Original from: Becton, Dickinson and Company

BD (Becton, Dickinson and Company) (NYSE: BDX), a leading global medical technology company, today announced results for its first quarter of fiscal 2023, which ended December 31, 2022.

"Our strong performance in Q1 reflects the momentum of our BD 2025 strategy, driven by a combination of innovation and continued strong execution," said Tom Polen, chairman, CEO and president of BD. "Consistent, durable performance in our base business reflects our team's relentless focus on delivering category-leading products and transformative solutions that are helping our customers deliver quality and more cost-effective care to patients around the world. We believe that our strong execution, coupled with our winning portfolio, position BD to play a central role in reinventing care for a new era and creating sustained value for all stakeholders."

Recent ESG Highlights

- Issued annual Global Inclusion, Diversity and Equity and Cybersecurity reports, detailing BD's progress toward promoting a healthy workforce and communities and its ongoing efforts to advance cybersecurity maturity and educate customers about cyber risks and vulnerabilities, respectively.

- Named to top 25% of Newsweek's 2023 list of America's Most Responsible Companies.

- Included in 2023 Bloomberg Gender-Equality Index for fourth consecutive year demonstrating the company's ongoing commitment to advance workplace equality and progress in female leadership and talent pipeline.

Basis of Presentation¡ª Continuing Operations

On April 1, 2022, the Company completed the spin-off of its Diabetes Care business as a separate publicly traded company named Embecta Corp. ("Embecta"). The historical results of the Diabetes Care business are now accounted for as discontinued operations. Financial information presented in this release reflects BD's results on a continuing operations basis, which excludes Embecta. The prior period has been recast to conform to this presentation.

