Original from: Becton, Dickinson and Company

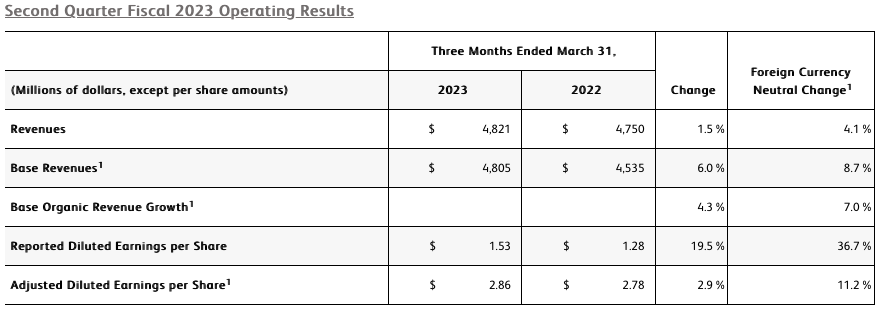

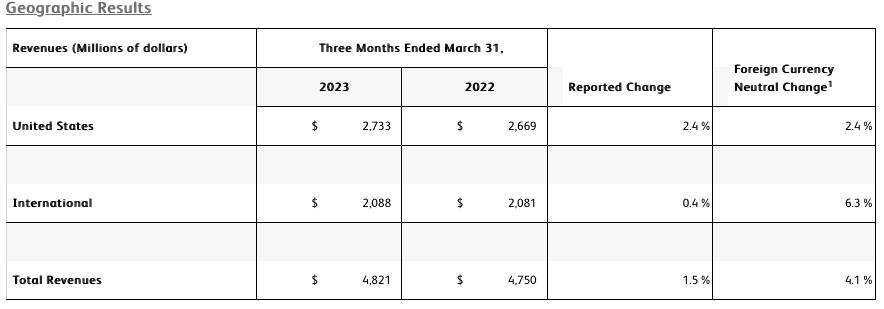

- Revenue of $4.8 billion increased 1.5% as reported and 4.1% on a currency-neutral basis

- Revenue from base business (which excludes COVID-only diagnostic testing) grew 6.0% as reported, 8.7% currency-neutral

- GAAP and adjusted diluted EPS from continuing operations of $1.53 and $2.86, respectively

- Company raises full-year base revenue guidance, enabling additional investments in growth and innovation while absorbing lower COVID-only diagnostic testing revenue and incremental FX impacts

BD (Becton, Dickinson and Company) (NYSE: BDX), a leading global medical technology company, today announced results for its second quarter of fiscal 2023, which ended March 31, 2023.

"Since launching BD 2025, we have made purposeful and strategic investments to shift BD into attractive end markets to advance innovations that are transforming healthcare and driving company growth," said Tom Polen, chairman, CEO and president of BD. "Our strong performance this quarter reflects our strategy in action and the positive impact of these investments on our business as we deliver for our customers and patients around the world. Particularly, our innovation pipeline and the impact of our M&A strategy played a key role in our results, and we remain well-positioned to continue driving strong growth and performance in the future."

Recent Business and ESG Highlights

- In BD Life Sciences, the Biosciences business unit completed the first early access shipments to customers of the BD FACSDiscover™ S8 Cell Sorter, the worlds' first real-time imaging, spectral flow cytometer equipped with the breakthrough BD CellView™ Image Technology profiled last year on the cover of the journal Science.

- In BD Life Sciences, the Biosciences business unit introduced the BD Rhapsody™ HT Xpress System, a new high-throughput single-cell multiomics platform that enables scientists to isolate, barcode and analyze single cells at a high sample throughput to obtain more insights in less time. The new system, alongside BD cell sorters and the rest of the BD Rhapsody™ portfolio of reagents, assays and bioinformatics tools, enables BD to provide a true end-to-end portfolio of single-cell multiomics solutions for researchers.

- In BD Life Sciences, the Integrated Diagnostics Solutions business unit received FDA approval for the BD Onclarity™ HPV molecular diagnostics assay for use with both BD SurePath™ liquid-based pap test and Hologic ThinPrep® pap test. Approval expands access to the BD HPV test - the only FDA-approved assay that tests for an extended set of HPV types individually, and particularly for HPV31, a specific type of HPV that poses a high-risk for causing cervical cancer.

