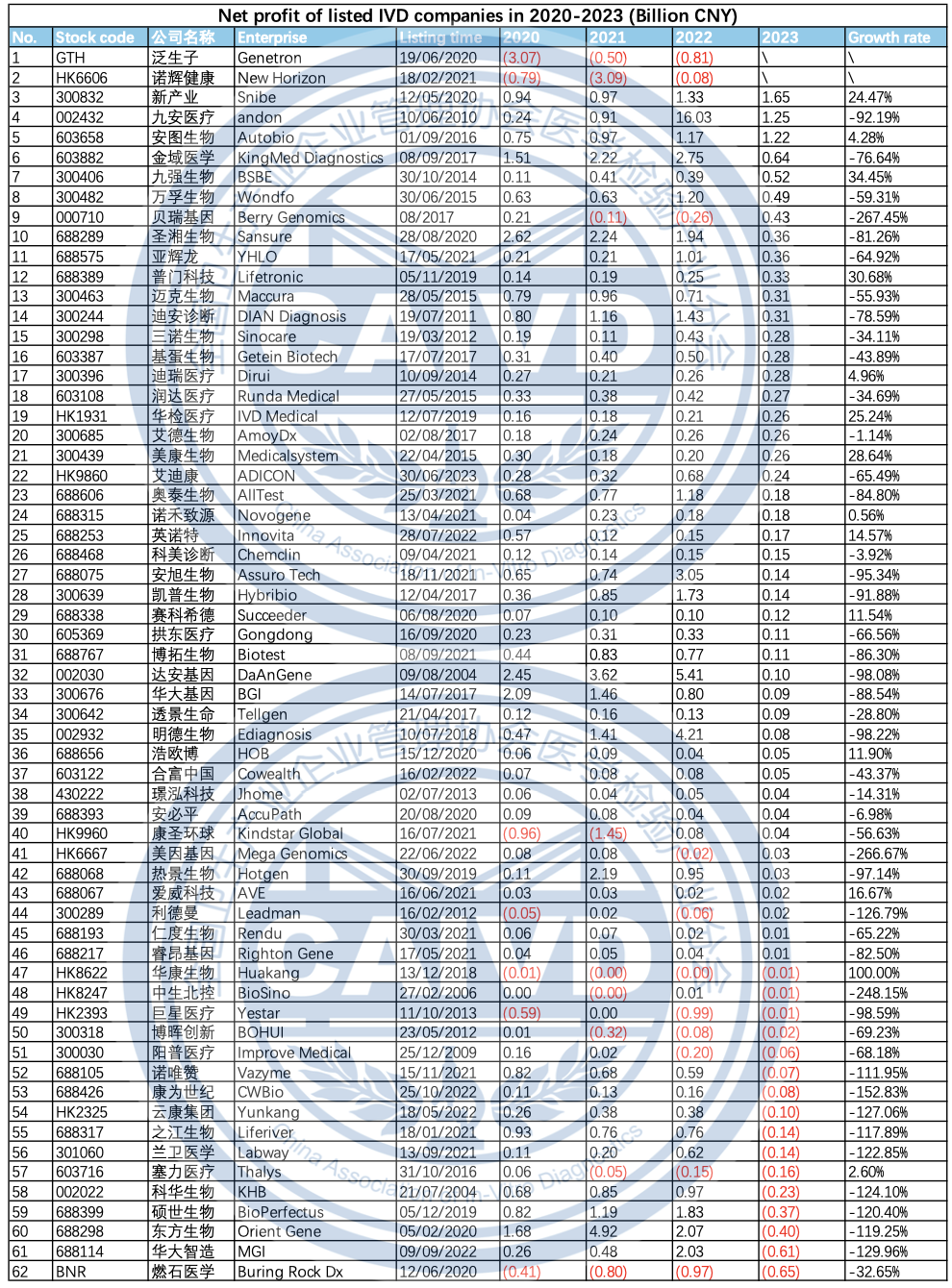

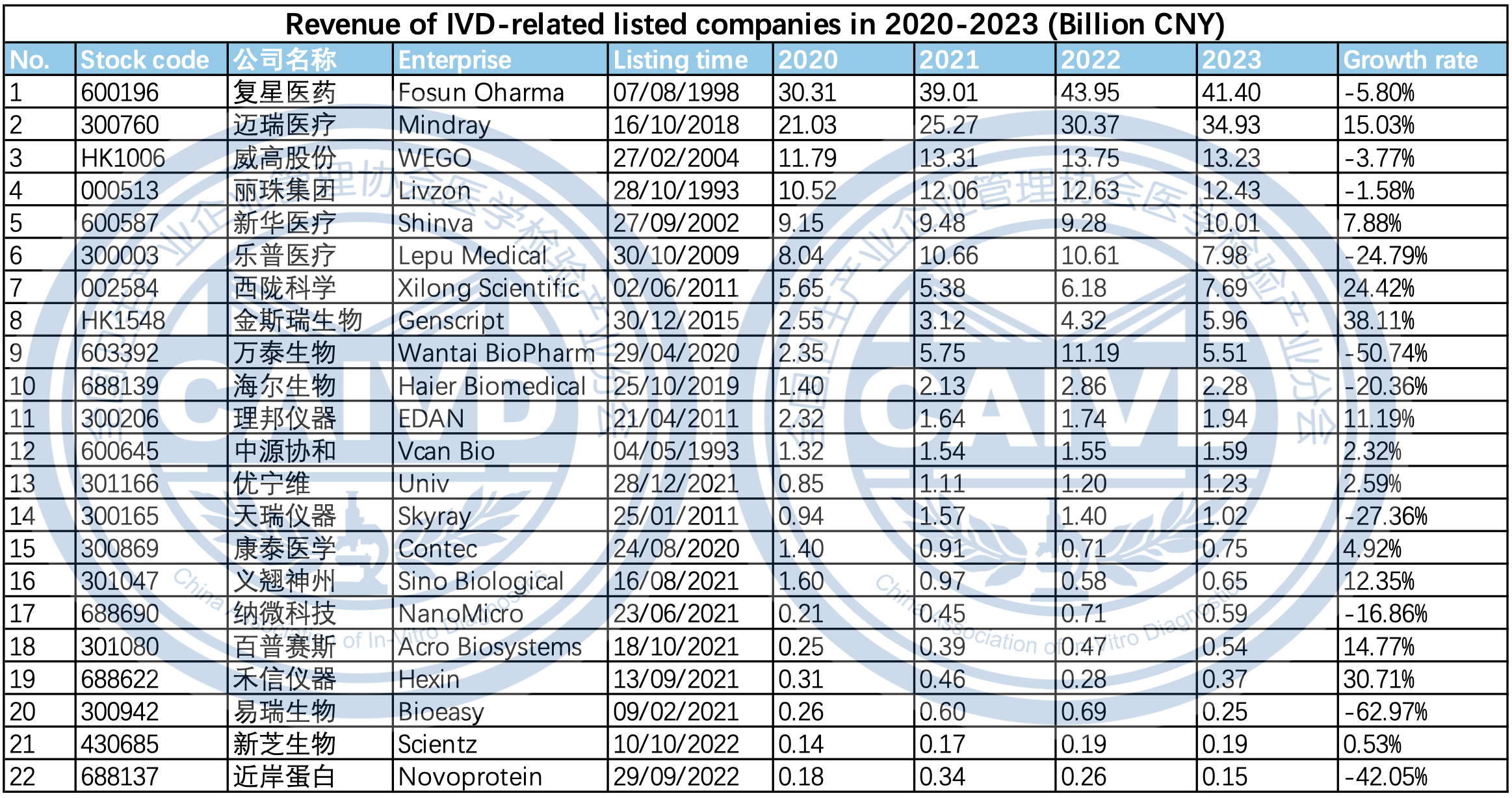

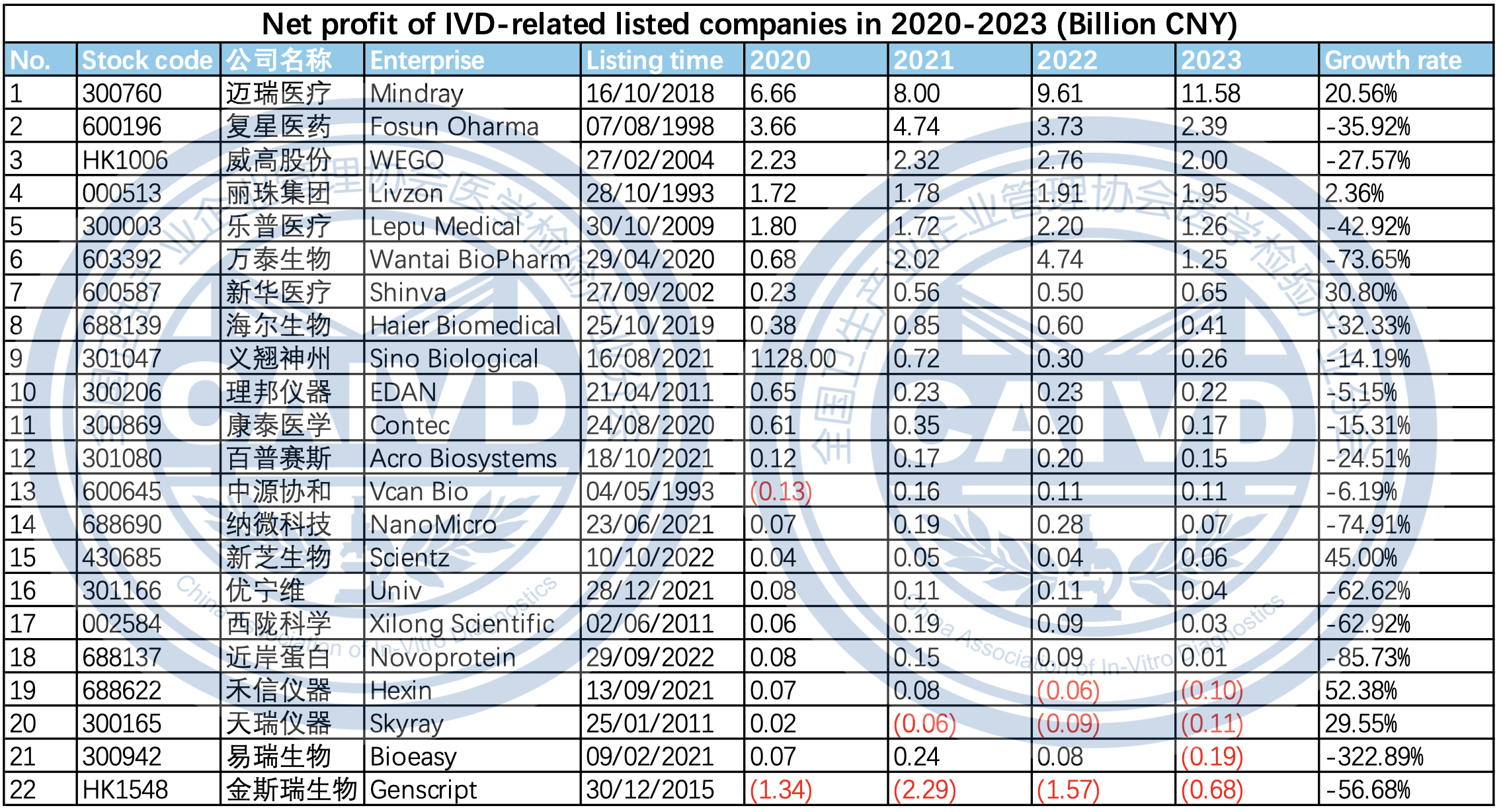

There were 31 newly added IVD listed companies nationwide from 2020 to 2023. Presently, there are 60 IVD listed companies and 22 IVD related listed companies nationwide. The domestic in vitro diagnostic industry giants have emerged, among which the representatives in the biochemical market include Mindray, BSBE, Medicalsystem, Maccura, Dirui, Leadman, Wantai, BioSino. The biochemical diagnostic reagents have a low technical threshold and there are many manufacturers, so the product homogeneity is high and the overall market structure is relatively dispersed. In the future, the leading enterprises will gradually build up the competitive advantages, and a large number of small- and medium-sized enterprises will develop longitudinally through innovation drive, and high-quality services and products.

In 2023, due to the significant decline in COVID-19 testing, the overall IVD market rapidly reverted to routine testing business, leading to a revenue decline for most companies. Out of 60 listed IVD companies, only 16 achieved positive revenue growth in 2023. Among them, Sinocare's revenue increased by 44.28% year-on-year, and BSBE's net profit grew by 34.45% year-on-year in 2023.

22 IVD-related listed companies performed relatively stably in 2023. Fosun Pharma ranked first in annual revenue with 41.4 billion CNY, while Mindray topped the net profit list with a net profit of 11.58 billion CNY in 2023.

Last: In Vitro Diagnostic Industry in China - Clinical Chemistry VIII

Next: In Vitro Diagnostic Industry in China - Clinical Chemistry X