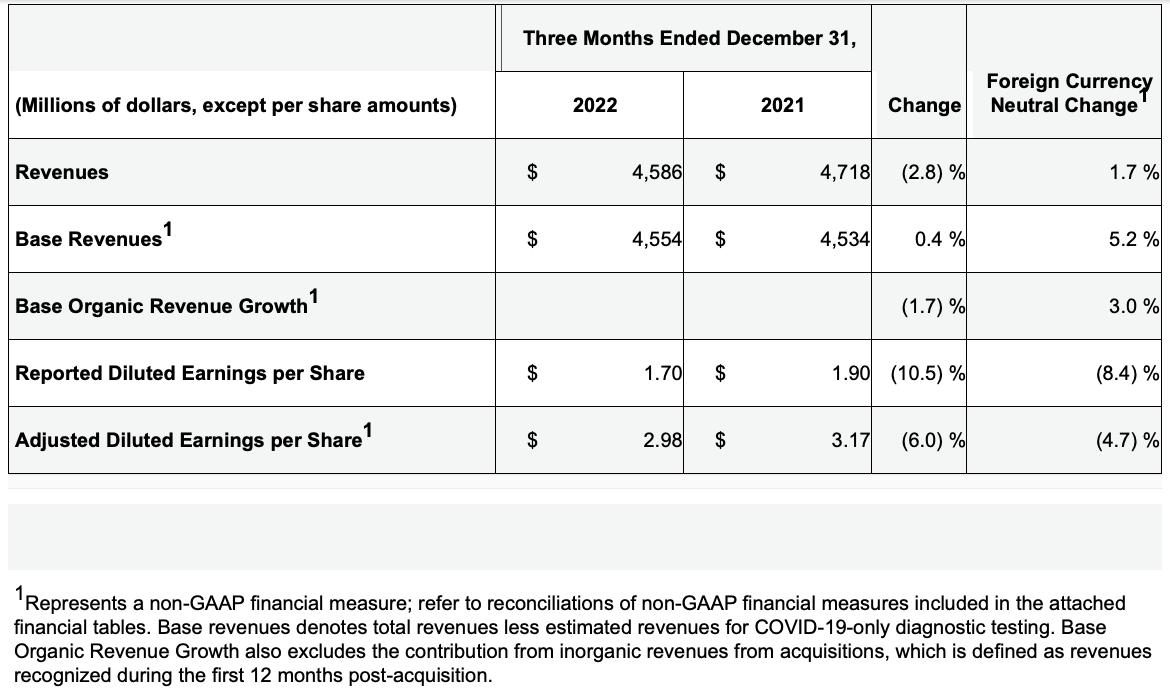

First Quarter Fiscal 2023 Operating Results

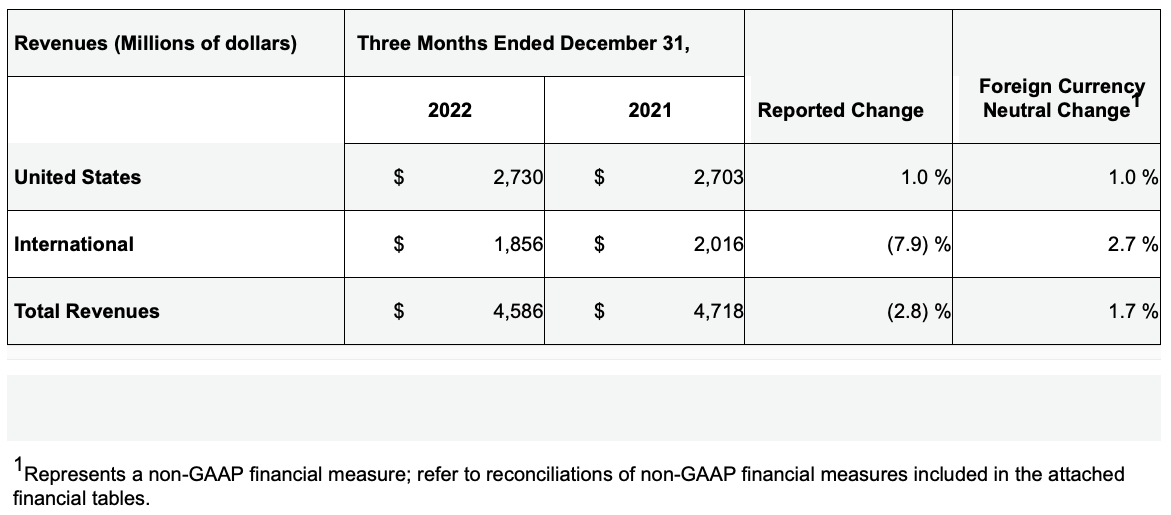

Geographic Results

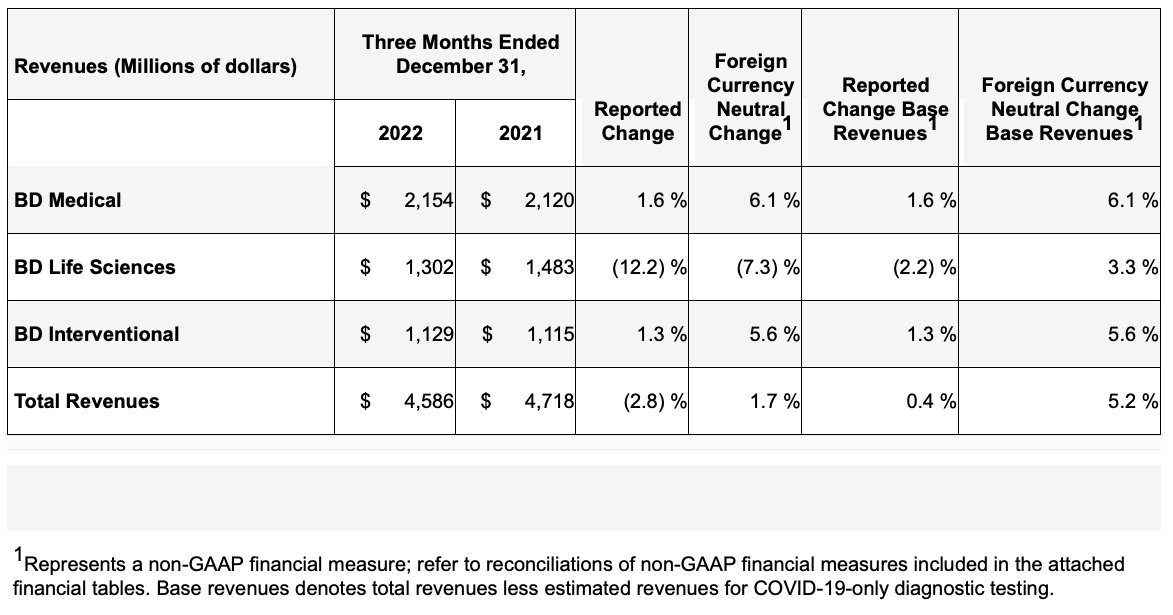

Segment Results

The BD Medical segment includes the Medication Delivery Solutions (MDS), Medication Management Solutions (MMS), and Pharmaceutical Systems (PS) business units. BD Medical revenue growth was driven by strong performance in MMS and PS.

- MDS performance reflects the impact of COVID dynamics including the comparison to prior-year vaccine device demand and recent restrictions in China, as well as planned strategic portfolio exits, partially offset by continued strong performance in vascular access management outside the US.

- MMS performance reflects momentum of our Pharmacy Automation solutions, including both Parata and BD Rowa™. As anticipated, growth was tempered by prior-year COVID dynamics including elevated dispensing installations and infusion set utilization.

- PS performance reflects our strong leadership position in pre-fillable solutions for high-growth markets like biologic drugs and vaccines supported by our differentiated supply capabilities.

The BD Life Sciences segment includes the Integrated Diagnostic Solutions (IDS) and Biosciences (BDB) business units. BD Life Sciences performance reflects a decline in COVID-only diagnostic testing revenues partially offset by growth in the segment's base business.