- In BD Life Sciences, the Integrated Diagnostics Solutions business unit received FDA 510(k) clearance for the BD Vaginal Panel for use on the BD COR™ System. This first-of-its-kind, high-throughput molecular diagnostic test for large laboratories directly detects the three most common infectious causes of vaginitis using only one swab and one test. Availability of the vaginal panel reflects BD's commitment to expand the menu of assays for women's health and other infectious diseases.

- In BD Life Sciences, the Integrated Diagnostics Solutions business unit filed for US regulatory clearance of BD MiniDraw™, a device which enables the collection of a high-quality capillary blood sample that is less invasive and more convenient than the traditional collection method.

- In BD Medical, the Medication Delivery Solutions business unit launched the BD Prevue™ II System, the latest example of how BD is advancing the vision of a "one-stick hospital stay" with new ultrasound technology that helps drive first-stick success for IV insertions.

- BD continued to further its progress toward achieving its 2030+ ESG goals, including its focus on reducing the environmental impact of its product portfolio. To support this effort, BD introduced new circular economy pilots in several regions, partnering with healthcare facilities and waste management companies to recycle used materials, including BD syringes in the US and BD vacutainers in Denmark.

Basis of Presentation― Continuing Operations

On April 1, 2022, the Company completed the spin-off of its Diabetes Care business as a separate publicly traded company named Embecta Corp. ("Embecta"). The historical results of the Diabetes Care business are now accounted for as discontinued operations. Financial information presented in this release reflects BD's results on a continuing operations basis, which excludes Embecta. The prior periods have been recast to conform to this presentation.

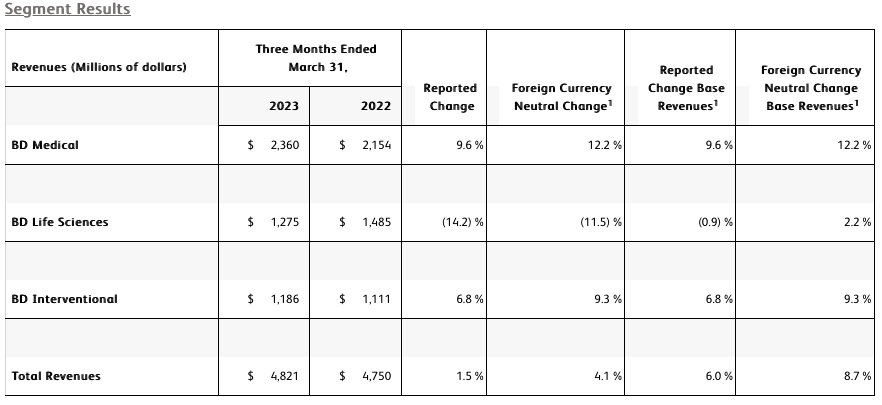

The BD Medical segment includes the Medication Delivery Solutions (MDS), Medication Management Solutions (MMS), and Pharmaceutical Systems (PS) business units. BD Medical revenue growth was driven by strong double-digit growth in MMS and PS.

・ MDS performance reflects our comprehensive Vascular Access Management strategy that continues to drive strong results, evidenced by BD Posiflush™ and our Catheter Solutions. Strength in our durable core products more than offset the comparison to prior-year COVID vaccine device demand and planned strategic portfolio exits.

・ MMS performance reflects investments in high-growth end-markets, such as Pharmacy Automation, which are driving strong performance, led by our Parata and BD ROWA™ solutions. MMS performance also reflects double-digit growth in Dispensing driven by our continued focus on innovation to improve workflows and efficiencies, evidenced by performance of our BD Pyxis™ and BD HealthSight™ portfolio including the recent BD Pyxis™ ES 1.7 launch.

・ PS performance reflects another strong quarter enabled by capacity investments in BD Hypak™ and innovation in products like BD Effivax™, BD Hylok™ and BD Neopak™, which are enhancing efficiencies for our Pharmaceutical customers while supporting increased demand in the high-growth biologics and vaccine categories.

The BD Life Sciences segment includes the Integrated Diagnostic Solutions (IDS) and Biosciences (BDB) business units. BD Life Sciences performance reflects growth in the segment's base business despite a negative impact of approximately 800 basis points from the comparison to prior-year respiratory testing revenues. The segment's performance also reflects a decline in COVID-only diagnostic testing revenues.

・ IDS performance reflects the decline in COVID-only diagnostic testing revenues as well as the impact in the base business from the comparison to higher prior-year combination flu/COVID respiratory testing revenues and due to a softer respiratory illness season in the current quarter. Partially offsetting the decline in combination testing was growth in Microbiology, aided by adoption of our BD Kiestra™ IdentifA and Total Modular Track solutions, and Specimen Management, and continued double-digit growth from Molecular IVD assays leveraging the incremental BD Max™ installed base.

