Original from: Becton, Dickinson and Company

BD (Becton, Dickinson and Company) (NYSE: BDX), a leading global medical technology company, today announced results for its first quarter of fiscal 2024, which ended December 31, 2023.

"Our Q1 results reflect our team's strong execution of our BD 2025 strategy, in particular leveraging our broad portfolio of simplification programs to deliver both margin performance and cash flow ahead of our expectations," said Tom Polen, chairman, CEO and president of BD. "As we build on this momentum, advance our strong innovation pipeline and accelerate the adoption of our BD Excellence operating system, we are well-positioned to achieve our increased fiscal 2024 guidance and create sustained value for all stakeholders."

Recent Business and ESG Highlights

・ BD Medical:

- The Medication Delivery Solutions business unit launched the SiteRite™ 9 Ultrasound System which is designed to aid clinicians with first attempt insertion success when placing peripherally inserted central catheters (PICCs), central venous catheters, IV lines and other vascular access devices.

・ BD Life Sciences:

- The Integrated Diagnostics Solutions business unit received FDA 510(k) clearance for the BD MiniDraw™ Capillary Blood Collection System, a device which enables fingertip collection of a high-quality blood sample that is less invasive and more convenient than the traditional collection method.

・ Aligned with its recent collaboration with the Kenyan Government to advance access to critical cancer diagnostics for women in Kenya, the company signed the World Economic Forum's Zero Health Gaps Pledge, reinforcing its longstanding commitment to help improve health equity and expand access to care in under-resourced communities around the world.

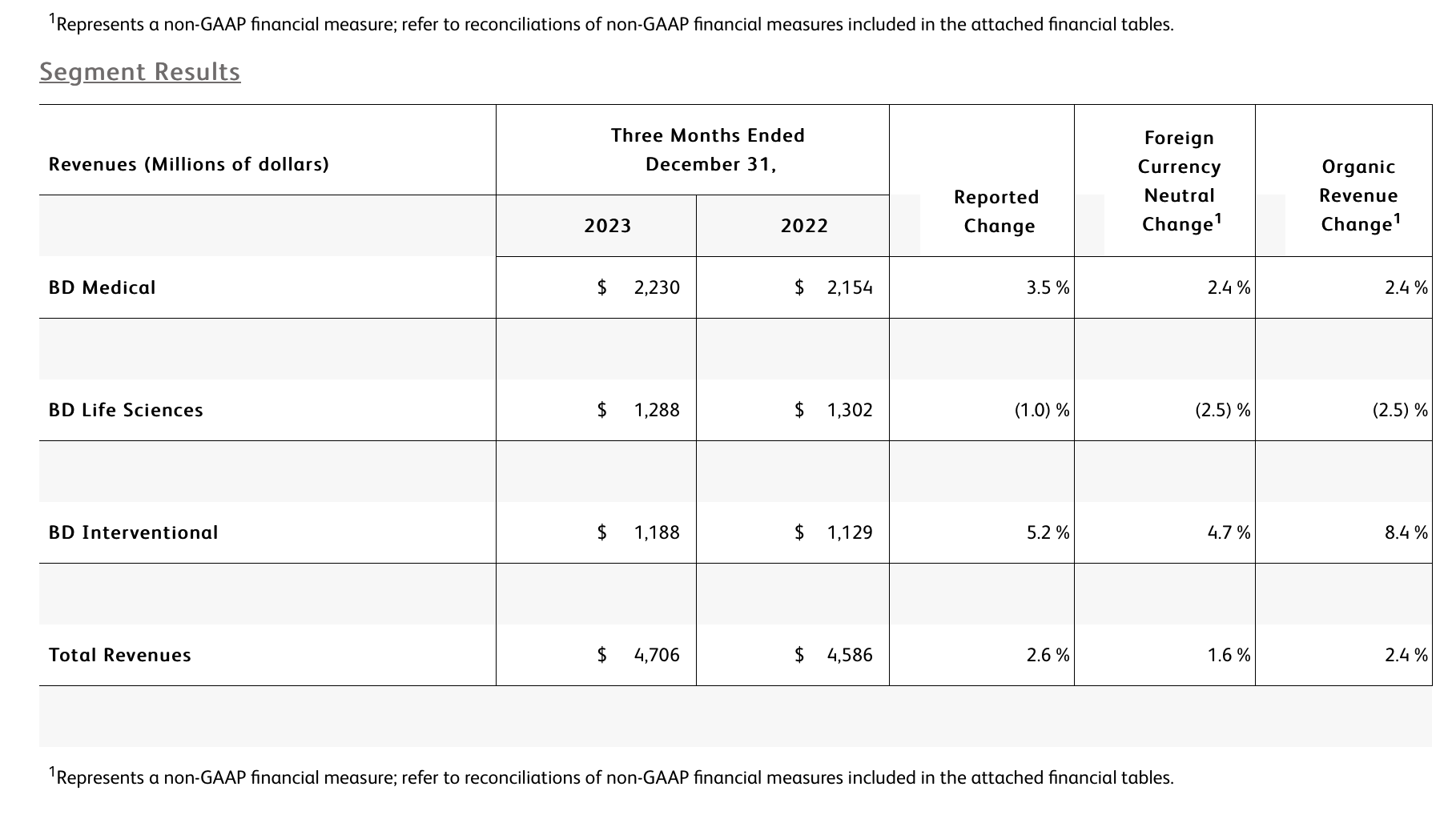

The BD Medical segment includes the Medication Delivery Solutions (MDS), Medication Management Solutions (MMS), and Pharmaceutical Systems (PS) business units. BD Medical revenue growth was driven by MMS and PS.

