Original from: Becton, Dickinson and Company

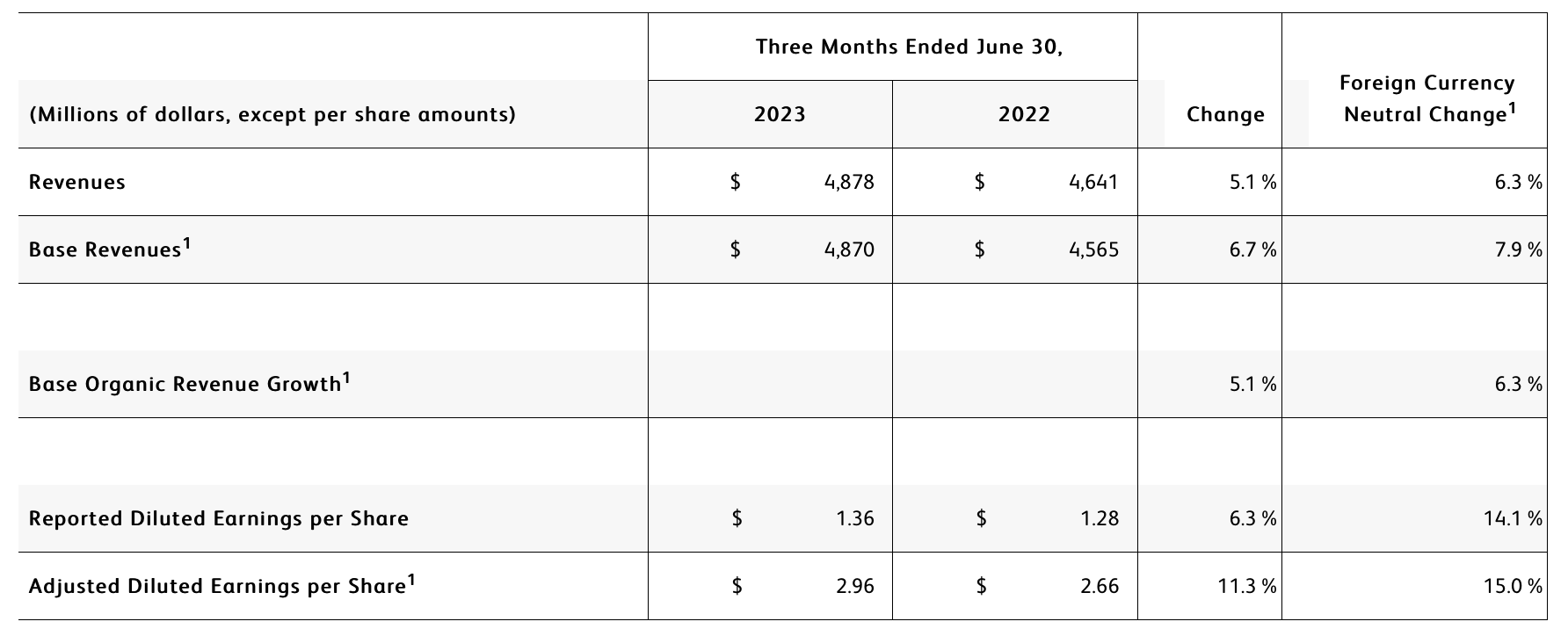

Īż Revenue of $4.9 billion increased 5.1% as reported and 6.3% on a currency-neutral basis

Īż Revenue from base business (which excludes COVID-only diagnostic testing) grew 6.7% as reported, 7.9% currency-neutral or 6.3% organic

Īż GAAP and adjusted diluted EPS from continuing operations of $1.36 and $2.96, respectively

Īż Company raises full-year base organic revenue growth guidance; maintains full-year adjusted EPS guidance

BD (Becton, Dickinson and Company) (NYSE: BDX), a leading global medical technology company, today announced results for its third quarter of fiscal 2023, which ended June 30, 2023.

