Original from: PR Newswire

Abbott announced financial results for the fourth quarter ended Dec. 31, 2022.

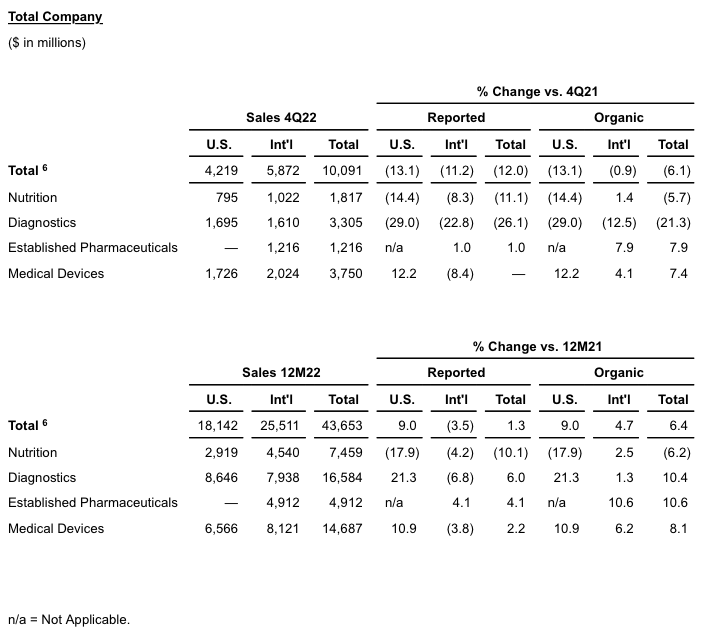

- Fourth-quarter sales of $10.1 billion, which were negatively impacted by an expected year-over-year decline in COVID-19 testing-related sales, decreased 12.0 percent on a reported basis and 6.1 percent on an organic basis, which excludes the impact of foreign exchange.

- Excluding COVID-19 testing-related sales, fourth-quarter sales decreased 1.4 percent on a reported basis and increased 5.4 percent on an organic basis.

- Excluding COVID-19 testing-related sales and U.S. infant formula sales that were impacted by manufacturing disruptions3, full-year 2022 sales increased 1.9 percent on a reported basis and 7.4 percent on an organic basis.

- GAAP diluted EPS was $0.59 in the fourth quarter. Excluding specified items, adjusted diluted EPS was $1.03.

- Abbott issues full-year 2023 guidance for diluted EPS from continuing operations on a GAAP basis of $3.05 to $3.25and full-year adjusted EPS from continuing operations of $4.30 to $4.50.

- Abbott projects full-year 2023 organic sales growth, excluding COVID-19 testing-related sales, of high-single digits4and COVID-19 testing-related sales of around $2.0 billion.

- In October, Abbott's market-leading FreeStyle Libre® continuous glucose monitoring system was named the "Best Medical Technology" of the last 50 years by the Galien Foundation.

- In December, Abbott announced U.S. Food and Drug Administration (FDA) approval of its Eterna™ spinal cord stimulation system ¡ª the smallest implantable, rechargeable system currently available for the treatment of chronic pain.

- In January, Abbott announced U.S. FDA approval of its minimally invasive Navitor™ transcatheter aortic valve implantation (TAVI) system for people with severe aortic stenosis who are at high risk for surgery.

"We significantly exceeded the EPS guidance we provided at the beginning of last year despite challenging global business conditions," said Robert B. Ford, chairman and chief executive officer, Abbott. "Our R&D pipeline continues to be highly productive with several recent and upcoming new product launches that position us well going forward."

