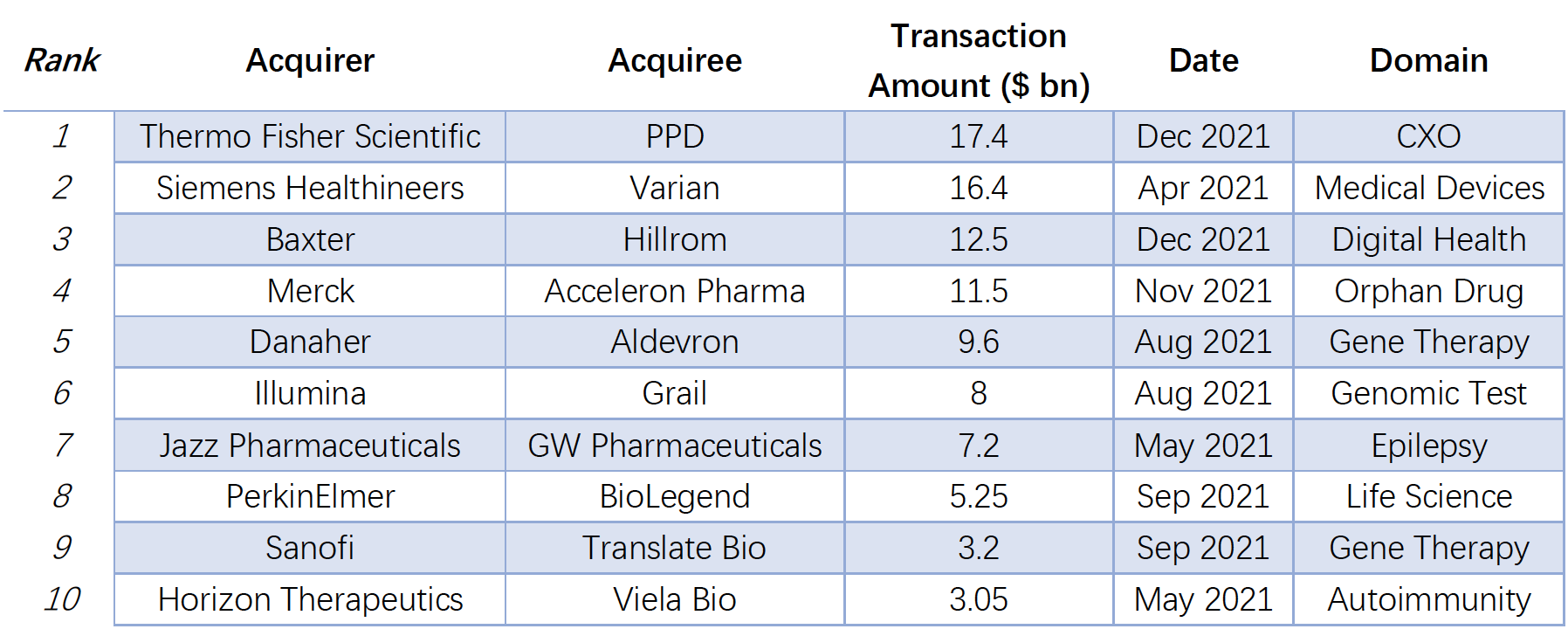

In 2021, global M&A transactions in the biomedical field will basically return to pre-pandemic levels. Enterprises are actively developing in cutting-edge fields such as CXO, digital health, gene therapy, precision medicine etc. According to public statistics, the transaction value of the global TOP10 healthcare M&A deals in 2021 will all be more than $3 billion, of which Thermo Fisher¡¯s acquisition of PPD for $17.4 billion ranks first. In addition, due to AstraZeneca¡¯s block, Advent Capital and Aurora¡¯s $8.1 billion acquisition of Sobi failed, so it was not included in the calculation.

1. Thermo Fisher Scientific Completes Acquisition of PPD, Inc.

Dec. 8, 2021 - Thermo Fisher Scientific Inc. (NYSE: TMO), the world leader in serving science, announced that it has completed its acquisition of PPD, Inc. (Nasdaq: PPD), a leading global provider of clinical research services to the biopharma and biotech industry, for $17.4 billion.

The transaction is expected to contribute $1.50 to Thermo Fisher's adjusted earnings per share in 2022.1 Details of the 2021 impact will be provided during Thermo Fisher's fourth quarter earnings call in early 2022.