"We continue to deliver strong results and this quarter is another reflection of our consistent execution against our BD 2025 goals." said Tom Polen, chairman, CEO and president of BD. "Our teams are working unwaveringly to achieve key milestones that set us up for continued growth and consistent performance. We are very pleased to deliver our number one priority since launching BD 2025 ©C achieving 510(k) clearance for the updated BD Alaris™ Infusion System ©C allowing us to bring this updated system to our customers and their patients."

Recent Business and ESG Highlights

- Received FDA 510(k) clearance for the updated BD Alaris™ Infusion System.

- Completed the sale of the Surgical Instrumentation platform in the Surgery business unit of the BD Interventional segment to STERIS for $540 million.

- BD Medical:

Īż The Medication Delivery Solutions business unit announced expanded customer availability of BD PosiFlush™ SafeScrub, an all-in-one prefilled flush syringe. The innovation is part of the company's vascular access management portfolio and further drives the BD "One-Stick Hospital Stay" vision.

- BD Life Sciences:

Īż The Biosciences business unit announced the worldwide commercial launch of the BD FACSDiscover™ S8 Cell Sorter, the world's first spectral cell sorter with high-speed real-time cell imaging. The new-to-world instrument features two breakthrough technologies, BD CellView™ Image Technology and BD SpectralFX™, that enable researchers to uncover more detailed information about cells that was previously invisible in traditional flow cytometry experiments.

Īż The Biosciences business unit launched the BD FACSDuet™ Premium Sample Preparation System, a new robotic system to automate clinical flow cytometry and improve standardization and reproducibility in cellular diagnostics.

Īż The Integrated Diagnostics Solutions business unit received FDA 510(k) clearance for the new BD Kiestra™MRSA imaging application that uses artificial intelligence powered by BD Synapsys™ Informatics Solution to interpret bacterial growth.

- Opened a new R&D facility in Dublin, which will focus on the commercialization of the Pharmaceutical Systems business unit's first on-body injector device, known as the BD Evolve™ On-Body Injector.

- Issued FY 2022 ESG Report, with notable progress in energy and waste reduction, health care access and diversity.

- Earned HIRC Transparency Partner Badge from the Healthcare Industry Resilience Collaborative (HIRC), demonstrating BD's commitment to transparency as a foundation of supply chain resiliency and progress toward the company's 2030+ ESG goals.

- Named a "Noteworthy Company" in DiversityInc's annual ranking of the top U.S. companies for diversity.

- Recognized as a Best Place to Work for Disability Inclusion for the fifth consecutive year. Top score on 2023 Disability Equality Index® demonstrates ongoing progress in creating employment opportunities for people with disabilities.

- Named to U.S. News & World Report's inaugural "Best Companies to Work For" list.

