Original from: PR Newswire

Illumina, Inc. (Nasdaq: ILMN) today announced its financial results for the fourth quarter and fiscal year 2022, which include consolidated financial results for GRAIL.

"Our fourth quarter operating results were in line with our expectations, with ongoing traction across our product portfolio amid a challenging macroeconomic environment," said Francis deSouza, Chief Executive Officer. "Illumina's continued focus on innovation across multiple new products, including the NovaSeq X, the most powerful, most sustainable, and most cost-effective sequencer ever developed, have been met with strong customer interest. Our order book is exceeding expectations and we have begun shipping instruments. GRAIL ended the year with accelerating consumer excitement for its Galleri test; more than 4,500 health providers ordered the test in 2022, contributing to more than 60,000 tests ordered to date."

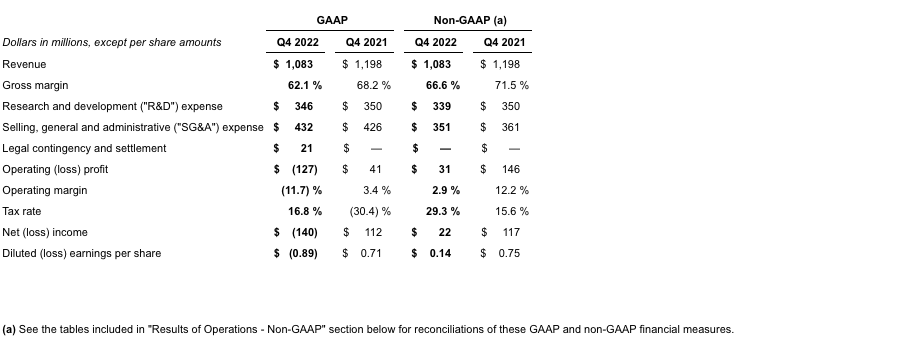

Fourth quarter consolidated results

Capital expenditures for free cash flow purposes were $88 million for Q4 2022. Cash flow provided by operations was $147 million, compared to $282 million in the prior year period. Free cash flow (cash flow provided by operations less capital expenditures) was $59 million for the quarter, compared to $212 million in the prior year period. Depreciation and amortization expenses were $107 million for Q4 2022. At the close of the quarter, the company held $2,037 million in cash, cash equivalents and short-term investments, compared to $1,339 million as of January 2, 2022. Cash as of the close of the quarter included $991 million in net proceeds from the term notes issued on December 13, 2022.

Fourth quarter segment results

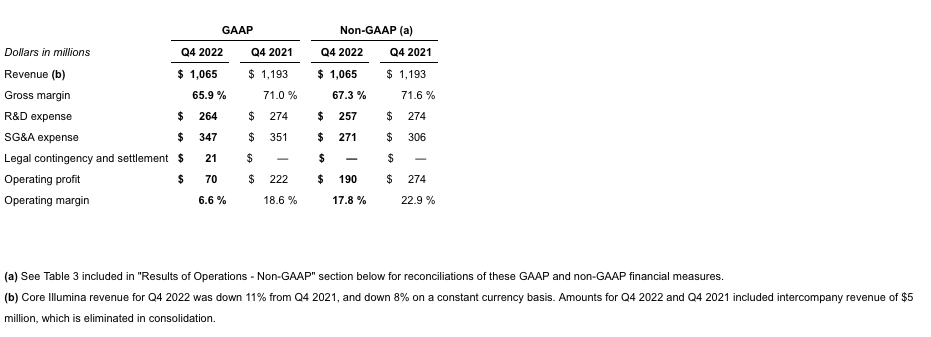

Core Illumina

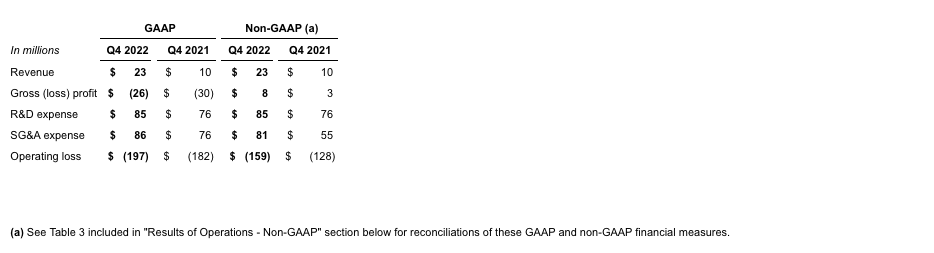

GRAIL

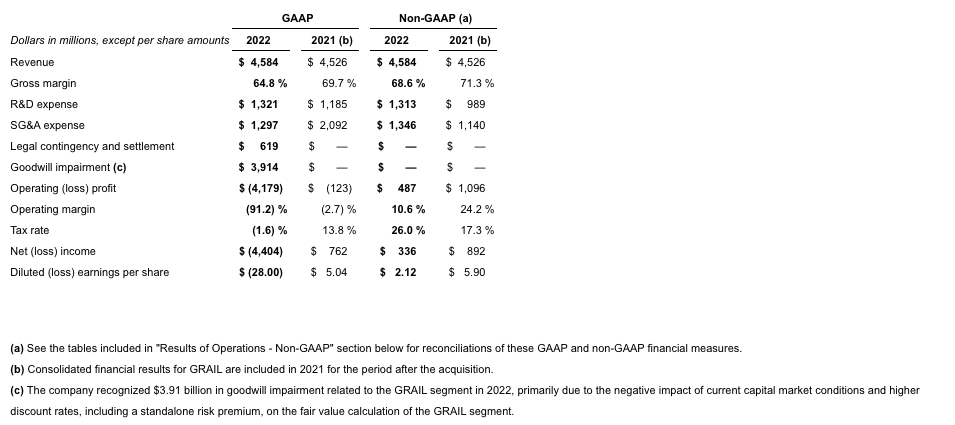

Fiscal year 2022 consolidated results

Capital expenditures for free cash flow purposes were $286 million for fiscal year 2022. Cash flow provided by operations was $392 million, compared to $545 million in the prior year. Free cash flow (cash flow provided by operations less capital expenditures) was $106 million for the year, compared to $337 million in the prior year. Depreciation and amortization expenses were $394 million for fiscal year 2022.