Thermo Fisher continues to expect to realize total synergies of approximately $125 million by year three following close, consisting of approximately $75 million of cost synergies and approximately $50 million of adjusted operating income benefit from revenue-related synergies. In connection with the acquisition, Thermo Fisher will also assume approximately $3.0 billion in net debt of PPD. All assumed debt will be retired in connection with the closing of the transaction.2

With the addition of PPD, Thermo Fisher will offer a comprehensive suite of world-class services across the clinical development spectrum − from scientific discovery, to assessing safety, efficacy, and health care outcomes, to managing clinical trial logistics, to the development and manufacturing of the drug product.

Apr. 15, 2021 - Siemens Healthineers AG (Frankfurt: SHL) announced that it has successfully completed the acquisition of Varian Medical Systems, Inc. (¡°Varian¡±). The acquisition was previously announced on August 2, 2020.

l Transformative combination accelerates the company¡¯s impact on global healthcare and establishes a strong partner for customers and patients along the entire cancer care continuum and for many of the most threatening diseases

l Varian becomes new business segment within Siemens Healthineers; important step in the implementation of its Strategy 2025

l Synergies of at least EUR 300 million per annum expected to be achieved in fiscal year 2025

3. Baxter Completes Acquisition of Hillrom, Creating ~$15 Billion Global Medtech Leader

Dec. 13, 2021 - Baxter International Inc. (NYSE:BAX), a global medtech leader, announced it has completed its acquisition of Hillrom. Baxter paid $156.00 in cash for each outstanding share of Hillrom common stock for a purchase price of $10.5 billion (based on Hillrom share counts at closing). Including the assumption of Hillrom's outstanding debt obligations, the enterprise value of the transaction is approximately $12.5 billion.

l Accelerates the company's vision for transforming healthcare and advancing patient care worldwide ¨C from the hospital to the home

l Combination creates opportunities for innovation that should drive efficiencies across care settings and help improve care outcomes

l Complementary products and pipeline enable broader access to care globally

l Expected to generate high single-digit ROIC by year five and approximately $250 million of annual pre-tax cost synergies by the end of year three

l Positions Baxter for anticipated faster top- and bottom-line growth

4. Merck Completes Acquisition of Acceleron Pharma Inc.

Nov. 22, 2021 - Merck (NYSE: MRK), known as MSD outside the United States and Canada, announced the successful completion of the acquisition of Acceleron Pharma Inc. (Nasdaq: XLRN).

Acceleron is focused on harnessing the power of the transforming growth factor (TGF)-beta superfamily of proteins that is known to play a central role in the regulation of cell growth, differentiation and repair. Acceleron¡¯s lead therapeutic candidate, sotatercept, has a novel mechanism of action with the potential to improve short-term and/or long-term clinical outcomes in patients with pulmonary arterial hypertension (PAH), a progressive and life-threatening blood vessel disorder. Sotatercept is in Phase 3 trials as add-on to current standard of care for the treatment of PAH.

5. DANAHER COMPLETES ACQUISITION OF ALDEVRON

Aug. 30, 2021 - Danaher Corporation (NYSE: DHR) ("Danaher") announced the completion of its acquisition of Aldevron. As previously announced, Aldevron will operate as a standalone operating company and brand within Danaher's Life Sciences segment.

June 17, 2021 - Danaher Corporation (NYSE: DHR) (the "Company") announced that Danaher has entered into a definitive agreement to acquire privately-held Aldevron, for a cash purchase price of approximately $9.6 billion. Danaher expects to finance the acquisition using cash on hand and/or proceeds from the issuance of commercial paper.

Founded in 1998 by Michael Chambers and John Ballantyne, Aldevron is headquartered in Fargo, North Dakota and employs approximately 600 people. Aldevron manufactures high-quality plasmid DNA, mRNA, and proteins, serving biotechnology and pharmaceutical customers across research, clinical and commercial applications. Aldevron will operate as a standalone operating company and brand within Danaher's Life Sciences segment.

Aug 18, 2021 - Illumina, Inc. (NASDAQ: ILMN) announced that it has acquired GRAIL, a healthcare company focused on life-saving early detection of multiple cancers, but will hold GRAIL as a separate company during the European Commission's ongoing regulatory review.