Third Quarter Fiscal 2023 Operating Results

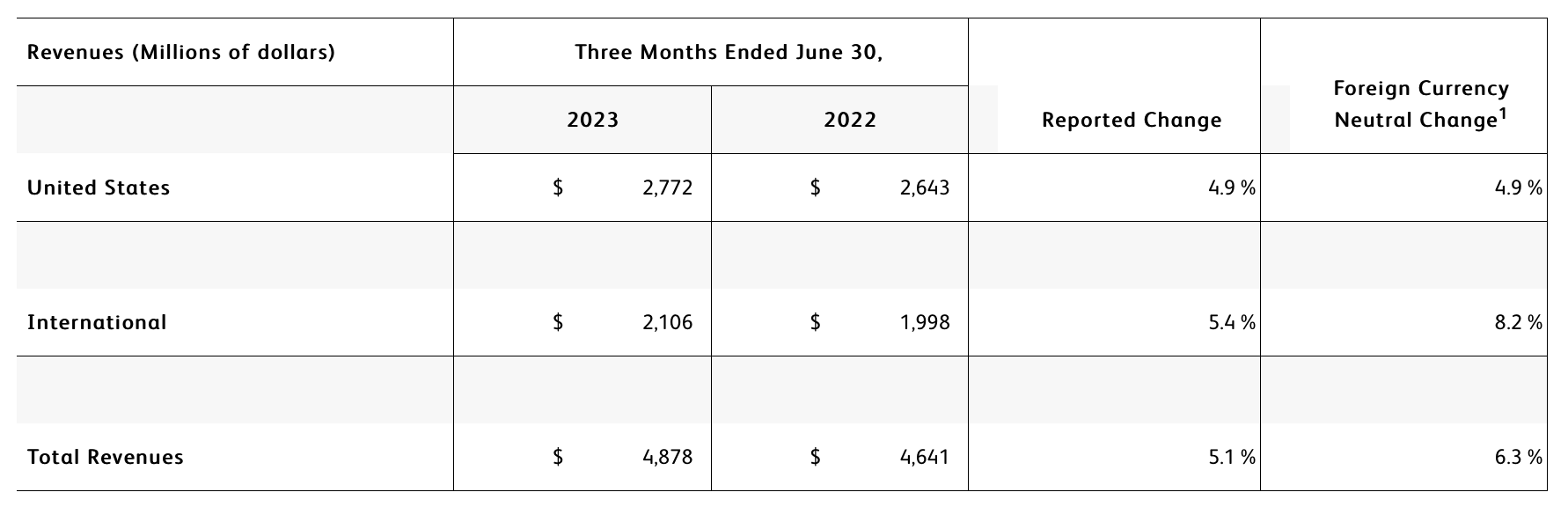

Geographic Results

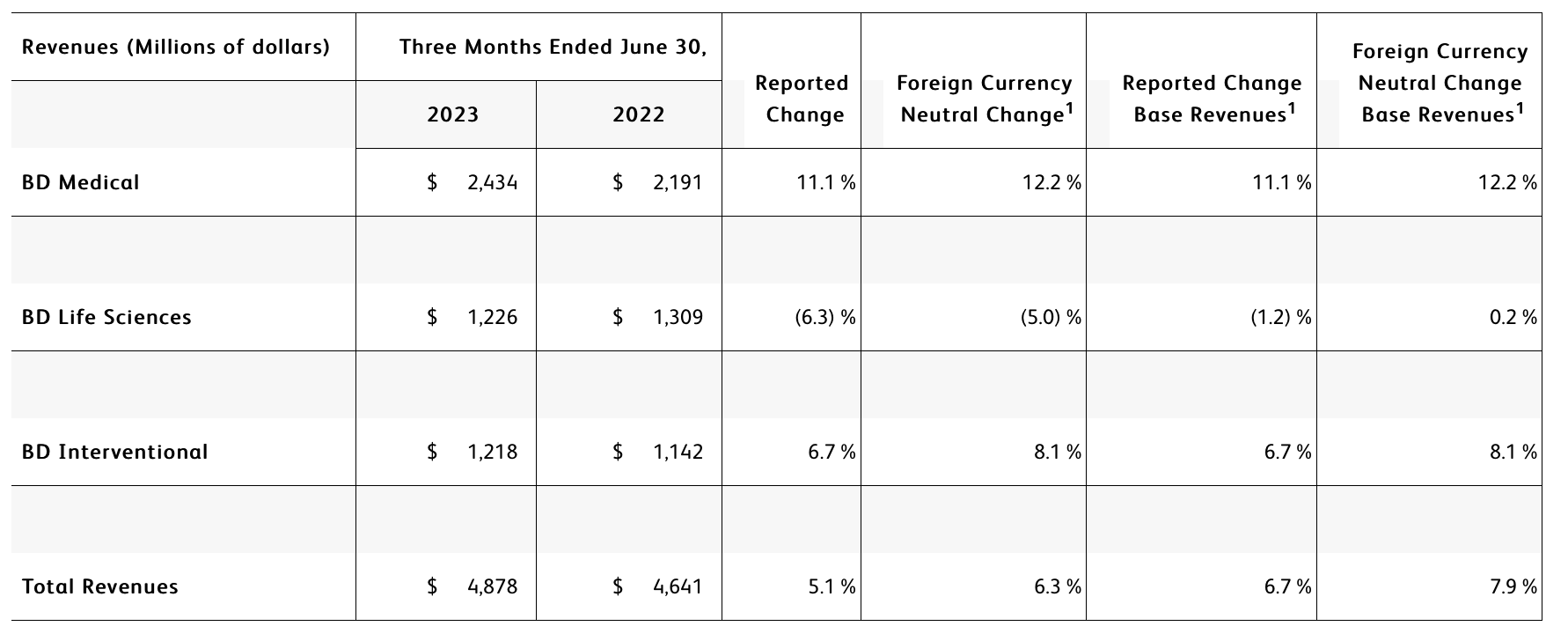

Segment Results

The BD Medical segment includes the Medication Delivery Solutions (MDS), Medication Management Solutions (MMS), and Pharmaceutical Systems (PS) business units. BD Medical revenue growth was driven by strong double-digit growth in MMS and PS.

- MDS performance reflects continued execution of our comprehensive Vascular Access Management strategy, which drove strong performance in BD Posiflush™ and our Catheter Solutions in both the US and international markets. The unit's performance also reflects a favorable comparison to prior-year COVID restrictions in China that was partially offset by negative impacts from the comparison to prior-year COVID vaccination device demand and planned strategic portfolio exits in the current quarter.

- MMS performance reflects strong growth in Pharmacy Automation, led by our Parata and BD ROWA™ solutions. The unit's performance also reflects double-digit growth in Dispensing driven by our continued focus on innovation to improve workflows and efficiencies, evidenced by performance of our BD Pyxis™ and BD HealthSight™ portfolio.

- PS performance reflects our strong leadership position in pre-fillable solutions such as BD Hypak™ and innovative products like BD Neopak™, BD Effivax™ and BD Hylok™, which drove another quarter of double-digit growth while supporting increased demand in high-growth categories like biologics.