Following the acquisition of GRAIL on August 18, 2021, we have two reportable segments, Core Illumina and GRAIL. GRAIL financial results are reflected for the period after the acquisition.

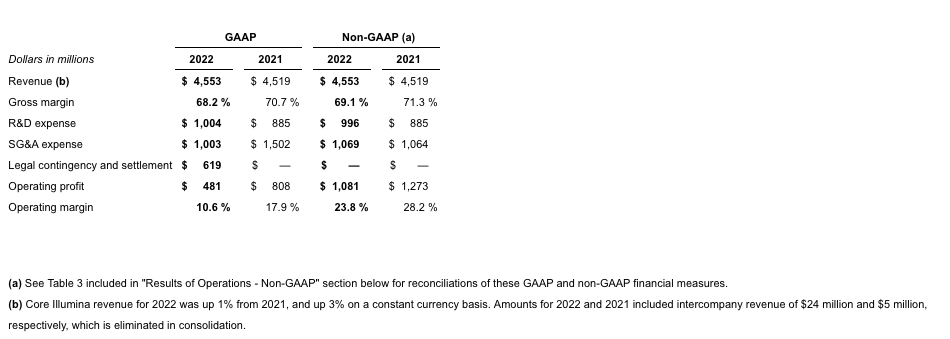

Core Illumina

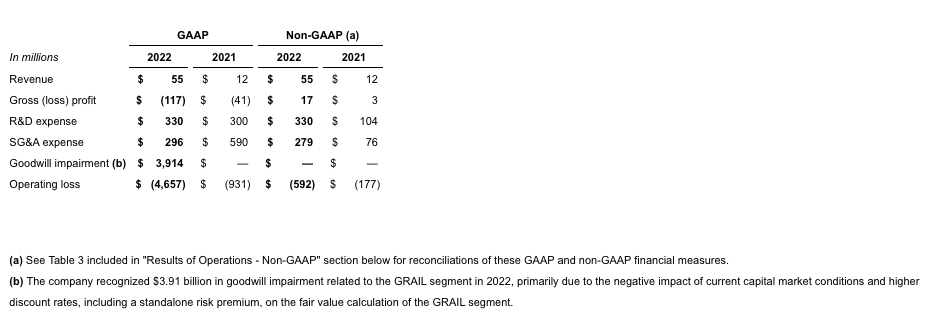

GRAIL

Key announcements by Illumina since Illumina's last earnings release

- Partnered with Amgen, a global biopharmaceutical company, to whole-genome sequence a cohort of approximately 35,000 DNA samples made up of DNA from African Americans, who are currently underrepresented in research for the clinical applications of genomics, including drug target discovery

- Achieved the highest score out of 72 companies in its industry in the S&P Global Corporate Sustainability Assessment, also known as the Dow Jones Sustainability Index (DJSI)

- Opened an over 9,100-square-foot state-of-the-art Solutions Center in Dubai, United Arab Emirates to offer Illumina's partners and customers broad genomic capabilities

- Announced a comprehensive, high-accuracy long-read view of the genome for as low as $600 with Illumina Complete Long Read Prep with Enrichment, available in the second half of 2023

- Appointed Joydeep Goswami as Chief Financial Officer

A full list of recent Illumina announcements can be found in the company's News Center.

Key announcements by GRAIL since Illumina's last earnings release

- Launched research use only, methylation-based solution for cancer prognosis, minimal residual disease and recurrence monitoring and biomarker discovery

- Expanded partnership with Point32Health to offer Galleri® to Harvard Pilgrim Health Care members on the Maine Health Insurance Marketplace, the second phase of a pilot focusing on collecting real-world evidence to assess the impact of Galleri® on health care resource utilization and patient-reported outcomes

- Announced findings from a fundamental substudy of the Circulating Cell-free Genome Atlas (CCGA) study, demonstrating that methylation had the most promising combination of cancer detection and prediction of cancer signal origin when compared with other evaluated approaches

A full list of recent GRAIL announcements can be found in GRAIL's Newsroom.

Financial outlook and guidance

The non-GAAP financial guidance discussed below reflects certain pro forma adjustments to assist in analyzing and assessing our core operational performance, including our Core Illumina and GRAIL segments. Please see our Reconciliation of Consolidated Non-GAAP Financial Guidance included in this release for a reconciliation of these GAAP and non-GAAP financial measures.

For fiscal year 2023, the company expects consolidated revenue growth of 7% to 10% compared to fiscal year 2022. We expect GAAP diluted earnings per share of $0.03 to $0.28 and non-GAAP diluted earnings per share of $1.25 to $1.50. The GAAP and non-GAAP diluted earnings per share guidance ranges assume that the existing R&D capitalization requirements are not repealed in fiscal year 2023 and, as a result, reflect an impact of approximately $75 million.

The company expects Core Illumina revenue growth of 6% to 9% compared to fiscal year 2022. GRAIL revenue is expected to be in the range of $90 million to $110 million.

The company encourages investors to carefully consider its results under GAAP, as well as its supplemental non-GAAP information and the reconciliation between these presentations, to more fully understand its business. Reconciliations between GAAP and non-GAAP results are presented in the tables of this release.

About GRAIL

Source: Illumina Reports Financial Results for Fourth Quarter and Fiscal Year 2022