・ MDS performance reflects continued execution of our Vascular Access Management strategy which drove strong performance in Catheter Solutions. As expected, growth was tempered by market dynamics in China.

・ MMS performance reflects strong growth in Dispensing and Infusion with a continued focus on innovation within the BD Pyxis™ portfolio to improve nursing workflows and efficiencies, and strong progress bringing the BD Alaris™ Infusion System back to market. Performance in Pharmacy Automation was impacted by the comparison to the prior year, as expected, and the timing of planned capital installations.

・ PS performance reflects leadership in Pre-Fillable Solutions which drove double-digit growth in biologics with BD Hypak™ and innovative products like BD Neopak™. As expected, growth was tempered by customer inventory dynamics, including a slowdown in demand for anticoagulants.

The BD Life Sciences segment includes the Integrated Diagnostic Solutions (IDS) and Biosciences (BDB) business units. BD Life Sciences revenue reflects a decline in IDS that was partially offset by growth in BDB.

・ IDS performance reflects the comparison to higher prior-year respiratory testing revenues. Partially offsetting this decline was high single-digit growth in our Microbiology platforms and strong double-digit growth from Molecular IVD assays leveraging the BD COR™ System and BD Max™ System install base.

・ BDB performance was driven by strong mid-single digit growth in both Research and Clinical Solutions despite the impact of prior-year comparisons. Performance was led by double-digit growth in Research Instruments enabled by the BD FACSDiscover™ S8 Cell Sorter and BD Rhapsody™ HT Xpress launches, and double-digit growth in Clinical Reagents driven by our growing FACSLyric™ Clinical Cell Analyzer and FACSDuet™ Sample Preparation System install base.

The BD Interventional segment includes the Surgery, Peripheral Intervention (PI), and Urology & Critical Care (UCC) business units. BD Interventional organic revenue growth was primarily driven by Surgery and UCC.

・ Surgery performance reflects continued market adoption of the Phasix™ hernia resorbable scaffold, which drove double-digit growth worldwide in Advanced Repair and Reconstruction, and high-single digit growth in Infection Prevention, driven by strong demand for ChloraPrep™. The unit's performance also reflects the impact from the divestiture of the Surgical Instrumentation platform.

・ PI performance reflects global penetration of the Peripheral Vascular Disease portfolio, including the Venovo™ Venous Stent System and the Rotarex™ Atherectomy System. As expected, growth was impacted by the timing of prior-year distributor ordering in the US.

・ UCC performance reflects double-digit growth in the PureWick™ franchise for chronic incontinence driven by continued adoption in both acute care and home care settings.

Assumptions and Outlook for Full Year Fiscal 2024

The company provided the following guidance with respect to fiscal 2024.

The company raised the lower end and midpoint of its fiscal 2024 organic revenue growth guidance range, and increased its adjusted diluted earnings per share guidance range.

・ The company now expects fiscal year 2024 revenues to be in the range of approximately $20.2 billion to $20.4 billioncompared to $20.1 billion to $20.3 billion previously.

- Organic revenue growth is now expected to be 5.5% to 6.25% compared to 5.25% to 6.25% previously.

- Total currency-neutral revenue growth is now expected to be 4.75% to 5.5% compared to 4.5% to 5.5% previously. Total currency-neutral revenue growth continues to reflect a negative impact of approximately 75 basis points from the impact of the Surgical Instrumentation platform divestiture.

- Based on current rates, foreign exchange represents a reduction of approximately 25 basis points to total company revenue growth.

・ The company now expects fiscal year 2024 adjusted diluted EPS to be $12.82 to $13.06, compared to $12.70 to $13.00previously. This reflects an increase of 9 cents at the midpoint including an operational increase of 7 cents driven by strong execution in the first quarter, and a 2-cent improvement related to foreign currency translation.

- Adjusted earnings per share guidance reflects growth of approximately 5% to 7%. This includes a reduction of approximately 360 basis points from foreign exchange based on current rates and continues to include the absorption of an estimated 75 basis point negative impact from the divestiture of the Surgical Instrumentation platform.

BD's outlook for fiscal 2024 reflects numerous assumptions about many factors that could affect its business, based on the information management has reviewed as of this date. Management will discuss its outlook and several of its assumptions on its first fiscal quarter earnings call.

The company's expected adjusted diluted EPS for fiscal 2024 excludes potential charges or gains that may be recorded during the fiscal year, such as, among other things, the non-cash amortization of intangible assets, acquisition-related charges, spin-related costs, and certain tax matters. BD does not attempt to provide reconciliations of forward-looking adjusted diluted non-GAAP EPS guidance to the comparable GAAP measure because the impact and timing of these potential charges or gains is inherently uncertain and difficult to predict and is unavailable without unreasonable efforts. In addition, the company believes such reconciliations would imply a degree of precision and certainty that could be confusing to investors. Such items could have a substantial impact on GAAP measures of BD's financial performance. We also present our estimated revenue, organic revenue growth and adjusted diluted EPS growth for our 2024 fiscal year after adjusting for the anticipated impact of foreign currency translation. BD believes that this adjustment allows investors to better evaluate BD's anticipated underlying earnings performance for our 2024 fiscal year in relation to our underlying 2023 fiscal year performance.

Source: BD Reports First Quarter Fiscal 2024 Financial Results