FOURTH-QUARTER BUSINESS OVERVIEW

Note: Management believes that measuring sales growth rates on an organic basis is an appropriate way for investors to best understand the underlying performance of the business. Organic sales growth excludes the impact of foreign exchange. In order to compute results excluding the impact of exchange rates, current year U.S. dollar sales are multiplied or divided, as appropriate, by the current year average foreign exchange rates and then those amounts are multiplied or divided, as appropriate, by the prior year average foreign exchange rates. Management further believes that measuring sales growth rates on an organic basis excluding COVID-19 tests is an appropriate way for investors to best understand the underlying performance of the business in the fourth quarter ended Dec. 31, 2022 as well as in 2023 as the COVID-19 pandemic shifts to an endemic state, resulting in significantly lower expected demand for COVID-19 tests.

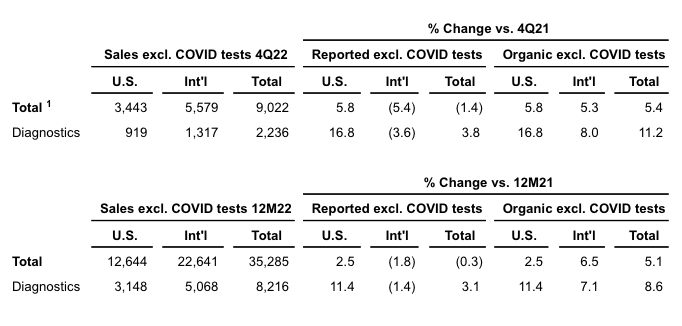

Worldwide COVID-19 testing-related sales were $1.069 billion in the fourth quarter of 2022 compared to $2.319 billion in the fourth quarter of the prior year. Worldwide COVID-19 testing-related sales were $8.368 billion in the full year of 2022 compared to $7.679 billion in the prior year.

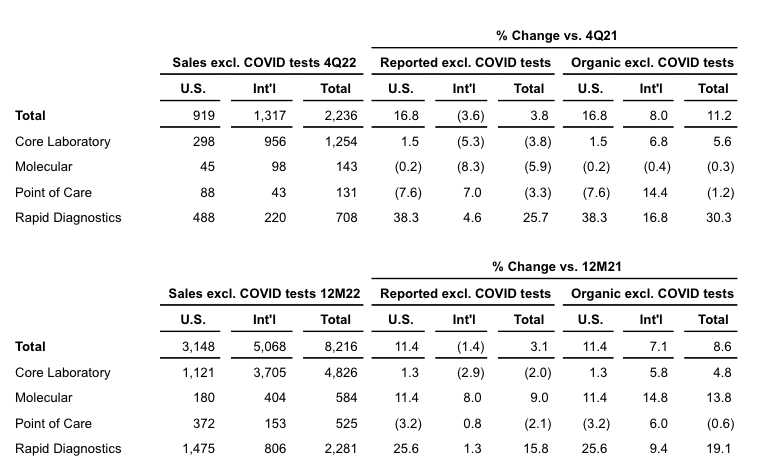

The following tables summarize sales excluding COVID-19 testing-related sales and the change in reported and organic sales excluding COVID-19 testing-related sales in 2022 versus the prior year:

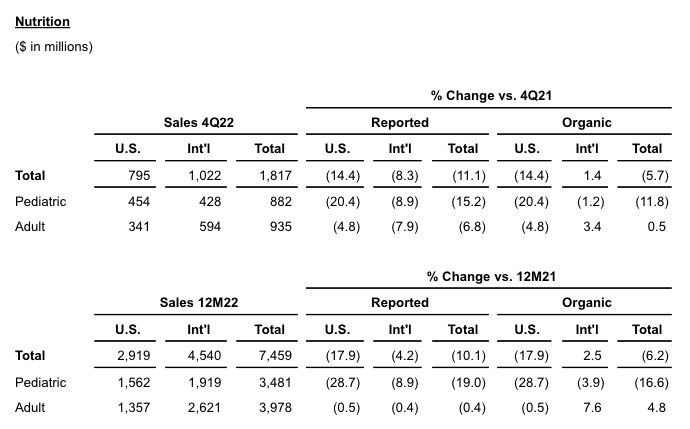

Worldwide Nutrition sales decreased 11.1 percent on a reported basis and 5.7 percent on an organic basis in the fourth quarter. Total worldwide Nutrition and Pediatric Nutrition sales were negatively impacted as a result of manufacturing disruptions during 2022 of certain infant formula products3 at Abbott's Sturgis, Michigan, facility. The manufacturing facility has subsequently restarted production.

