Original from: Roche

¡¤ Group sales grow by 1%1 at constant exchange rates (CER) in the first nine months, showing a strong increase of 7% in the third quarter

¡¤ Excluding COVID-19 products, Group sales increase by 9%

¡¤ Pharmaceuticals Division sales grow by 9%, driven by continued high demand for newer medicines

¡¤ Diagnostics Division¡¯s base business increases by 7%; overall divisional sales are down 18% due to a surge in demand for COVID-19 tests in 2022

¡¤ Highlights in the third quarter of 2023:

- EU approval of Evrysdi for babies under two months old with spinal muscular atrophy

- First approval of subcutaneous form of cancer immunotherapy Tecentriq

- Positive phase III data for Alecensa (early-stage lung cancer) and Ocrevus (subcutaneous injection; multiple sclerosis)

- Positive phase II data for zilebesiran (hypertension in patients at high risk of cardiovascular disease) and additional positive phase II data for fenebrutinib (multiple sclerosis)

- Positive longer-term efficacy and safety data for Ocrevus (multiple sclerosis) and Vabysmo (retinal vein occlusion, a severe eye disease)

- Launch of first validated test for earlier diagnosis of neonatal sepsis and new module to improve laboratory efficiency

¡¤ Outlook for 2023 confirmed

Roche CEO Thomas Schinecker: ¡°We achieved good results in the first nine months of 2023, more than compensating for the expected decline in demand for COVID-19 products. Our Group sales excluding COVID-19 products continued to grow strongly by +9% at constant exchange rates. Additionally, we made significant progress in our product pipeline with numerous positive clinical studies. I am particularly pleased about the phase III data for Alecensa in early-stage lung cancer. Treating cancer at an early stage may give patients a chance for a cure. We confirm our outlook for 2023.¡±

*Asia-Pacific, CEETRIS (Central Eastern Europe, T¨¹rkiye, Russia and Indian subcontinent), Latin America, Middle East, Africa, Canada, others

Outlook for 2023 confirmed

Due to the sharp decline in sales of COVID-19 products of roughly CHF 4.5 billion, Roche expects a decrease in Group sales in the low single digit range (at constant exchange rates). Excluding this COVID-19 sales decline, Roche anticipates strong sales growth in both divisions¡¯ base business.

Core earnings per share are targeted to develop broadly in line with the sales decline (at constant exchange rates). Roche expects to further increase its dividend in Swiss francs.

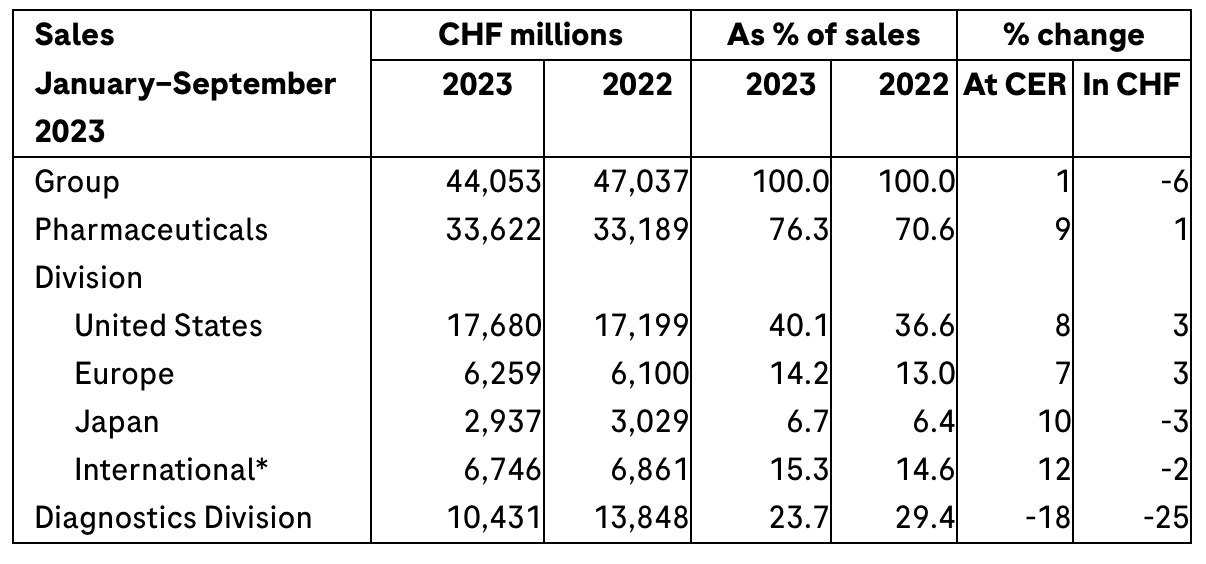

Group sales

In the first nine months of 2023, Group sales increased by 1% (-6% in CHF) to CHF 44.1 billion, even though the company had to compensate for the significant drop in sales of COVID-19 products and the biosimilar erosion2 (a total of CHF 4.0 billion or 9% of sales).

Excluding COVID-19 products, Group sales grew by 9%.

The appreciation of the Swiss franc against most currencies had a significant adverse impact on the results presented in Swiss francs compared to constant exchange rates.

Continued high demand for newer medicines to treat severe diseases led to a 9% increase in Pharmaceuticals Division sales, reaching CHF 33.6 billion.

Roche¡¯s top five growth drivers ¨C Vabysmo (severe eye diseases), Ocrevus (multiple sclerosis), Hemlibra (haemophilia), Polivy (blood cancer) and Evrysdi (spinal muscular atrophy) ¨C collectively generated total sales of CHF 11.2 billion, marking a CHF 3.3 billion increase compared to the first nine months of 2022.

In the United States, sales increased by 8%. This notable growth was primarily driven by Vabysmo, Ocrevus and Hemlibra, in contrast to declining sales of medicines with expired patent protection.

Sales in Europe grew 7%, mainly driven by Germany, UK and France. Sales growth of Vabysmo, Phesgo, Evrysdi and Hemlibra was partially offset by the impact of biosimilars and the absence of sales for Ronapreve (COVID-19).

Sales in Japan experienced a 10% increase, primarily driven by Ronapreve, Polivy, Vabysmo, Hemlibra, Enspryng and Tamiflu (influenza). This sales growth more than offset the impact of biosimilars.

In the International region, sales grew by 12%. This encouraging trend was evident in all major markets, with Brazil and Canada leading the way. China recorded a 6% increase in sales, mainly fuelled by Tamiflu, Xeloda, Polivy and Perjeta. This more than outweighed the impact of biosimilars.

Sales of the Diagnostics Division¡¯s base business grew strongly (+7%) across all major markets. The primary drivers of growth were immunodiagnostics, particularly cardiac tests, and diagnostic solutions for clinical chemistry.

Overall, the Diagnostics Division achieved sales of CHF 10.4 billion. The 18% decrease was in line with the anticipated significant drop in demand for COVID-19 tests (CHF 0.4 billion in the first nine months of 2023, in contrast to CHF 3.6 billion in the same period last year).

Sales in the North America, Asia-Pacific and Europe, Middle East and Africa (EMEA) regions were down by 23%, 19% and 17%, respectively. The decline in sales across regions is primarily due to the sharp decline in demand for COVID-19 tests.

Source: Roche reports good sales growth despite decline in demand for COVID-19 products