Original from: Siemens Healthineers

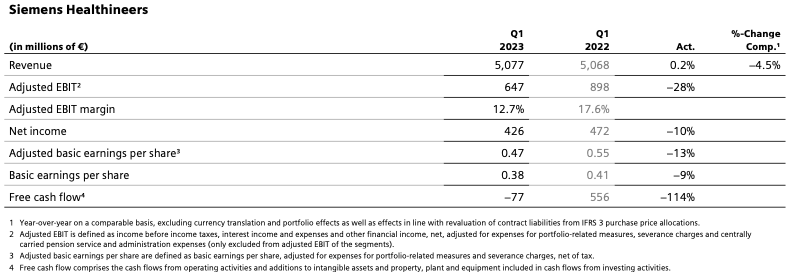

Siemens Healthineers AG today announces its results for the first quarter of fiscal year 2023, ending December 31, 2022.

Q1 Fiscal Year 2023

- Broad-based equipment order growth in double-digit percentages; equipment book-to-bill ratio of 1.36

- Comparable revenue decline of 4.5% from strong prior-year quarter due to markedly lower revenue from rapid COVID- 19 antigen tests, as expected; excluding antigen tests, comparable revenue growth of 0.7%

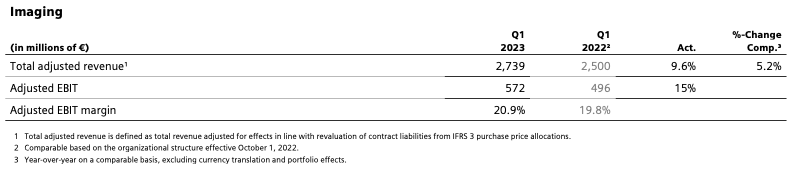

- Imaging showed solid comparable revenue growth of 5.2% and a clear improvement in adjusted EBIT margin of 100 basis points year-over-year to 20.9%

- Diagnostics revenue down 23.7% on a comparable basis, mainly due to a markedly lower contribution from rapid COVID-19 antigen tests and the COVID-19 situation in China; adjusted EBIT margin slightly negative at -2.2% due to transformation costs

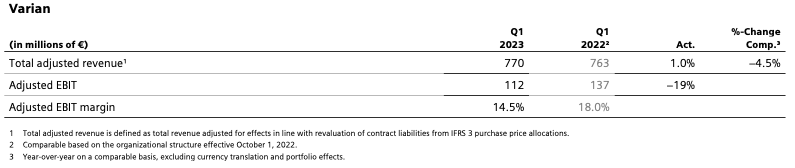

- Varian comparable revenue down 4.5% and adjusted EBIT margin of 14.5%, hampered by delays at a supplier that have since been resolved

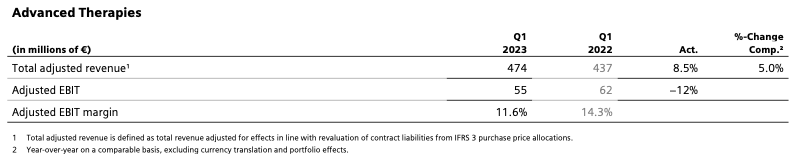

- Advanced Therapies comparable revenue growth at a solid 5.0% and adjusted EBIT margin of 11.6%

- Lower overall adjusted EBIT margin of 12.7% weighed down by lower contributions from rapid COVID-19 antigen tests, cost increases ¨C particularly for procurement and logistics ¨C and transformation costs in Diagnostics

- Adjusted basic earnings per share below prior-year quarter at €0.47

Outlook for Fiscal Year 2023

We confirm our expectation for comparable revenue growth of -1% to 1% (6% to 8% excluding revenue from rapid COVID- 19 antigen tests) and adjusted basic earnings per share of €2.00 to €2.20.

Bernd Montag, CEO of Siemens Healthineers AG:

Our consistently strong equipment order growth underscores the trust that customers have in our innovation leadership. This gives us great momentum to achieve our full-year targets.

Business Development Q1

Revenue in the first quarter of fiscal year 2023 declined on a comparable basis by 4.5%. The primary reason is markedly lower revenue from rapid COVID-19 antigen tests. Excluding the antigen tests, revenue rose on a comparable basis by 0.7%. The Imaging and Advanced Therapies segments achieved solid growth. On the downside were a pandemic-related fall in Diagnostics revenue in China and supply-chain delays due to a problem at a Varian supplier, which has since been resolved.

From a geographical perspective, the Asia Pacific Japan region achieved significant revenue growth ¨C driven in particular by a strong rise in revenue from rapid COVID-19 antigen tests in Japan. Excluding the antigen tests, the region still achieved moderate growth, whereas revenue in the China region declined for reasons including the pandemic. In EMEA, revenue fell sharply due to materially lower contributions from rapid COVID-19 antigen tests in this region. Excluding antigen tests, revenue in the region was on the prior-year level. The Americas region recorded moderate growth on a comparable basis.