In Adult Nutrition, global sales decreased 6.8 percent on a reported basis and increased 0.5 percent on an organic basis in the fourth quarter, led by Ensure®, Abbott's market-leading complete and balanced nutrition brand.

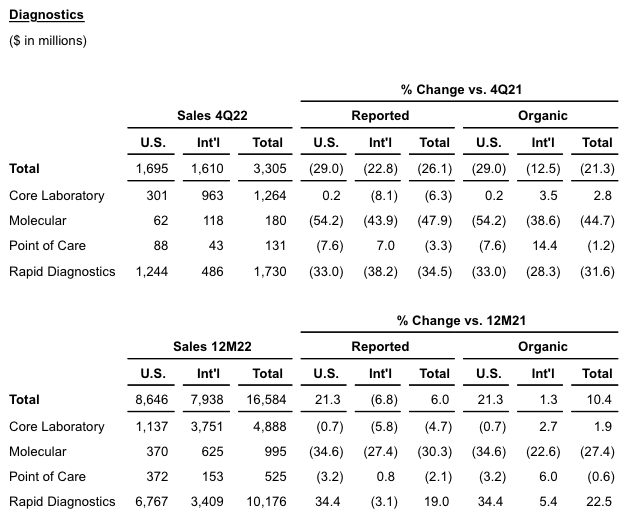

As expected, Diagnostics sales in the fourth quarter were negatively impacted by year-over-year declines in COVID-19 testing-related sales. Worldwide COVID-19 testing-related sales were $1.069 billion in the fourth quarter of 2022 compared to $2.319 billion in the fourth quarter of the prior year.

The following tables summarize sales excluding COVID-19 testing-related sales and the change in reported and organic sales excluding COVID-19 testing-related sales in 2022 versus the prior year:

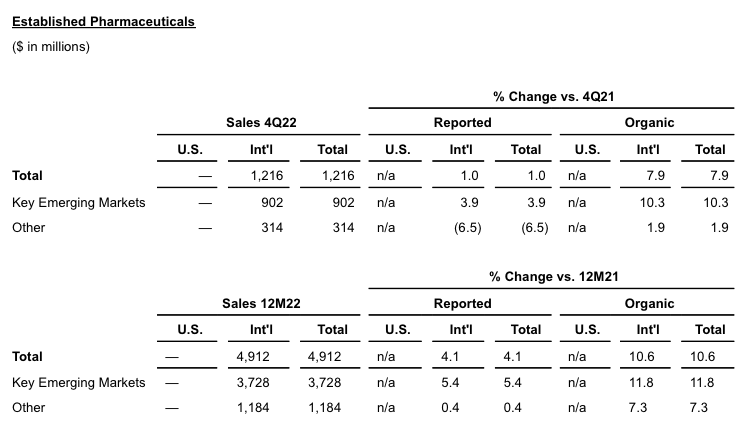

Established Pharmaceuticals sales increased 1.0 percent on a reported basis and 7.9 percent on an organic basis in the fourth quarter.

Key Emerging Markets include several emerging countries that represent the most attractive long-term growth opportunities for Abbott's branded generics product portfolio. Sales in these geographies increased 3.9 percent on a reported basis and 10.3 percent on an organic basis, led by strong growth in several geographies including India, China, Brazil and Mexico, and across several therapeutic areas, including cardiometabolic, women's health and central nervous system/pain management.