Illumina, the global leader in DNA sequencing, first announced its intention to acquire GRAIL nearly a year ago, reuniting Illumina with GRAIL four years after it was spun off. GRAIL's Galleri blood test detects 50 different cancers before they are symptomatic. Illumina's acquisition of GRAIL will accelerate access and adoption of this life-saving test worldwide.

7. Jazz Pharmaceuticals Completes Acquisition of GW Pharmaceuticals plc

May 5, 2021 - Jazz Pharmaceuticals (Nasdaq: JAZZ) announced the completion of its acquisition of GW Pharmaceuticals plc (Nasdaq: GWPH) ("GW"), a leader in the science, development and commercialization of cannabinoid-based prescription medicines.

Feb. 3, 2021 - Jazz Pharmaceuticals plc (Nasdaq: JAZZ) and GW Pharmaceuticals plc (Nasdaq: GWPH) announced the companies have entered into a definitive agreement for Jazz to acquire GW for $220.00 per American Depositary Share (ADS), in the form of $200.00 in cash and $20.00 in Jazz ordinary shares, for a total consideration of $7.2 billion, or $6.7 billion net of GW cash. The transaction, which has been unanimously approved by the Boards of Directors of both companies, is expected to close in the second quarter of 2021.

Upon close of the transaction, the combined company will be a leader in neuroscience with a global commercial and operational footprint well positioned to maximize the value of its diversified portfolio.

8. PerkinElmer Completes Acquisition of Antibody and Reagent Leader BioLegend

Sep. 17, 2021 - PerkinElmer, Inc. (NYSE: PKI) a global leader committed to innovating for a healthier world, announced it has completed its acquisition of BioLegend, a leading, worldwide provider of life science antibodies and reagents for a total consideration of approximately $5.25 billion.

The acquisition, the largest in PerkinElmer¡¯s history, further expands the Company¡¯s life science franchise into high-growth areas such as cytometry, proteogenomics, multiplex assays, recombinant proteins, magnetic cell separation and bioprocessing.

As previously communicated, it is expected that BioLegend will contribute an incremental $380 million of revenue and $0.30 of adjusted earnings per share accretion to PerkinElmer in fiscal year 2022. Additional commentary regarding its expected financial contribution to the remainder of the current fiscal year will be provided on the Company¡¯s upcoming third quarter 2021 earnings call.

PerkinElmer¡¯s expectations for incremental adjusted earnings per share accretion for fiscal year 2022 attributable to BioLegend is provided on a non-GAAP basis and cannot be reconciled to the closest GAAP measure without unreasonable effort due to the unpredictability of the amounts and timing of events affecting the items PerkinElmer excludes from this non-GAAP measure. The timing and amounts of such events and items could be material to PerkinElmer¡¯s results prepared in accordance with GAAP.

Sep. 14, 2021 - Sanofi announced the completion of its acquisition of Translate Bio, further accelerating the company¡¯s efforts to develop transformative vaccines and therapies using mRNA technology. The acquisition adds a critical pillar to the company¡¯s mRNA Center of Excellence which aims to unlock the potential of next-generation mRNA vaccines and other strategic areas such as immunology, oncology, and rare diseases.

The tender offer for all of the outstanding shares of Translate Bio common stock expired as scheduled at one minute after 11:59 p.m., Eastern Time, on Monday, September 13, 2021. The minimum tender condition and all of the other conditions to the offer have been satisfied and on September 14, 2021, Sanofi accepted for payment and will promptly pay for all shares validly tendered and not validly withdrawn.

Following its acceptance of the tendered shares, Sanofi completed its acquisition of Translate Bio through the merger of a wholly owned subsidiary of Sanofi with and into Translate Bio, pursuant to Section 251(h) of the General Corporation Law of the State of Delaware, with Translate Bio continuing as the surviving corporation and becoming an indirect, wholly owned subsidiary of Sanofi.

10. Horizon Therapeutics plc Completes Acquisition of Viela Bio, Inc.

Mar. 15, 2021- Horizon Therapeutics plc (Nasdaq: HZNP) announced that it has completed the acquisition of Viela Bio, Inc. (Nasdaq: VIE) (¡°Viela¡±).

l Adds to commercial rare disease medicine portfolio with UPLIZNA.

l Strengthens current R&D capability by adding a team with early-stage research, translational and clinical development capabilities along with deep scientific knowledge in autoimmune and severe inflammatory diseases.

l Adds deep, mid-stage biologics pipeline focused primarily on autoimmune and severe inflammatory diseases.