- IDS performance reflects a decline in COVID-only diagnostic testing revenues offset by growth in the base business that was driven by strong demand for our respiratory testing portfolio, which was partly aided by timing of dealer orders, strong BD Kiestra™ lab automation installations and leveraging our higher BD MAX™ installed base for molecular IVD assay growth. Base business growth was impacted by licensing fee revenue in the prior year.

- BDB performance reflects strong research reagent growth that continues to be enabled by our differentiated content and dye strategy, and continued advancement of our category leadership position in flow cytometry aided by strong demand for our recently launched BD FACSymphony™ A1/A5 SE analyzers and BD FACSymphony™ S6 sorter.

The BD Interventional segment includes the Surgery, Peripheral Intervention (PI), and Urology & Critical Care (UCC) business units. BD Interventional performance was primarily driven by strong performance in PI.

- Surgery performance reflects strong worldwide growth in Advanced Repair and Reconstruction driven by continued strong market adoption of the Phasix™ hernia resorbable scaffold, and double-digit growth worldwide in biosurgery, aided by the Tissuemed acquisition. As expected, growth was tempered by planned strategic portfolio exits and the prior-year comparison from BD ChloraPrep™ dealer stocking.

- PI performance reflects double-digit growth in Peripheral Vascular Disease due to the Venovo™ relaunch, coupled with global penetration of Rotarex™ and the acquisition of Venclose™ which addresses chronic venous insufficiency. PI performance also reflects strong growth in Oncology within Greater Asia due to an improved backlog situation associated with prior-year supplier constraints.

- UCC performance reflects double-digit growth in BD PureWick™, which addresses chronic incontinence, and Endourology, that was aided by reduced backorder due to improved supplier performance. Growth was partially offset by the comparison to the Surestep™ backorder release and distributor stocking in the prior year in Urological Drainage.

Assumptions and Outlook for Full Year Fiscal 2023

The company raised its full-year revenue and adjusted EPS guidance ranges.

- The company now expects fiscal year 2023 revenues to be in the range of approximately $19.1 billion to $19.3 billion compared to $18.6 billion to $18.8 billion previously announced, which reflects an increase of approximately $500 million at the mid-point.

- Revenue guidance now assumes base business currency-neutral revenue growth of 5.75% to 6.75% compared to 5.25% to 6.25% previously announced, which represents an increase of 50 basis points, or approximately $90 million at the mid-point. Our increased base business revenue guidance reflects continued momentum as we execute our BD 2025 growth strategy.

- Revenue guidance now assumes approximately $50 million to $100 million in COVID-only diagnostic testing revenues, which is a decrease of approximately $75 million at the mid-point compared to approximately $125 million to $175 millionpreviously announced.

- Based on current rates, foreign exchange would represent a reduction of approximately 200 basis points to total company revenue growth compared to approximately 450 basis points previously announced, which represents a reduction in the estimated foreign currency headwind of approximately 250 basis points or approximately $480 million.

- The company now expects fiscal year 2023 adjusted diluted EPS to be $12.07 to $12.32 compared to $11.85 to $12.10previously announced, which is an increase of $0.22 at the mid-point.

- On a currency-neutral basis, we continue to expect adjusted diluted EPS growth of approximately 9% to 11%.

- Adjusted diluted EPS guidance includes an estimated impact from foreign currency of approximately 230 basis points based on current rates compared to 420 basis points previously announced, which represents a reduction in the estimated foreign currency headwind of approximately 190 basis points.

BD's outlook for fiscal 2023 reflects numerous assumptions about many factors that could affect its business, based on the information management has reviewed as of this date. Management will discuss its outlook and several of its assumptions on its first fiscal quarter earnings call.

The company's expected adjusted diluted EPS for fiscal 2023 excludes potential charges or gains that may be recorded during the fiscal year, such as, among other things, the non-cash amortization of intangible assets, acquisition-related charges, spin related costs, and certain tax matters. BD does not attempt to provide reconciliations of forward-looking adjusted diluted non-GAAP EPS guidance to the comparable GAAP measure because the impact and timing of these potential charges or gains is inherently uncertain and difficult to predict and is unavailable without unreasonable efforts. In addition, the company believes such reconciliations would imply a degree of precision and certainty that could be confusing to investors. Such items could have a substantial impact on GAAP measures of BD's financial performance. We also present our estimated revenue, base business revenue growth and adjusted diluted EPS growth for our 2023 fiscal year after adjusting for the anticipated impact of foreign currency translation. BD believes that this adjustment allows investors to better evaluate BD's anticipated underlying earnings performance for our 2023 fiscal year in relation to our underlying 2022 fiscal year performance.

Source: BD Reports First Quarter Fiscal 2023 Financial Results