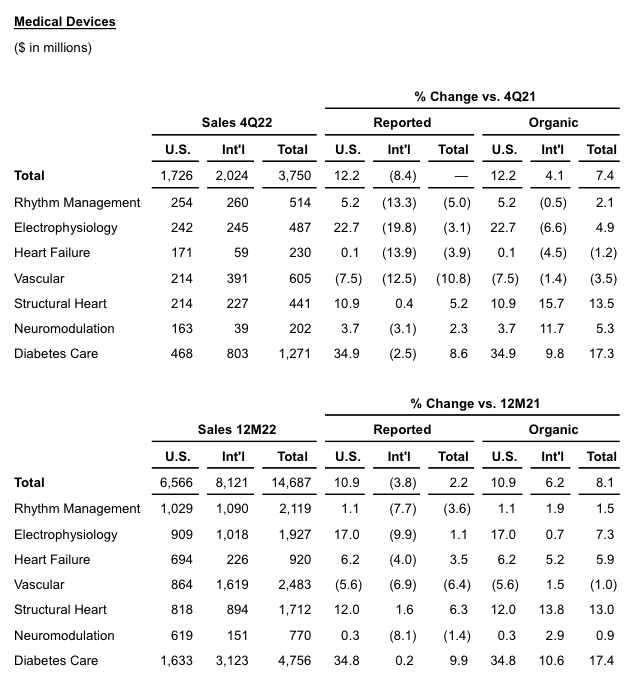

Worldwide Medical Devices sales were flat on a reported basis and increased 7.4 percent on an organic basis in the fourth quarter. Sales growth in the U.S. was led by strong double-digit growth in Electrophysiology, Structural Heart and Diabetes Care. Internationally, sales growth was negatively impacted by intermittent COVID-19 lockdown restrictions in China as well as supply constraints in certain areas, including Electrophysiology and Diabetes Care.

In Diabetes Care, FreeStyle Libre sales were approximately $1.1 billion in the quarter, including U.S. growth of more than 40 percent.

In 2022, Abbott continued to strengthen its Medical Devices portfolio with several recent pipeline advancements, including U.S. FDA approvals of:

- Navitor, Abbott's latest-generation transcatheter aortic valve implantation (TAVI) system, used for the treatment of severe aortic stenosis.

- Eterna, Abbott's rechargeable spinal cord stimulator used for treating chronic pain.

- Aveir™ leadless pacemaker, used for treating patients with slow heart rhythms.

- An expanded indication of use for CardioMEMS™ HF remote monitoring system, which detects early warning signs of worsening heart failure.

- U.S. FDA clearance of the FreeStyle Libre 3 system, which provides continuous glucose readings and unsurpassed 14-day accuracy in the world's smallest and thinnest wearable sensor.

ABBOTT'S EARNINGS-PER-SHARE GUIDANCE

Abbott projects full-year 2023 diluted earnings per share from continuing operations under GAAP of $3.05 to $3.25. Abbott forecasts specified items for the full-year 2023 of $1.25 per share primarily related to intangible amortization, restructuring and cost reduction initiatives and other net expenses. Excluding specified items, projected adjusted diluted earnings per share from continuing operations would be $4.30 to $4.50 for the full-year 2023.

ABBOTT DECLARES 396TH CONSECUTIVE QUARTERLY DIVIDEND

On Dec. 9, 2022, the board of directors of Abbott declared the company's quarterly dividend of $0.51 per share. Abbott's cash dividend is payable Feb. 15, 2023, to shareholders of record at the close of business on Jan. 13, 2023.

Abbott has increased its dividend payout for 51 consecutive years and is a member of the S&P 500 Dividend Aristocrats Index, which tracks companies that have annually increased their dividend for at least 25 consecutive years.

About Abbott:

Abbott is a global healthcare leader that helps people live more fully at all stages of life. Our portfolio of life-changing technologies spans the spectrum of healthcare, with leading businesses and products in diagnostics, medical devices, nutritionals and branded generic medicines. Our 115,000 colleagues serve people in more than 160 countries.

Source: Abbott Reports Fourth-Quarter and Full-Year 2022 Results; Issues 2023 Financial Outlook