The BD Life Sciences segment includes the Integrated Diagnostic Solutions (IDS) and Biosciences (BDB) business units. BD Life Sciences performance reflects a decline in COVID-only diagnostic testing revenues and performance in the segment's base business that was about flat. The segment's base business performance reflects high-single digit growth in BDB that was offset by a decline in base IDS revenues due to the comparison to higher prior-year flu/COVID respiratory testing revenues, which impacted the segment's base business revenue growth by approximately 400 basis points, and the impact of US distributor de-stocking in Specimen Management.

- IDS performance reflects the decline in COVID-only diagnostic testing revenues as well as the impacts in the base business from higher prior-year respiratory testing revenues and distributor de-stocking. Partially offsetting these declines was double-digit growth in our Microbiology platform driven by continued adoption of our BD Kiestra™ IdentifA and Total Modular Track solutions, and strong demand for blood culture and ID/AST reagents. IDS base business performance also reflects continued strong growth from Molecular IVD assays leveraging the BD COR™ System and the incremental BD Max™ System installed base.

- BDB performance reflects double-digit growth in Cancer reagents leveraging our growing installed base of FACSLyric™ analyzers, adoption of FACSDuet™ sample preparation automation and continued strong growth in research reagents enabled by our innovative and differentiated BD Horizon™ dyes.

The BD Interventional segment includes the Surgery, Peripheral Intervention (PI), and Urology & Critical Care (UCC) business units. BD Interventional performance was driven by strong growth across the segment.

- Surgery performance reflects double-digit growth in Advanced Repair and Reconstruction, driven by continued market adoption of the Phasix™ hernia resorbable scaffold and double-digit growth in Biosurgery, aided by TissuePatch™ and Avitene™ hemostat in Greater Asia.