・ BDB performance reflects continued double-digit growth in Research Reagents enabled by our innovative and differentiated BD Horizon™ dyes. Strong performance in Instruments was driven by continued demand for the recently launched BD FACSymphony™ A1/A5 SE research analyzers combined with improved BD FACSLyric™ product availability for our clinical customers.

The BD Interventional segment includes the Surgery, Peripheral Intervention (PI), and Urology & Critical Care (UCC) business units. BD Interventional performance was driven by strong performance across the segment.

・ Surgery performance reflects double-digit worldwide growth in Advanced Repair and Reconstruction, driven by continued market adoption of the Phasix™ hernia resorbable scaffold and double-digit worldwide growth in Biosurgery, aided by Arista™ AH absorbable hemostat. Strong procedure volumes also contributed to Surgery performance.

・ PI performance reflects double-digit growth in Peripheral Vascular Disease driven by the Venovo™ relaunch, coupled with global penetration of Rotarex™. PI performance also reflects strong growth in Oncology in the US and Greater Asia that was aided by an improved backlog associated with prior-year supplier constraints.

・ UCC performance reflects double-digit growth in the PureWick™ franchise, aided by the recent launch of PureWick™ Male, with a strong presence in both the acute care and alternative care settings for chronic incontinence. UCC performance also reflects double-digit growth in Endourology that benefited from improved supplier performance.

Assumptions and Outlook for Full Year Fiscal 2023

The company raised the lower-end and mid-point of its full-year revenue and adjusted EPS guidance ranges. This includes an increase to base business currency-neutral revenue growth, which is enabling additional investments in growth and innovation while absorbing lower COVID-only diagnostic testing revenue and an estimated incremental foreign currency headwind.

- The company now expects fiscal year 2023 revenues to be in the range of approximately $19.2 billion to $19.3 billioncompared to $19.1 billion to $19.3 billion previously announced, which reflects an increase of approximately $50 million at the mid-point.

・ Revenue guidance now assumes base business currency-neutral revenue growth of 6.5% to 7.0% compared to 5.75% to 6.75% previously announced, which represents an increase of 50 basis points, or approximately $90 million at the mid-point.

・ Revenue guidance now assumes approximately $50 million in COVID-only diagnostic testing revenues, compared to approximately $50 million to $100 million previously announced.

・ Based on current rates, foreign exchange continues to represent a reduction of approximately 200 basis points, or approximately $370 million, to total company revenue growth.

- The company now expects fiscal year 2023 adjusted diluted EPS to be $12.10 to $12.32 compared to $12.07 to $12.32previously announced. This reflects an increase of 1.5 cents at the mid-point, including an operational increase of 6.5 centsoffset by an incremental headwind of approximately 5 cents from foreign currency.

・ On a currency-neutral basis, adjusted diluted EPS guidance now represents growth of approximately 9.5% to 11%.

・ Adjusted diluted EPS guidance now includes an estimated headwind from foreign currency of approximately 270 basis points based on current rates.

BD's outlook for fiscal 2023 reflects numerous assumptions about many factors that could affect its business, based on the information management has reviewed as of this date. Management will discuss its outlook and several of its assumptions on its second fiscal quarter earnings call.

The company's expected adjusted diluted EPS for fiscal 2023 excludes potential charges or gains that may be recorded during the fiscal year, such as, among other things, the non-cash amortization of intangible assets, acquisition-related charges, spin related costs, and certain tax matters. BD does not attempt to provide reconciliations of forward-looking adjusted diluted non-GAAP EPS guidance to the comparable GAAP measure because the impact and timing of these potential charges or gains is inherently uncertain and difficult to predict and is unavailable without unreasonable efforts. In addition, the company believes such reconciliations would imply a degree of precision and certainty that could be confusing to investors. Such items could have a substantial impact on GAAP measures of BD's financial performance. We also present our estimated revenue, base business revenue growth and adjusted diluted EPS growth for our 2023 fiscal year after adjusting for the anticipated impact of foreign currency translation. BD believes that this adjustment allows investors to better evaluate BD's anticipated underlying earnings performance for our 2023 fiscal year in relation to our underlying 2022 fiscal year performance.

Source: BD Reports Second Quarter Fiscal 2023 Financial Results