Original from: bioM¨¦rieux

¡¤ Solid first-quarter sales performance with an organic growth of +7.5%

¡¤ This robust performance has been fueled by BIOFIRE® non-respiratory panels growing a remarkable +32%, while respiratory panels remained positive at +3%

¡¤ Very good performance also in microbiology (+12%) and industrial applications (+9%)

¡¤ As a result, total non-respiratory sales organic growth reached +8.8%, in line with full-year guidance

¡¤ Strong momentum of product launches: key milestones have been achieved especially on VITEK® REVEALTM, BIOFIRE® SPOTFIRE® and VIDAS® KUBETM fronts

¡¤ bioMérieux confirms its 2023 outlook for sales and operating profit, as published on March 8th

Alexandre Mérieux, Chairman and Chief Executive Officer, said: ¡°bioMérieux had a good dynamic in this first-quarter, the company delivered a solid sales performance both in clinical and industrial applications. In line with its commitment to innovation for enhanced diagnostic, bioMérieux also had a strong momentum in terms of collaboration and key product launches.¡±

bioM¨¦rieux, a world leader in the field of in vitro diagnostics, today releases its business review for the three months ended March 31th, 2023.

SALES

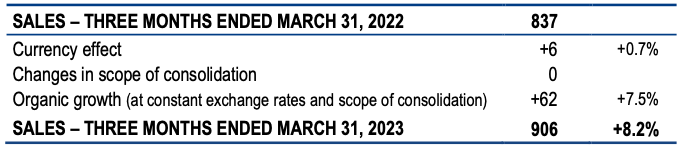

Consolidated sales totaled €906 million in the first quarter of 2023, up 8.2% from €837 million in the year©\earlier period. Organic growth (at constant exchange rates and scope of consolidation) stood at +7.5%, in line with expectations. Exchange rate movements resulted in a positive currency effect of €6 million, mainly reflecting a stronger euro versus the US dollar.

Analysis of sales

In € millions

ANALYSIS OF SALES BY APPLICATION

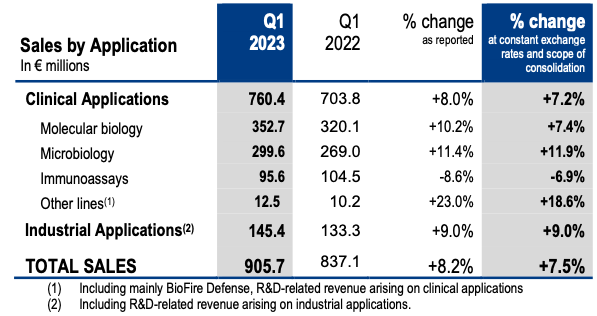

Clinical applications sales, which account for approximately 84% of the consolidated total, increased by 7.2% year-on-year to €760 million in the first quarter of 2023.

¡¤ In molecular biology, the sales performance for BIOFIRE® non-respiratory reagents has been remarkable, overall up 32%, with a consistent growth across the portfolio and the regions. Respiratory panels sales grew 3% despite a decrease of demand since February, linked to the early slow-down of the respiratory pathogens season. BIOFIRE® installed base increased by 500 new systems, bringing the total to around 24,000 units.

¡¤ In microbiology, sales performance has been very robust for reagents, led by VITEK® automated ID/AST and BACT/ALERT® blood culture ranges, and including price increases in these ranges. Sales growth for equipment has been strong in key ranges.

¡¤ In immunoassays, the routine assays have pursued their return to positive growth, started in Q3 2022, while procalcitonin assays continued to experience downward trends in the US and in China.

Industrial applications sales, which represent around 16% of the consolidated total, increased by a robust +9% year-on-year to €145 million, fueled by a high single-digit growth in reagents sales, and notably a remarkable business trend in healthcare segment.

ANALYSIS OF SALES BY REGION

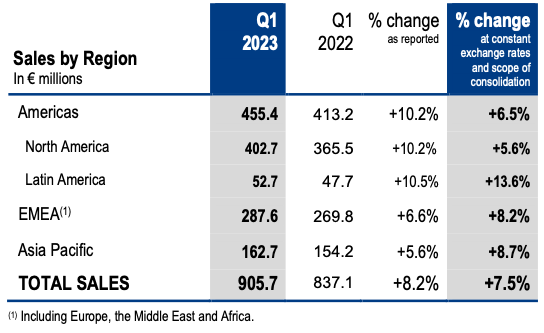

¡¤ Sales in the Americas (half of the consolidated total) reached €455 million in the first quarter, up 6.5% compared to the same period last year.

- In North America (44% of the consolidated total), sales performance has been fueled by the growth of BIOFIRE® non-respiratory panels and, to a lesser extent, respiratory panels as well as BACT/ALERT® blood culture assays, slightly offset by the decrease in immunoassay PCT.

- In Latin America, quarterly organic sales performance has been robust, reflecting a solid momentum in microbiology reagents sales.

- Sales in the Europe ¨C Middle East ¨C Africa region (32% of the consolidated total) came to €288 million in the first three months, up 8% year-on-year. This strong performance has been driven by BIOFIRE® non- respiratory panels sales, as well as microbiology key ranges.

- Sales in the Asia Pacific region (18% of the consolidated total) amounted to €163 million in the first quarter, up nearly 9% organically compared with €154 million in the same period of 2022. Growth has been led by reagents sales in India and equipment sales in China.

Source: bioM¨¦rieux ¨C First-Quarter 2023 Business Review