- PI performance reflects double-digit growth in Peripheral Vascular Disease that was driven by broad-based strength across the portfolio including global penetration of the Rotarex™ Atherectomy System. PI growth was tempered by planned strategic portfolio exits and Venclose™ RF Ablation System supplier constraints.

- UCC performance reflects double-digit growth in our PureWick™ solutions for chronic incontinence, driven by continued adoption in both the acute care and alternative care settings. The unit's performance also reflects double-digit growth in Targeted Temperature Management as well as Endourology which reflects the success of the Aptra™ Digital Endoscope System launch and improved supplier performance.

Assumptions and Outlook for Full Year Fiscal 2023

The company raised its full-year base organic revenue growth guidance. Adjusted EPS guidance remains unchanged but reflects increased base business earnings offset by the Surgical Implementation platform divestiture and foreign currency headwinds.

- The company now expects fiscal year 2023 revenues to be approximately $19.3 billion compared to $19.2 billion to $19.3 billion previously announced.

Īż Revenue guidance now assumes base business currency-neutral revenue growth of 6.8% to 7.1% before the impact of the Surgical Instrumentation platform divestiture. This reflects an increase of 25 basis points at the mid-point to 7.0%, driven by strong third quarter performance.

Īż Base organic revenue growth is now expected to be 5.5% to 5.8%, compared to 5.25% to 5.75% previously announced, and continues to reflect fourth quarter organic revenue growth of about 6%.

Īż Adjusting for the impact of the Surgical Instrumentation platform divestiture lowers the updated base revenue growth guidance by 20 basis points to a range of 6.6% to 6.9%. Increased base organic revenue growth guidance of 5.5% to 5.8% is not impacted.

Īż Revenue guidance includes $56 million in year-to-date COVID-only diagnostic testing revenues.

Īż Based on current rates, foreign exchange continues to represent a reduction of approximately 200 basis points, or approximately $370 million, to total company revenue growth.

- The company's fiscal year 2023 adjusted diluted EPS guidance of $12.10 to $12.32 remains unchanged but reflects absorbing a $0.02 negative impact from the divestiture of the Surgical Instrumentation platform and a $0.05 negative impact from the latest foreign currency rates. Adjusted EPS guidance also reflects an increase to base business earnings of $0.07, which is offsetting the impact of the divestiture and foreign currency.

Īż On a currency-neutral basis, adjusted diluted EPS guidance now represents growth of approximately 10% to 11.5%, an increase of 50 basis points from the company's prior expectation.

Īż Adjusted diluted EPS guidance now includes an estimated headwind from foreign currency of approximately 320 basis points based on current rates, compared to 270 basis points previously.

BD's outlook for fiscal 2023 reflects numerous assumptions about many factors that could affect its business, based on the information management has reviewed as of this date. Management will discuss its outlook and several of its assumptions on its third fiscal quarter earnings call.

The company's expected adjusted diluted EPS for fiscal 2023 excludes potential charges or gains that may be recorded during the fiscal year, such as, among other things, the non-cash amortization of intangible assets, acquisition-related charges, spin related costs, and certain tax matters. BD does not attempt to provide reconciliations of forward-looking adjusted diluted non-GAAP EPS guidance to the comparable GAAP measure because the impact and timing of these potential charges or gains is inherently uncertain and difficult to predict and is unavailable without unreasonable efforts. In addition, the company believes such reconciliations would imply a degree of precision and certainty that could be confusing to investors. Such items could have a substantial impact on GAAP measures of BD's financial performance. We also present our estimated revenue, base business revenue growth, base organic revenue growth and adjusted diluted EPS growth for our 2023 fiscal year after adjusting for the anticipated impact of foreign currency translation. BD believes that this adjustment allows investors to better evaluate BD's anticipated underlying earnings performance for our 2023 fiscal year in relation to our underlying 2022 fiscal year performance.

Source: BD Reports Third Quarter Fiscal 2023 Financial Results