Overall, revenue of just under €5.1 billion was on a level with the very good prior-year quarter on a nominal basis. The equipment book-to-bill ratio of 1.36 was excellent, and the seventh quarter in a row at over 1.1.

Adjusted EBIT fell by 28% to €647 million, translating into a lower adjusted EBIT margin of 12.7%. This was against the backdrop of a lower contribution from rapid COVID-19 antigen tests, cost increases ¨C particularly for procurement and logistics ¨C and transformation costs for the Diagnostics business. Pandemic-related factors in China also weighed on the margin.

Net income fell by 10% to €426 million. The tax rate was 14%, compared with 29% in the prior-year quarter, mainly due to the release of a tax provision in the mid-double-digit millions of euros. Against the backdrop of lower contributions from rapid COVID-19 antigen tests, adjusted basic earnings per share fell by 13% to €0.47.

Free cash flow, at negative €77 million, was below the prior-year quarter. This was mainly due to a build-up of inventory in preparation for an expected rise in the level of equipment revenue in the following quarters.

Due to the positive revenue development, the segment¡¯s adjusted EBIT margin rose to 20.9%. Cost increases, particularly for procurement and logistics, weighed on the margin but were largely compensated by positive currency effects.

First-quarter revenue in the Diagnostics segment was down 23.7% on a comparable basis from the very strong prior-year period to around €1.1 billion. The reason was the markedly lower contribution from rapid COVID-19 antigen tests, as expected, of €63 million (prior year: €329 million). Excluding antigen tests, revenue was down 7.3%. The main reason was lower revenue in China, where fewer routine tests were done because of lockdowns at the start of the quarter and raised infection rates at the end.

In the Asia Pacific Japan region, Diagnostics posted a sharp rise in revenue due to a strong increase in sales of rapid COVID-19 antigen tests in Japan. In the Americas region, revenue was on the level of the prior year on a comparable basis. A double-digit revenue decline in the EMEA region was attributable to a lower contribution from rapid COVID-19 antigen tests.

The segment's adjusted EBIT margin was down, at -2.2%. The decline was largely due to the lower contributions from rapid COVID-19 antigen tests. Transformation costs of €34 million, negative effects from the COVID-19 situation in China, negative currency effects and cost increases ¨C particularly for procurement and logistics ¨C also weighed on the business.

The Varian segment posted revenue of €770 million in the first quarter, representing a decline of 4.5% on a comparable basis. Supply-chain delays due to a problem at a supplier, which has since been resolved, led to revenue being pushed out into the next quarters, especially in the Asia Pacific Japan and China regions. In the EMEA and Americas regions, revenue was on the prior-year levels.

The adjusted EBIT margin was down from the prior year, at 14.5%. Factors were negative currency effects, missing profit contributions due to the revenue push-outs in the aftermath of the supply-chain delays, and cost increases, particularly for procurement and logistics. These clearly outweighed an advantageous business mix.

The EMEA and Asia Pacific Japan regions posted significant growth. Revenue in the China region grew strongly, while in the Americas region revenue declined.

The adjusted EBIT margin of 11.6% was below the prior-year quarter. This was due to an unfavorable business mix and cost increases, particularly for procurement and logistics. Currency effects were positive.

Reconciliation to consolidated financial statements

Amortization, depreciation and other effects from IFRS 3 purchase price allocation adjustments decreased to €107 million. The prior-year quarter saw higher effects in connection with the Varian acquisition.

Net income was down 10% to €426 million. The tax rate was 14% compared with 29% in the prior-year quarter, mainly due to the release of a tax provision in the mid-double-digit millions of euros.

Adjusted basic earnings per share were down 13% to €0.47, against the backdrop of the lower contributions from rapid COVID-19 antigen tests. Adjustments were lower than in the prior-year quarter due to lower expenses incurred in connection with the Varian acquisition.

Outlook

For fiscal year 2023, we continue to expect comparable revenue growth of between -1% and 1% compared with fiscal year 2022. Excluding revenue from rapid COVID-19 antigen tests, this corresponds to comparable revenue growth of between 6% and 8%.

Adjusted basic earnings per share (adjusted for expenses for portfolio-related measures and severance charges, net of tax) are still expected to be between €2.00 and €2.20.

The outlook is based on several assumptions including the expectation that current and potential future measures to keep the COVID-19 pandemic under control will not negatively impact demand for our products and services. Regarding developments related to the war in Ukraine, we assume there will be no material adverse effect on our business activities. The outlook is also based on the current macroeconomic environment and current exchange-rate assumptions, and excludes portfolio activities. The outlook is based on the number of outstanding shares at the end of fiscal year 2022. The outlook further excludes charges related to legal, tax, and regulatory matters and frameworks.